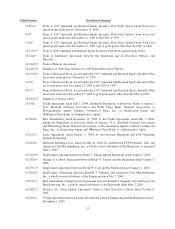

Redbox 2005 Annual Report Download - page 30

Download and view the complete annual report

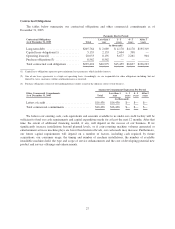

Please find page 30 of the 2005 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rate hedge, we will continue to pay interest at prevailing rates plus any spread, as defined by our credit facility,

but will be reimbursed for any amounts paid on LIBOR in excess of the ceiling. Conversely, we will be required

to pay the financial institution that originated the instrument if LIBOR is less than the respective floor rates. We

have recognized the fair value of the interest rate cap and floor as an asset of $0.2 million and $0.1 million at

December 31, 2005 and 2004, respectively.

As of December 31, 2005, we had nine irrevocable standby letters of credit that totaled $16.4 million. These

standby letters of credit, which expire at various times through December 31, 2006 are used to collateralize

certain obligations to third parties. As of December 31, 2005, no amounts were outstanding under these standby

letters of credit.

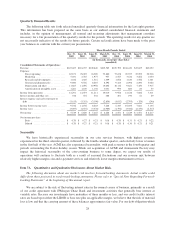

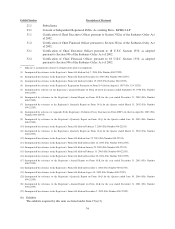

Under the terms of our credit agreement entered into on July 7, 2004, we are permitted and our Board of

Directors has authorized us to repurchase up to $3.0 million of our common stock plus proceeds from the

issuance of new shares of capital stock under our employee equity compensation plans. As of December 31,

2005, the cumulative proceeds received from option exercises or other equity purchases under our equity

compensation plans subsequent to July 7, 2004, totaled approximately $10.6 million bringing the total authorized

for purchase under our credit agreement to $13.6 million.

As of December 31, 2005 and 2004, our net deferred income tax assets totaled $22.7 million and $34.7

million, respectively. In the years ended December 31, 2005 and 2004, we recorded $14.2 million and $10.2

million in income tax expense, respectively, which, as a result of our U.S. NOL carryforwards, will not result in

cash payments for U.S. federal income taxes other than federal alternative minimum taxes.

Off-Balance Sheet Arrangements

As of December 31, 2005, off-balance sheet arrangements are comprised of our conditional consideration

agreement related to our equity investment disclosed in Note 2 to our Consolidated Financial Statements,

obligations under our interest rate hedge disclosed in Note 6 to our Consolidated Financial Statements, and our

operating leases and letters of credit disclosed in Note 8 to our Consolidated Financial Statements. We have no

other off-balance sheet arrangements that have had or are reasonably likely to have a material current or future

effect on our financial condition or consolidated financial statements.

26