Qantas 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Qantas Annual Report 2008

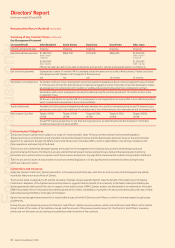

(D) Principles of Consolidation

Controlled Entities

Controlled entities are entities controlled by Qantas. Control exists when

Qantas has the power, directly or indirectly, to govern the fi nancial and

operating policies of an entity so as to obtain benefi ts from its activities.

In assessing control, potential voting rights that presently are exercisable

or convertible are taken into account.

The Financial Statements of controlled entities are included in the

consolidated Financial Statements from the date that control commences

until the date that control ceases.

Investments in controlled entities are carried at their cost of acquisition,

less any charge for impairment, in the Financial Statements of Qantas.

Intra-group balances and any unrealised gains and losses or income

and expenses arising from intra-group transactions are eliminated

in preparing the consolidated Financial Statements.

Minority interests in the results of controlled entities are shown

as a separate item in the Qantas Group Financial Statements.

Associates

Associates are those entities in which the Qantas Group has signifi cant

infl uence, but not control, over the fi nancial and operating policies.

In the consolidated Financial Statements, investments in associates are

accounted for using equity accounting principles and are carried at the

lower of the equity accounted amount and the recoverable amount.

The consolidated Financial Statements include the Qantas Group’s

share of the total recognised gains and losses of associates on an equity

accounted basis, from the date that signifi cant infl uence commences

until the date that signifi cant infl uence ceases.

The Qantas Group’s share of post-acquisition movements in

reserves is recognised in reserves in the consolidated Financial

Statements. The cumulative post-acquisition movements are adjusted

against the carrying value of the investment. Dividends declared by

associates are recognised in Qantas’ Income Statement, while in

the consolidated Financial Statements they reduce the carrying

amount of the investment.

When the Qantas Group’s share of losses exceeds its interest in an

associate, the Qantas Group’s carrying amount is reduced to nil and

recognition of further losses is discontinued except to the extent that

the Qantas Group has incurred legal or constructive obligations or

made payments on behalf of an associate.

In the Financial Statements of Qantas, investments in associates are

carried at cost less any charge for impairment.

Jointly Controlled Entities

Jointly controlled entities are those entities over whose activities the

Qantas Group has joint control, established by contractual agreement.

In the consolidated Financial Statements, investments in jointly

controlled entities, including partnerships, are accounted for using

equity accounting principles and are carried at the lower of the equity

accounted amount and the recoverable amount.

The share of the jointly controlled entity’s net profi t or loss is recognised

in the consolidated Income Statement from the date joint control

commences until the date joint control ceases. Other movements in

reserves are recognised directly in equity. Dividends and distributions

declared by jointly controlled entities are recognised in Qantas’ Income

Statement, while in the consolidated Financial Statements they reduce

the carrying amount of the investment.

When the Qantas Group’s share of losses exceeds the carrying value

of its investment in a jointly controlled entity, the Qantas Group’s

carrying amount is reduced to nil and recognition of further losses

is discontinued except to the extent that the Qantas Group has incurred

legal or constructive obligations or made payments on behalf of a jointly

controlled entity.

In the Financial Statements of Qantas, investments in jointly controlled

entities are carried at cost less any charge for impairment.

(E) Foreign Currency Transactions

Transactions

Foreign currency transactions are translated to Australian dollars

at the rates of exchange prevailing at the date of each transaction except

where hedge accounting is applied. At balance date, amounts receivable

and payable in foreign currencies are translated at the rates of exchange

prevailing at that date. Resulting exchange differences are brought to

account as exchange gains or losses in the Income Statement in the year

in which the exchange rates change. Non-monetary assets and liabilities

that are measured in terms of historical cost in a foreign currency are

translated using the exchange rate at the date of the transaction. Non-

monetary assets and liabilities denominated in foreign currencies that

are stated at fair value are translated to Australian dollars at foreign

exchange rates prevailing at the dates the fair value was determined.

Translation of Foreign Operations

Assets and liabilities of foreign operations, including controlled

entities and investments in associates and jointly controlled entities,

are translated at the rates of exchange prevailing at balance date.

The Income Statements of foreign operations are translated to Australian

dollars at rates approximating the foreign exchange rates prevailing at

the dates of the transactions. Exchange differences arising on translation

are recorded in the foreign currency translation reserve. The balance of

the foreign currency translation reserve relating to a foreign operation

that is disposed of, or partially disposed of, is recognised in the Income

Statement in the year of disposal.

(F) Derivative Financial Instruments

Qantas is subject to foreign currency, interest rate, fuel price and credit

risks. Derivative fi nancial instruments are used to hedge these risks.

It is Qantas policy not to enter into, issue or hold derivative fi nancial

instruments for speculative trading purposes.

Derivative fi nancial instruments are recognised at fair value both initially

and on an ongoing basis. Transaction costs attributable to the derivative

are recognised in the Income Statement when incurred. The method of

recognising gains and losses resulting from movements in market prices

depends on whether the derivative is a designated hedging instrument,

and if so, the nature of the risk being hedged. The Qantas Group

designates certain derivatives as either hedges of the fair value of

recognised assets or liabilities or a fi rm commitment (fair value hedges);

or hedges of highly probable forecast transactions (cash fl ow hedges).

Gains and losses on derivative fi nancial instruments qualifying for hedge

accounting are recognised in the same Income Statement category as

the underlying hedged instrument. Changes in underlying market

conditions or hedging strategies could result in recognition in the Income

Statement of changes in fair value of derivative fi nancial instruments

designated as hedges.

Qantas documents at the inception of the transaction the relationship

between hedging instruments and hedged items, as well as its risk

management objective and strategy for undertaking each transaction.

Qantas also documents its assessment, both at hedge inception and on

an ongoing basis, of whether the hedging instruments that are used in

hedge transactions have been and will continue to be highly effective.

Notes to the Financial Statements

for the year ended 30 June 2008

1. Statement of Significant Accounting Policies continued

For personal use only