Qantas 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

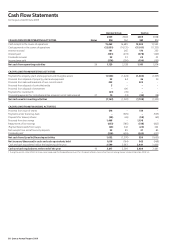

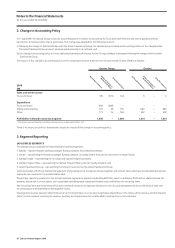

98 Qantas Annual Report 2009

Notes to the Financial Statements

for the year ended 30 June 2009

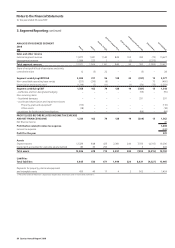

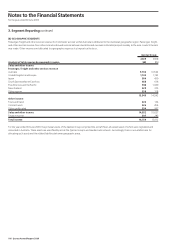

3. Segment Reporting continued

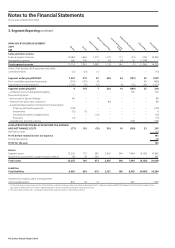

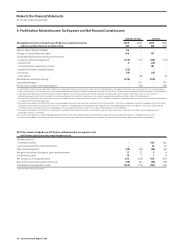

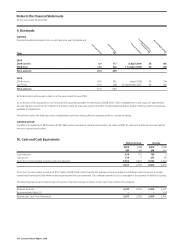

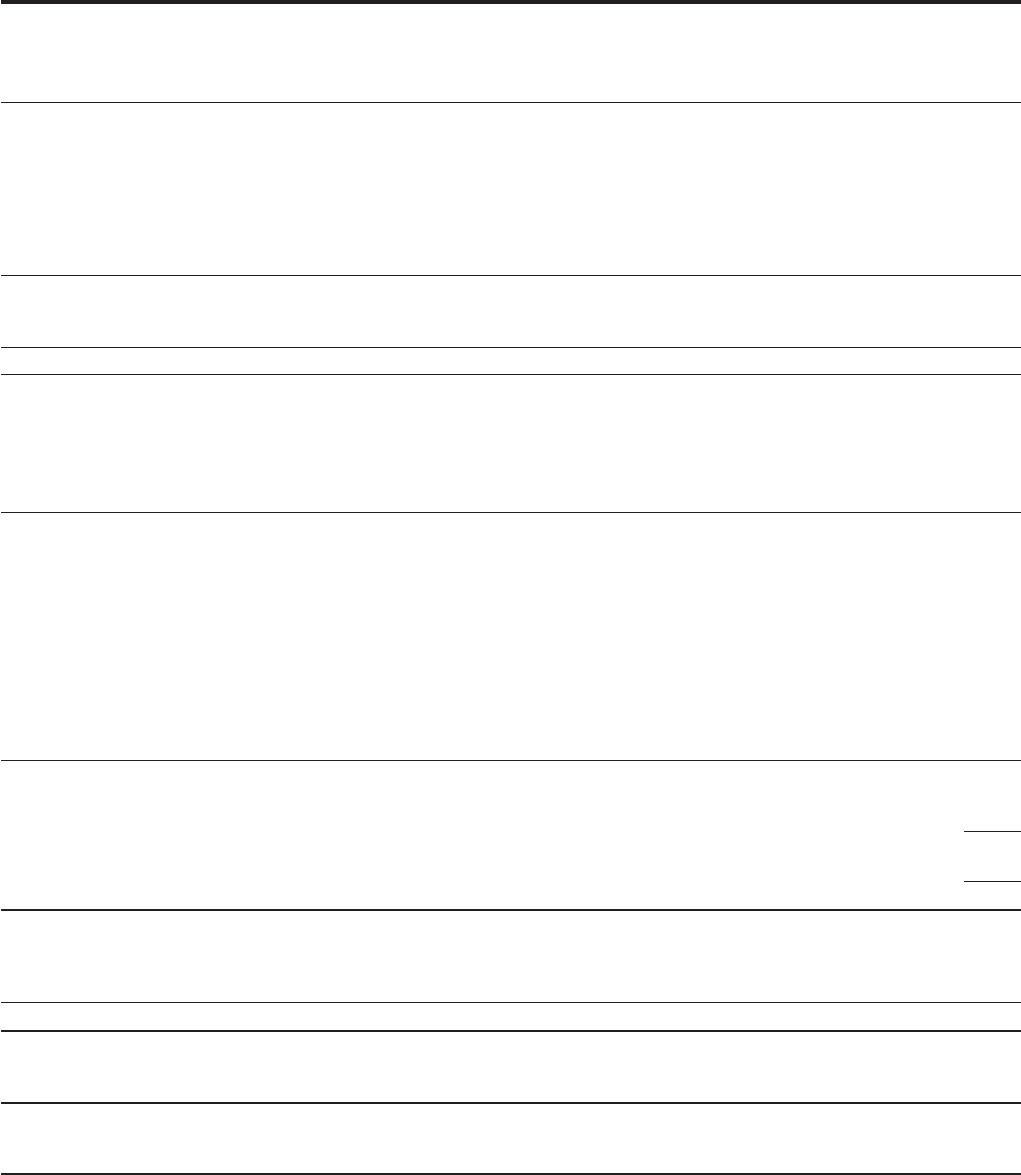

ANALYSIS BY BUSINESS SEGMENT

2009

$M

Sales and other income

External segment revenue 10,784 1,646 1,077 1,103 117 (23) (152) 14,552

Intersegment revenue 926 205 3 30 28 16 (1,208) –

Total segment revenue 11,710 1,851 1,080 1,133 145 (7) (1,360) 14,552

Share of net (loss)/profit of associates and jointly

controlled entities (13) (15) 13 – – – – (15)

Segment underlying EBITDAR1 1,363 373 25 226 22 (137) 33 1,905

Non-cancellable operating lease rentals (253) (251) (6) – – – 60 (450)

Depreciation and amortisation2 (1,106) (15) (12) – (6) (52) (60) (1,251)

Segment underlying EBIT 4 107 7 226 16 (189) 33 204

– ineffective and non-designated hedging – – – – – 105 – 105

Non-recurring items:

– gain on sale of Qantas Holidays 86 – – – – – – 86

– revenue from direct earn conversion1 – – – 84 – – – 84

– accelerated depreciation and impairment (losses)/gains

Property, plant and equipment2 (139) – – – – – – (139)

Investments (15) 19 – – – – – 4

Goodwill and other intangible assets – – (22) – – – – (22)

Provisions (13) – – – – – – (13)

– redundancies and restructuring – – – – – (106) – (106)

(LOSS)/PROFIT BEFORE RELATED INCOME TAX EXPENSE

AND NET FINANCE COSTS (77) 126 (15) 310 16 (190) 33 203

Net finance costs (22)

Profit before related income tax expense 181

Income tax expense (58)

Profit for the year 123

Assets

Segment assets 12,205 757 382 2,616 364 7,494 (4,156) 19,662

Investments accounted for using the equity method 58 39 290 – – – – 387

Total assets 12,263 796 672 2,616 364 7,494 (4,156) 20,049

Liabilities

Total liabilities 6,650 656 651 2,137 168 8,518 (4,496) 14,284

Payments for property, plant and equipment

and intangible assets 802 24 12 – – 692 – 1,530

1. Of the net change in accounting estimates of $16 4 million in relation to frequent flyer accounting as described in Note 1, Segment underlying EBITDAR includes $80 million (Qantas Frequent Flyer

$63 million and Eliminations $17 million) representing the six month impact of the change in accounting estimate.

2. The combination of these lines is reported as Depreciation and amortisation in the Income Statement.

Qantas

Jetstar

Qantas Frequent Flyer

Jetset Travelworld

Group

Corporate/Unallocated

Eliminations

Consolidated

Qantas Freight