Qantas 2009 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148 Qantas Annual Report 2009

Notes to the Financial Statements

for the year ended 30 June 2009

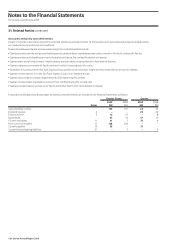

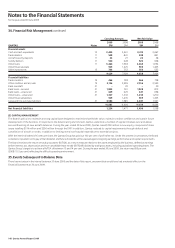

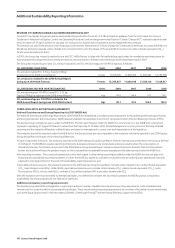

34. Financial Risk Management continued

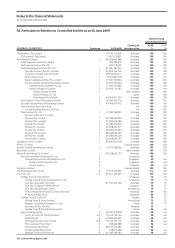

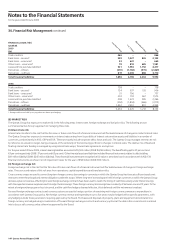

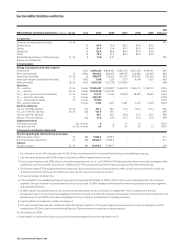

Carrying Amount Net Fair Value

2009 2008 2009 2008

QANTAS Notes $M $M $M $M

Financial assets

Cash and cash equivalents 10 3,404 2,461 3,413 2,467

Tradedebtors 11 548 841 548 841

Aircraft security deposits 11 22 27 22 28

Sundrydebtors 11 520 628 520 628

Other loans 11 3,464 1,994 3,464 1,994

Other financial assets 905 1,425 905 1,425

Other investments 15 766 553 766 553

9,629 7,929 9,638 7,936

Financial liabilities

Trade creditors 19 466 738 466 738

Other creditors and accruals 19 2,156 2,599 2,156 2,599

Bankoverdraft 21 – 20 – 20

Bankloans–secured 21 1,832 761 1,928 813

Bankloans–unsecured 21 629 629 641 658

Otherloans–unsecured 21 1,307 1,233 1,353 1,290

Othernancialliabilities 909 1,435 909 1,435

Leaseandhirepurchaseliabilities 21 3,584 1,985 3,681 1,941

10,883 9,400 11,134 9,494

Net financial liabilities 1,254 1,471 1,496 1,558

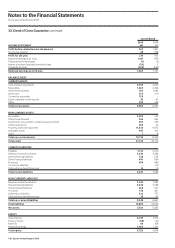

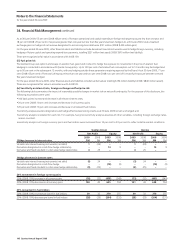

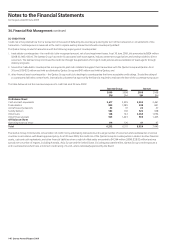

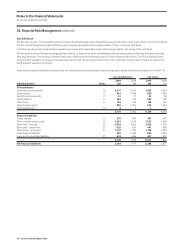

(E) CAPITAL MANAGEMENT

TheBoard’spolicyistomaintainastrongcapitalbasedesignedtomaximiseshareholdervalue,maintaincreditorcondenceandsustainfuture

developmentofthebusiness.Inresponsetothedeterioratingenvironment,Qantasundertookanumberofcapitalinitiativesoverandabove

secured financing of new aircraft deliveries. During the year ended 30 June 2009, Qantas raised $750 million in new equity, comprised of share

issues totalling $514 million and $236 million through the DRP. In addition, Qantas reduced its capital requirements through deferral and

cancellationofaircraftonorder,inadditiontolimitingnon-aircraftcapitalexpendituretoessentialprojects.

Withtheinterimdividendof6centspershare,theQantasGrouphaspaidout100percentofprotaftertax.Underthepresentcircumstances,theBoard

consideresitprudentnottopayanaldividend,andfuturedividendswillbeassesedagainstongoingearningsperformanceandcapitalrequirements.

TheBoardmonitorsthereturnontotalgrossassets(RoTGA),asareturnmeasurerelativetotheassetsemployedbythebusiness,denedasearnings

beforeinterest,tax,depreciationandnon-cancellableleaserentals(EBITDAR)dividedbytotalgrossassets,includingcapitalisedoperatingleases.The

QantasGroup’stargetistoachieveaRoTGAofbetween13and14percent.Duringtheyearended30June2009,thereturnwas8.8percent

(2008: 15.5 per cent) reflecting the difficult operating environment.

35. Events Subsequent to Balance Date

Therehasnotarisenintheintervalbetween30June2009andthedateofthisreport,anyeventthatwouldhavehadamaterialeffectonthe

FinancialStatementsat30June2009.