Redbox 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COINSTAR, INC.

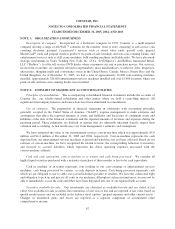

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2005, 2004, AND 2003

Recent accounting pronouncements: In December 2004, the Financial Accounting Standards Board

(“FASB”) issued Statement of Financial Accounting Standards No. 123 (revised 2004), Share-Based Payment

(“SFAS 123(R)”). SFAS 123(R) addresses the accounting for stock options and other stock-based compensation.

SFAS 123(R) eliminates the option of accounting for employee stock options using the intrinsic value provisions

of APB Opinion No. 25 and related interpretations, and requires that the compensation cost relating to share-

based payment transactions be recognized in financial statements. That cost will be measured based on the fair

value of the equity or liability instruments issued. In April 2005, the SEC delayed the effective date of SFAS

123(R) until January 1, 2006 for calendar year companies. Accordingly, beginning January 1, 2006, we will

expense the fair value of all stock-based compensation over the vesting period of the related equity instrument. In

addition, SFAS 123(R) will require the Company to reflect the tax savings resulting from tax deductions in

excess of expense reflected in its financial statements as a financing cash flow, which will impact the Company’s

future reported cash flows from operating activities. Our employee stock-based compensation plans include stock

options and restricted stock awards. Stock-based compensation expense amounts recognized going forward will

be based on the unvested options and awards granted prior to January 1, 2006, and impacted by future grants and

modifications. The impact of adoption of SFAS 123(R) on our results of operations may vary greatly depending

on the number of stock options and restricted stock awards granted and the future price of our common stock.

However, management currently anticipates that, based on a range of estimated prices of our common stock and

current expectations of the number of shares that may be awarded, stock-based compensation expense during the

year ending December 31, 2006 will be similar to our current and prior period proforma disclosures.

In March 2005, the FASB issued FASB Interpretation (FIN) No. 47, Accounting for Conditional Asset

Retirement Obligations—an Interpretation of FASB Statement No. 143, which requires recognition of a liability

for the fair value of a conditional asset retirement obligation when incurred if reasonably estimable. We adopted

the provisions of FIN No. 47 in the fourth quarter of fiscal 2005, which did not have a material impact on our

financial position, results of operations or cash flows.

Reclassifications: Certain reclassifications have been made to the prior period balances to conform to the

current period presentation.

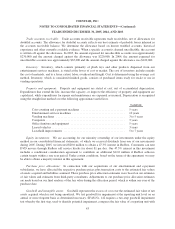

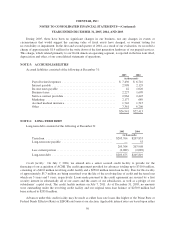

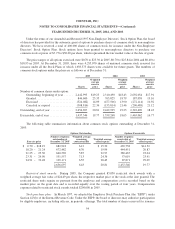

NOTE 3: ACQUISITIONS

In connection with our acquisitions, we have allocated the respective purchase prices plus transaction costs

to the estimated fair values of assets acquired and liabilities assumed. These purchase price allocation estimates

were based on our estimates of fair values and estimates from third-party consultants. During the allocation

period, certain purchase accounting adjustments related to the American Coin Merchandising, Inc. (collectively

referred to as “ACMI”) acquisition were made in accordance with Statement of Financial Accounting Standards

(“SFAS”) No. 141 Business Combinations. These adjustments related to refinement of income tax and other

liability estimates made during the initial purchase price allocation and increased goodwill by approximately $2.0

million. We have completed the allocation phase of this acquisition.

Amusement Factory: During the fourth quarter of 2005, we acquired substantially all of the assets and

assumed certain operating liabilities, excluding existing debt, of Amusement Factory for $36.5 million in shares

of Coinstar common stock, including cash acquired of $0.7 million. In addition to the purchase price, we incurred

approximately $0.5 million in transaction costs including amounts relating to legal and accounting charges. The

results of operations of Amusement Factory from November 1, 2005, to December 31, 2005, are included in our

statements of operations.

47