Qantas 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

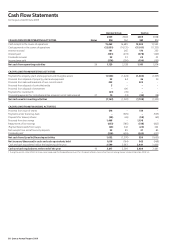

97 Qantas Annual Report 2009

Qantas Group Qantas

2008

$M

Sales and Other Income

Tours and travel 745 (621) 124 5 – 5

Expenditure

Tours and travel 608 (608) – – – –

Selling and marketing 763 (8) 755 683 – 683

Other 773 (5) 768 552 – 552

Profit before related income tax expense 1,408 – 1,408 1,614 – 1,614

1. These items are presented after restatement of comparatives as described in Note 1 (A A).

There is no impact on profit or shareholders’ equity as a result of this change in accounting policy.

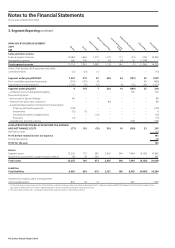

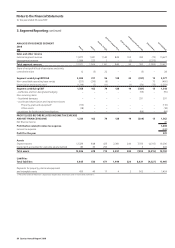

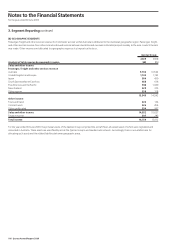

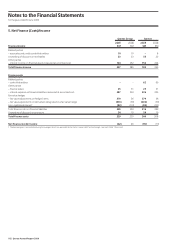

3. Segment Reporting

(A) BUSINESS SEGMENTS

The Qantas Group comprises the following main business segments:

1. Qantas – representing the Qantas passenger flying businesses and related businesses;

2. Jetstar – representing the Jetstar passenger flying businesses, including Jetstar Asia and an investment in Jetstar Pacific;

3. Qantas Freight – representing the air cargo and express freight businesses;

4. Qantas Frequent Flyer – representing the Qantas Frequent Flyer customer loyalty program; and

5. Jetset Travelworld Group – representing the Group’s investment in the Jetset Travelworld Group.

Costs associated with the centralised management and governance of the Qantas Group, together with certain items which are not allocated to business

segments, are reported in Corporate/Unallocated.

The primary reporting measure for the Group’s business segments is Segment underlying EBITDAR, which is defined as Profit before related income tax

expense, depreciation, amortisation, non-cancellable operating lease rentals and finance costs and before non-recurring items.

Non-recurring items are those items which are considered necessary for separate disclosure in the Group and segment results on the basis of their non-

recurring nature and materiality to the segment results.

Intersegment revenue has been determined on an arm’s length basis or a cost plus margin basis depending on the nature of the revenue and the financial

impact on the segment receiving the revenue. Ancillary and support services are allocated to segments on a cost only basis.

Notes to the Financial Statements

for the year ended 30 June 2009

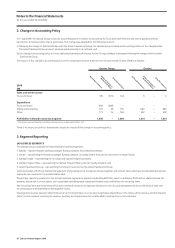

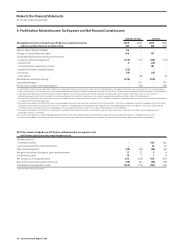

2. Change in Accounting Policy

On 1 July 2008, the Qantas Group revised its accounting policy in relation to accounting for Tours and travel revenue and cost of goods sold to be

reported on a net basis rather than a gross basis. The change was adopted for the following reasons:

(i) following the merger of Qantas Holidays with the Jetset Travelworld Group, the Qantas Group has aligned accounting policies of the merged entity.

The Jetset Travelworld Group report revenues predominantly on a net basis; and

(ii) the change in accounting policy is a more relevant presentation of revenue for the Group’s holidays businesses following the merger with the Jetset

Travelworld Group.

The impact of this change in accounting policy on the comparative income statement for the year ended 30 June 2008 is as follows:

Before Restatement1

Effect of Change in

Accounting Policy

Effect of Change in

Accounting Policy

After Restatement

Before Restatement

After Restatement