Qantas 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108 Qantas Annual Report 2008

Notes to the Financial Statements

for the year ended 30 June 2008

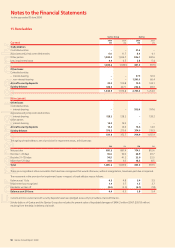

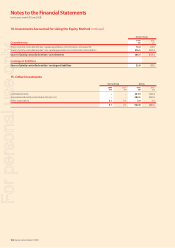

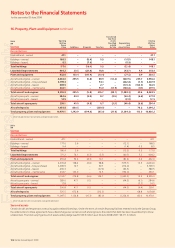

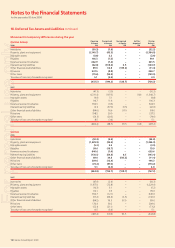

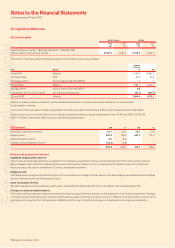

Impairment tests for CGUs containing goodwill and other intangible assets with indefinite useful lives

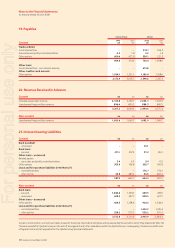

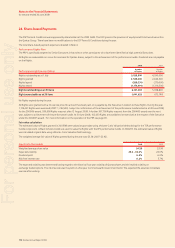

The following CGUs have signifi cant carrying amounts of goodwill and other intangible assets with indefi nite useful lives:

Qantas Group Qantas

2008

$M

2007

$M

2008

$M

2007

$M

Goodwill

Jetstar 90.5 90.5 ––

Qantas Flight Catering 18.2 18.2 ––

Qantas 37.8 24.1 ––

146.5 132.8 ––

Airport landing slots

Qantas 35.5 35.5 35.5 35.5

Jetstar

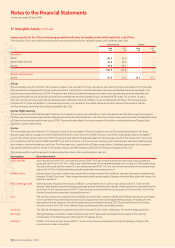

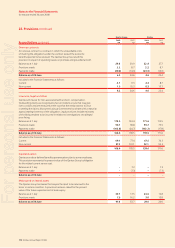

The recoverable amount of Jetstar CGU is based on value in use calculations. Those calculations use cash fl ow projections based on the three year

plan approved by management and endorsed by the Board. Cash fl ows for a further fi ve years have been extrapolated using an average 8.7 per

cent per annum growth rate out to 2016. This growth rate refl ects the planned expansion of Jetstar both domestically and internationally and

is appropriate given the actual growth achieved since establishment and the Qantas Group’s committed B787 order. For a further 12 years,

a 3.6 per cent per annum growth rate has been assumed, refl ecting long-term infl ation, when extrapolating cash fl ows. The three year plan,

coupled with a 17 year extrapolation, is believed appropriate, as it represents the capital intensive long-term nature of the aviation industry

and the estimated useful life of the assets employed in this CGU.

Qantas Flight Catering

The recoverable amount of Qantas Flight Catering CGU is based on value in use calculations. Those calculations use cash fl ow projections based on

the three year business plan approved by management and endorsed by the Board. Cash fl ows for a further seven years have been extrapolated using

a 3.6 per cent per annum growth rate out to 2018. This growth rate refl ects the mature nature of the airline catering industry and Qantas Flight

Catering’s current market share.

Qantas

The recoverable amount of Qantas CGU is based on value in use calculations. Those calculations use cash fl ow projections based on the three

year plan approved by management and endorsed by the Board. Cash fl ows for a further fi ve years have been extrapolated using an average 8.7

per cent per annum growth rate out to 2016. This growth rate refl ects the planned expansion of Qantas as a result of the introduction into service

of committed aircraft such as the A380 and B787. For a further 15 years, a 3.6 per cent per annum growth rate has been assumed, refl ecting long-

term infl ation, when extrapolating cash fl ows. The three year plan, coupled with a 20 year extrapolation, is believed appropriate, as it represents

the capital intensive long-term nature of the aviation industry and the estimated useful life of the assets employed in this CGU.

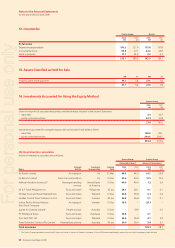

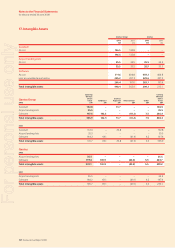

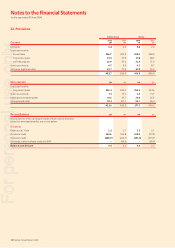

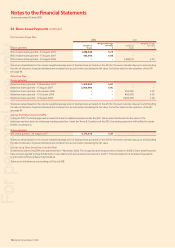

The key assumptions and the approach to determining their value in the current and prior year are:

Assumption How determined

Discount rate A pre-tax discount rate of 11.1 per cent per annum (2007: 10.5 per cent per annum) has been used in discounting the

projected cash fl ows of all CGUs, refl ecting a market estimate of the weighted average cost of capital of the Qantas Group.

This discount would need to exceed 13.3 per cent per annum (2007: 14.1 per cent per annum) before the carrying amount

of any of the CGUs of the Qantas Group would exceed their recoverable amount.

Market share Qantas Group’s domestic market share is expected to remain between 65 and 68 per cent and international market share

between 30 and 35 per cent. These ranges were estimated having regard to Qantas committed fl eet plans and those of its

existing competitors.

Real market growth Market growth, excluding the impacts of infl ation, is estimated to be 5.1 per cent per annum (2007: 3.7 per cent per

annum), refl ecting the long-term average passenger growth experienced by Qantas. Market growth would need to fall by

more than 4.5 per cent per annum (2007: 5.5 per cent per annum) before the carrying amount of any of the CGUs of the

Qantas Group would exceed their recoverable amount.

Fuel The fuel into-plane price is assumed to be US$162 per barrel (2007: between US$89 and US$100) and was set with regard

to the spot West Texas Intermediate crude oil price adjusted for historical average refi ning margins. Providing all other

assumptions remain constant, the fuel into-plane price would need to exceed US$172 per barrel before the carrying

amount of any of the CGUs of the Qantas Group would exceed their recoverable amount.

Currency The US$:A$ exchange rate is assumed to be 93.6 cents (2007: 84.7 cents), refl ecting a 12 month average spot price.

Fleet age Average fl eet age is forecast to remain between nine and 11 years and is estimated having regard to the existing

contractually committed long-term fl eet plan for the Qantas Group.

Inflation Infl ation of 3.6 per cent per annum (2007: 2.5 per cent per annum) represents the long-term average change in the

consumer price index in Australia.

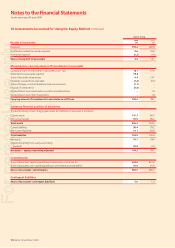

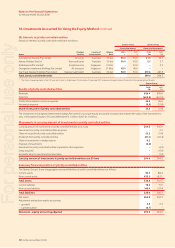

17. Intangible Assets continued

For personal use only