Redbox 2005 Annual Report Download - page 24

Download and view the complete annual report

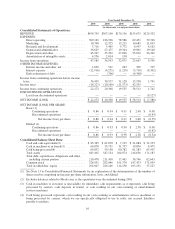

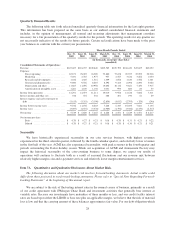

Please find page 24 of the 2005 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A third-party consultant used expectations of future cash flows to estimate the fair value of the acquired retailer

relationships. We amortize our intangible assets over their expected useful lives, which range from 3 to 10 years.

Fees paid to retailers: Fees paid to retailers relate to the amount we pay our retail partners for the benefit

of placing our machines in their stores and their agreement to provide certain services on our behalf to our

customers. The fee is calculated as a percentage of each coin-counting transaction or as a percentage of our

entertainment revenue and is recorded in our consolidated income statement under the caption “direct operating

expenses.” The fee arrangements are based on our evaluation of certain factors with the retailers such as total

revenue, e-payment capabilities, long-term non-cancelable contracts, installation of our machines in high traffic

and/or urban or rural locations, new product commitments, co-op marketing incentive or other criteria. We

recognize this expense at the time we recognize the associated revenue from each of our customer transactions.

This expense is recorded on a straight-line basis as a percentage of revenue based on estimated annual volumes.

In certain instances, we prepay amounts to our retailers, which are expensed over the contract term. The expense

is included in depreciation and other in the accompanying consolidated statements of operations and cash flows.

Stock-based compensation: We have several stock-based compensation programs which are described

more fully in the Notes to our Consolidated Financial Statements included elsewhere in this Annual Report on

Form 10-K. We account for stock-based awards to employees using the intrinsic value method in accordance

with Accounting Principles Board (“APB”) Opinion No. 25, Accounting for Stock Issued to Employees. If we had

determined compensation cost for our stock-based compensation consistent with the method prescribed in

SFAS No. 123, Accounting for Stock-Based Compensation, our net income would have decreased by $4.6 million

in 2005, $4.8 million in 2004 and $5.0 million in 2003. We have adopted SFAS 123(R) as of January 1, 2006.

Recent accounting pronouncements: In December 2004, the Financial Accounting Standards Board

(“FASB”) issued Statement of Financial Accounting Standards No. 123 (revised 2004), Share-Based Payment

(“SFAS 123(R)”). SFAS 123(R) addresses the accounting for stock options and other stock-based compensation.

SFAS 123(R) eliminates the option of accounting for employee stock options using the intrinsic value provisions

of APB Opinion No. 25 and related interpretations, and requires that the compensation cost relating to share-

based payment transactions be recognized in financial statements. That cost will be measured based on the fair

value of the equity or liability instruments issued. In April 2005, the SEC delayed the effective date of

SFAS 123(R) until January 1, 2006 for calendar year companies. Accordingly, beginning January 1, 2006, we

will expense the fair value of all stock-based compensation over the vesting period of the related equity

instrument. In addition, SFAS 123(R) will require the Company to reflect the tax savings resulting from tax

deductions in excess of expense reflected in its financial statements as a financing cash flow, which will impact

the Company’s future reported cash flows from operating activities. Our employee stock-based compensation

plans include stock options and restricted stock awards. Stock-based compensation expense amounts recognized

going forward will be based on the unvested options and awards granted prior to January 1, 2006, and impacted

by future grants and modifications. The impact of adoption of SFAS 123(R) on our results of operations may

vary greatly depending on the number of stock options and restricted stock awards granted and the future price of

our common stock. However, management currently anticipates that, based on a range of estimated prices of our

common stock and current expectations of the number of shares that may be awarded, stock-based compensation

expense during the year ending December 31, 2006 will be similar to our current and prior period proforma

disclosures.

20