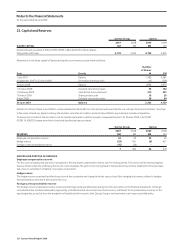

Qantas 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122 Qantas Annual Report 2009

Notes to the Financial Statements

for the year ended 30 June 2009

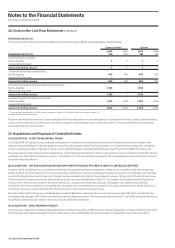

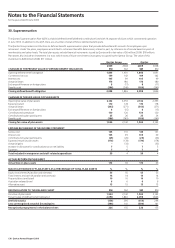

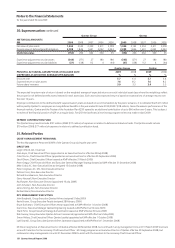

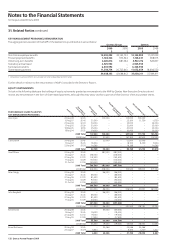

24. Share-based Payments

The DSP Terms & Conditions were approved by shareholders at the 2002 AGM. The DSP governs the provision of equity benefits to Executives within the

Qantas Group. There have been no modifications to the DSP Terms & Conditions during the year.

Eligible employees may be awarded equity benefits under the Qantas Profitshare Scheme.

Further details regarding the operation of equity plans for Executives are outlined in the Directors’ Report.

The total equity settled share-based payment expense for the year was $59 million (2008: $62 million).

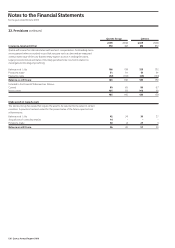

LONG TERM INCENTIVE PLAN (LTIP)

The LTIP is specifically targeted to Senior Executives in key roles or other participants who have been identified as high potential Executives.

All Rights are redeemable on a one-for-one basis for Qantas shares, subject to the achievement of the performance hurdle. Dividends are not payable

on the Rights.

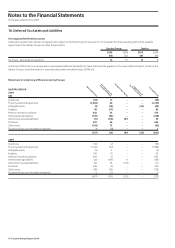

Number of Rights

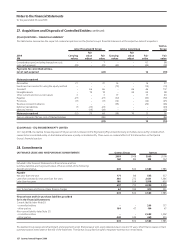

Performance Rights Reconciliation 2009 2008

Rights outstanding as at 1 July 6,121,033 5,038,800

Rights granted 3,117,000 2,545,000

Rights lapsed (1,301,362) (288,276)

Rights vested (1,020,579) (1,174,491)

Rights outstanding as at 30 June 6,916,092 6,121,033

Rights exercisable as at 30 June 1,311,949 1,041,633

No Rights expired during the year. Based on the performance hurdle tested as at 30 June 2009, 242,400 Rights will expire from the 2004/05 award.

All Rights were granted with a nil exercise price. No amount has been paid, or is payable by, the Executive in relation to these Rights.

During the year, 1,020,579 Rights were exercised (2008: 1,174,491). Based on the performance hurdle tested as at 30 June 2009, 1,140,681 Rights for

the 2006/07 award will vest after 12 August 2009. A further 135,124 Rights may vest from the 2005/06 award over the next year, subject to achievement

of the performance hurdle. At 30 June 2009, 27,535 Rights are available to be exercised at the request of the Executive under the 2004/05 award and a

further 143,733 Rights under the 2005/06 awards. For more information on the operation of the LTIP, see pages 71 and 72.

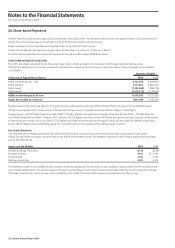

Fair Value Calculation

The estimated value of Rights granted with the TSR performance hurdle component was determined at grant date using a Monte-Carlo model.

A Black Scholes model was used to value the Rights with the EPS performance hurdle. The weighted average fair value of Rights granted during the year

was $1.64 (2008: $3.34).

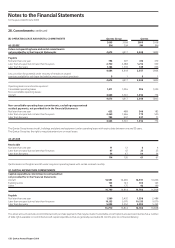

Inputs into the Models 2009 2008

Weighted average share value $2.13 $4.58

Expected volatility 50% 25 – 30%

Dividend yield 3.5% 6.2%

Risk-free interest rate 3.6% 6.2%

The expected volatility for the 2008/09 award was determined having regard to the historical one year volatility of Qantas shares and the implied volatility

on exchange traded options. The risk-free rate was the yield on an Australian Government bond at the grant date matching the remaining life of the plan.

The yield is converted into a continuously compounded rate in the model. The expected life assumes immediate exercise after vesting.