Redbox 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COINSTAR, INC.

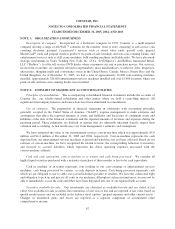

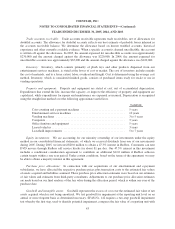

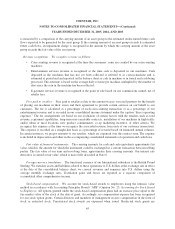

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2005, 2004, AND 2003

Amusement Factory was the second largest operator of entertainment services in the United States with a

complete line of amusement vending services for retailers including skill-crane machines, bulk vending, kiddie

rides and video games in over 16,000 locations. Amusement Factory distributes its equipment to mass merchants,

supermarkets, restaurants, entertainment centers, dollar stores and other distribution channels. We acquired

Amusement Factory in order to strengthen our market position, expand the scope of our retail relationships and

enhance operational efficiencies in our entertainment services line of business.

Of the total purchase price, $23.2 million was allocated to goodwill, which will not be amortized, and $5.0

million represented the value of the intangible assets which will be amortized over 10 years. All assets and

liabilities were valued at their fair values at acquisition date.

DVDXpress: On August 5, 2005, we entered into a credit agreement to provide DVDXpress with a $4.5

million credit facility. Loans made pursuant to the credit agreement are secured by a first security interest in

substantially all of DVDXpress’ assets as well as a pledge of their capital stock. The unpaid balance of the loan

will bear interest at an annual rate equal to LIBOR plus three percent. As of December 31, 2005, DVDXpress has

drawn down $3.5 million on this credit facility. Additionally, on December 7, 2005 we signed an asset purchase

option agreement that allows Coinstar to purchase substantially all of DVDXpress’ business assets and liabilities

in exchange for any outstanding debt and accrued interest on the credit facility plus $10,000 and contingent

consideration of up to $3.5 million based on achievement of specific conditions. Effective December 7, 2005, we

have consolidated DVDXpress, based on fair values, into our consolidated financial statements in accordance

with FASB Interpretation No. 46 (revised December 2003), Consolidation of Variable Interest Entities (“FIN

46R”).

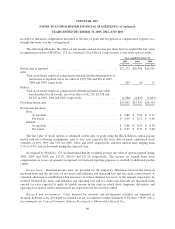

ACMI Holdings, Inc.: On July 7, 2004, we acquired ACMI for $235.0 million. As part of this acquisition,

we acquired cash totaling $11.5 million. The acquisition was effected pursuant to the “Agreement and Plan of

Merger” dated May 23, 2004 between ACMI and Coinstar. In addition to the purchase price, we incurred $4.3

million in transaction costs, including investment banking fees and amounts relating to legal and accounting

charges. The results of operations of ACMI since July 7, 2004 are included in our statement of operations.

ACMI offers various entertainment services to consumers in mass merchandisers, supermarkets, warehouse

clubs, restaurants, entertainment centers, truck stops and other distribution channels. These entertainment

services include skill-crane machines, bulk vending, kiddie rides and video games. We acquired ACMI in order

to add new classes of trade, broaden our retailer base, diversify services, expand the reach of field service and

create a platform for growth across all businesses, including coin-counting, e-payment and entertainment

services.

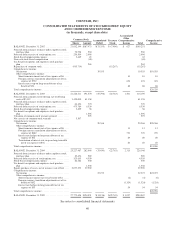

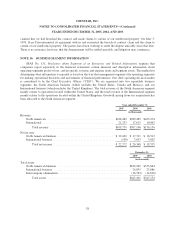

The total purchase consideration was allocated to the assets acquired and liabilities assumed, including

identifiable intangible assets, based on their respective fair values as summarized below. The accounting for the

purchase price was preliminary during the allocation period which ended upon the anniversary of the transaction.

Adjustments were made based on our final analysis of the fair value of assets acquired and liabilities assumed.

The following condensed balance sheet data presents the final determination of fair value of the assets acquired

and liabilities assumed.

48