Redbox 2005 Annual Report Download - page 28

Download and view the complete annual report

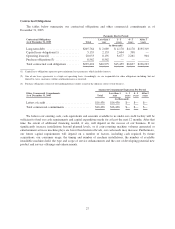

Please find page 28 of the 2005 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.during 2005 on our outstanding debt. During July of 2004 we entered into a $310.0 million credit facility in order

to finance our acquisition of ACMI. As of December 31, 2005, $205.8 million is outstanding on our term loan.

Income Taxes

The effective income tax rate was 39.0% in 2005 compared with 33.3% in 2004 and 37.2% in 2003. The

lower effective tax rate in 2004 was primarily due to change in the valuation allowance for our deferred tax asset

and the recognition of net deferred tax assets at an adjusted rate. The effective income tax rates for 2005 vary

from the federal statutory tax rate of 35% primarily due to state income taxes. The effective income tax rates for

2004 and 2003 vary from the federal statutory tax rate of 35% primarily due to change in valuation allowance for

deferred tax asset and recognition of net deferred tax assets at an adjusted rate and state income taxes.

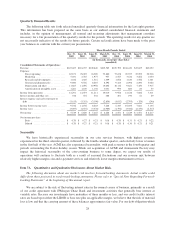

Liquidity and Capital Resources

Our business involves collecting and processing large volumes of cash, most of it in the form of coins. We

present three categories of cash on our balance sheet: cash and cash equivalents, cash in machine or in transit,

and cash being processed.

As of December 31, 2005, we had cash and cash equivalents, cash in machine or in transit, and cash being

processed totaling $175.3 million, which consisted of cash and cash equivalents immediately available to fund

our operations of $45.4 million, cash in machine or in transit of $60.1 million and cash being processed of $69.8

million. Cash in machine or in transit represents coin residing in our coin-counting or entertainment services

machines or being processed by carriers which is not immediately available to us until it has been collected and

deposited. Cash being processed represents coin residing in our coin-counting or entertainment services machines

or being processed by carriers which we are mainly obligated to use to settle our accrued liabilities payable to our

retailer partners. Working capital was $101.7 million at December 31, 2005, compared with $105.5 million at

December 31, 2004. The decrease in net working capital was primarily the result of cash paid for acquisitions

and investments during 2005 offset, to a lesser degree, by cash generated by our operations

Net cash provided by operating activities was $103.1 million for the year ended December 31, 2005,

compared to net cash provided by operating activities of $60.6 million for the year ended December 31, 2004.

Cash provided by operating activities increased as a result of an increase in net income of $1.9 million; an

increase in cash provided by our operating assets and liabilities of $21.5 million, mainly due to the timing of

payments to our retail customers and an increase in cash provided from a net increase of non-cash transactions on

our consolidated income statement of $18.1 million, mostly from increases in depreciation expense and

amortization of intangible assets acquired from acquisitions of subsidiaries.

Net cash used by investing activities for the year ended December 31, 2005 was $84.6 million compared to

$278.9 million in the prior year period. During 2005 net cash used by investing activities consisted of net equity

investments of $20.3 million, acquisitions of subsidiaries of $20.8 million and net capital expenditures of $43.5

million. Comparatively, during 2004 net cash used by investing activities consisted primarily of our acquisition

of ACMI for $227.8 million, acquisitions of other subsidiaries of $8.6 million and net capital expenditures of

$42.6 million, mainly to purchase coin-counting and entertainment service machines.

Net cash provided by financing activities for the year ended December 31, 2005 was $1.8 million compared to

$274.3 million in the prior year period. During 2005 net cash provided by financing activities represented cash

received from the proceeds of employee stock option exercises net of cash used to make principal payments on debt.

During 2004 we refinanced an existing credit facility by retiring $7.8 million of outstanding debt with funds

provided by drawing $250.0 million from a new credit facility. We used most of the remaining borrowings to

purchase ACMI. Additionally, during December 2004 we received proceeds of $81.6 million offset by $0.5 million

of financing fees from a secondary offering of our common stock and used some of the proceeds to retire $41.0

million of our long-term debt and we received $7.3 million from the proceeds of employee stock option exercises.

24