Qantas 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 Qantas Annual Report 2009

Directors’ Report

for the year ended 30 June 2009

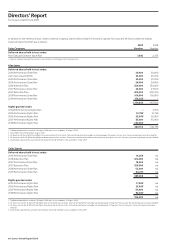

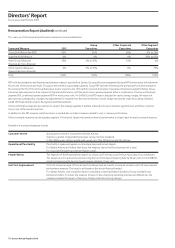

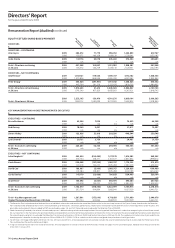

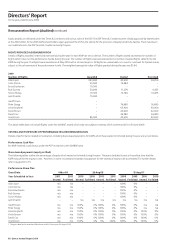

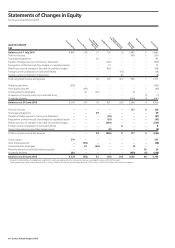

EQUITY SET TLED SHARE-BASED PAYMENT

DIRECTORS

$

DIRECTORS – CONTINUING

Alan Joyce 2009 284,372 71,779 896,742 1,252,893 657,767

2008 138,572 146,209 2,036,130 2,320,911 1,632,195

Colin Storrie 2009 137,176 33,078 405,240 575,494 299,691

2008 n/a n/a n/a n/a n/a

Total – Directors continuing 2009 421,548 104,857 1,301,982 1,828,387 957,458

at 30 June 2008 138,572 146,209 2,036,130 2,320,911 1,632,195

DIREC TORS – NOT CONTINUING

Geoff Dixon 3 2009 1,357,121 319,544 1,495,517 3,172,182 1,548,553

2008 1,275,836 656,044 4,455,383 6,387,263 3,855,843

Peter Gregg3 2009 453,524 (297,931) 1,513,032 1,668,625 554,552

2008 465,704 281,576 2,232,478 2,979,758 1,990,902

Total – Directors not continuing 2009 1,810,645 21,613 3,008,549 4,840,807 2,103,105

at 30 June 2008 1,741,540 937,620 6,687,861 9,367,021 5,846,745

20 09 2,232,193 126,470 4,310,531 6,669,194 3,060,563

Total – Directors at 30 June 20 08 1,880,112 1,083,829 8,723,991 11,687,932 7,478,940

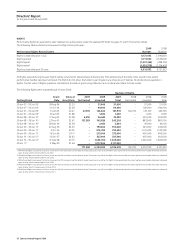

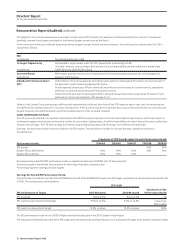

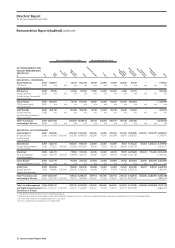

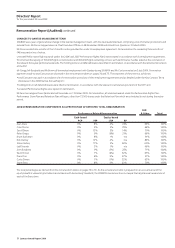

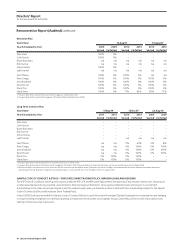

KEY MANAGEMENT AND HIGHEST REMUNERATED EXECUTIVES

$

EXECUTIVES – CONTINUING

Bruce Buchanan 20 09 63,504 7,025 – 70,529 66,258

2008 n/a n/a n/a n/a n/a

Rob Gurney 2009 18,060 3,451 – 21,511 13,497

2008 n/a n/a n/a n/a n/a

Simon Hickey 2009 122,936 32,018 293,590 448,544 250,746

2008 n/a n/a n/a n/a n/a

Lyell Strambi4 20 09 20,731 3,750 – 24,481 31,159

2008 n/a n/a n/a n/a n/a

Total – Executives continuing 2009 225,231 46,244 293,590 565,065 361,660

at 30 June 2008 n/a n/a n/a n/a n/a

EXECUTIVES – NOT CONTINUING

John Borghetti3 2009 453,524 (254,454) 1,217,915 1,416,985 569,542

2008 465,704 236,571 2,101,577 2,803,852 1,999,512

Kevin Brown 3 2009 244,408 (137,953) 1,068,767 1,175,222 512,479

2008 123,218 134,233 1,835,788 2,093,239 1,493,533

David Cox 3 2009 166,967 (5,906) 1,068,767 1,229,828 600,480

2008 101,584 109,827 1,835,788 2,047,199 1,454,143

Curtis Davies3 2009 147,179 (13,438) 700,659 834,400 328,194

2008 n/a n/a n/a n/a n/a

Grant Fenn 3 2009 130,492 (6,503) 366,491 490,480 267,723

2008 123,218 134,233 1,835,788 2,093,239 1,493,533

Total – Executives not continuing 20 09 1,142,570 (418, 254) 4,422,599 5,146,915 2,278,418

at 30 June 2008 813,724 614,864 7,608,941 9,037,529 6,440,721

Total – Key Management and 2009 1,367,801 (372,010) 4,716,189 5,711,980 2,640,078

Highest Remunerated Executives at 30 June 2008 813,724 614,864 7,608,941 9,037,529 6,440,721

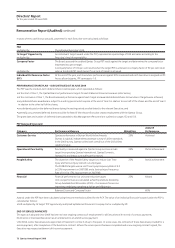

1. The Retention Plan involved awards of deferred shares to individuals whose roles and contribution were identified as critical to the continued success of the Qantas Group. Awards under the Retention

Plan involved awards of deferred shares with a service period of up to three years. Satisfactory performance, which involves achievement of personal KPIs was a further requirement under this plan. The

grant dates and number of shares awarded to KMPs are outlined on pages 133 and 134. No awards were made under the Retention Plan in 2008/09.

2. Under Accounting Standards, the value of a share -based payment is determined at grant date and recognised over the vesting period. No allowance is made when recognising the value of these awards

for any movement in the share price after grant date before vesting conditions are met and the Executive becomes entitled to the shares. For example, the volume weighted share price used to determine

the accounting value of grants issued under the Retention Plan to Executive Directors in 2008 was $5.82 (and to other Executives in 2008 was $5.45). The supplemental market value at year end of share-

based payments is based on the closing share price at 30 June 2009 of $2.01 (2008: $3.04) as a substitute for the volume weighted share price determined at grant date.

3. For Mr Dixon, Mr Gregg, Mr Borghetti, Mr Brown, Mr Cox, Mr Davies and Mr Fenn, share-based payment remuneration includes the value of accelerated vesting of awards under the Performance Share

Plan and Retention Plan and the forfeiture of Right s.

4. A sign-on award of 75,000 shares was made to Mr Strambi. The award operates in a similar manner to the PSP awards. Awards are subject to a ten-year holding lock, however Mr Strambi can call for the

shares from 1 January 2011.

Remuneration Report (Audited) continued

Performance

Share Plan

Long Term

Incentive Plan

Retention

Plan1

Supplemental

Market Value

at 30 June2

Total