Qantas 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 Qantas Annual Report 2009

Directors’ Report

for the year ended 30 June 2009

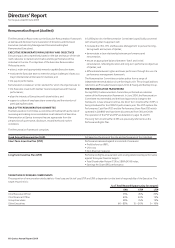

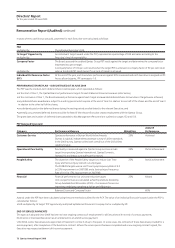

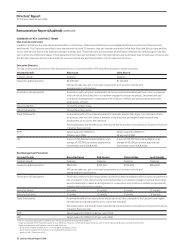

PERFORMANCE REMUNERATION AFFECTING FUTURE PERIODS

The fair value of share-based payments granted is amortised over the vesting period (in accordance with AASB 2 Share-based Payment) and therefore

remuneration in respect of these awards may be reported in future years.

The following table summarises the maximum value of these awards in future years. The minimum value of these awards is nil, should performance

conditions not be satisfied.

Executives 2010 2011

Alan Joyce 989,310 314,572

Colin Storrie 502,041 107,360

Bruce Buchanan 199,682 90,236

Rob Gurney 163,380 62,428

Simon Hickey 397,591 91,682

Lyell Strambi 190,341 114,638

Information on vesting and forfeiture of performance related remuneration during the year is provided on pages 80 and 81.

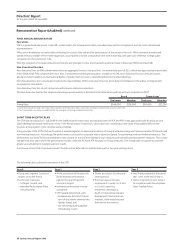

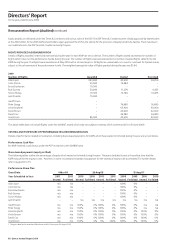

SUMMARY OF PERFORMANCE CONDITIONS

Link between Remuneration Policy and Qantas’ Performance

Relationship between Fixed Annual Remuneration and Qantas’

Performance

An individual’s FAR is not related to Qantas’ performance in a specific year.

FAR is set with reference to the scope of the role and the performance of

the individual in the role.

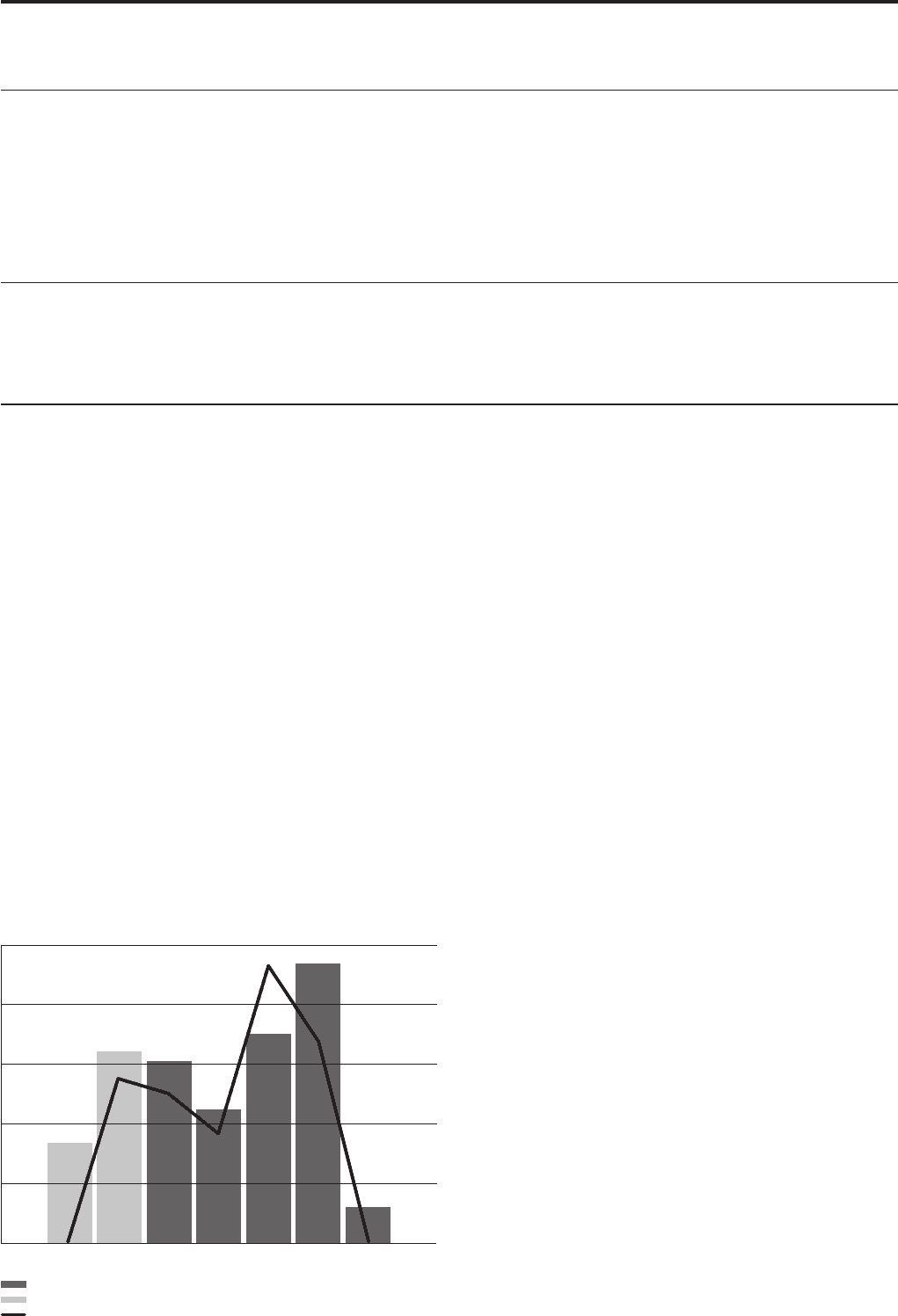

Relationship between Cash Incentives and Qantas’ Performance

In line with Qantas’ achievement against its financial targets in the past

seven years, cash incentives were:

•notpaidfor2002/03;

•paidat110percentoftargetfor2003/04;

•paidat100percentoftargetfor2004/05;

•paidat73percentoftargetfor2005/06;

•paidat186percentoftargetfor2006/07;

•paidat135percentoftargetfor2007/08;and

•notpaidfor2008/09.

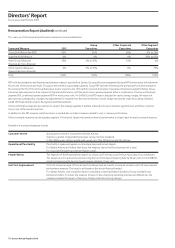

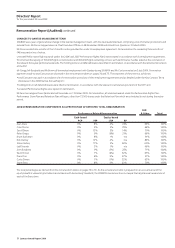

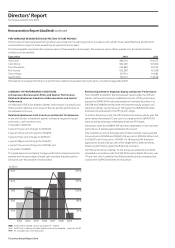

The graph below shows Qantas’ full year profit before related income tax

expense and the percentage of target cash incentives that were paid to

Executives over the past seven financial years.

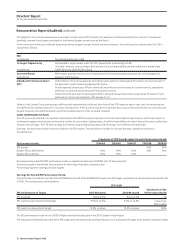

Relationship between Employee Equity and Qantas’ Performance

From 2004/05 to 2006/07, the link between reward under the LTIP and

Qantas’ performance has been established in terms of TSR performance

againsttheS&P/ASX100Indexandabasketofinternationalairlines.For

2007/08 and 2008/09 vesting under the long-term equity program will

dependonQantas’performanceonTSRagainsttheS&P/ASX100Index

and extent of achievement of an EPS growth target.

To achieve full vesting under the LTIP, Qantas must achieve a three year TSR

performancethatexceeds75percentofcompaniesintheS&P/ASX100

Index as well as achieving a challenging three year EPS target.

Allocations under the 2008/09 PSP have been dependent on the corporate

performance of Qantas against a Balanced Scorecard.

One hundred per cent of the target level of deferred shares were awarded

to Executives in 2003/04 and 2004/05, 95 per cent in 2005/06, 80 per cent

in 2006/07 and 91 per cent in 2007/08. On 18 August 2009 the Board

approved an award of 60 per cent of the target level of deferred shares,

based on performance against the Balanced Scorecard.

The TSR performance of Qantas for the three years ended 30 June 2009,

calculated in accordance with the 2006 Performance Rights Plan rules, was

(17) per cent, which ranked at the 60th percentile among companies that

comprisetheS&P/ASX100Indexforthisperiod.

Remuneration Report (Audited) continued

40%

80%

120%

160%

200%

300

600

900

1,200

1,500

2003 2004 2005 2006 2007 2008 2009

Profit before related income tax expense – A-IFRS

Profit from ordinary activities before income tax expense – previous GAAP

% of target cash incentives paid

$million