Qantas 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61 Qantas Annual Report 2008

Directors’ Report

for the year ended 30 June 2008

Remuneration Report (Audited) continued

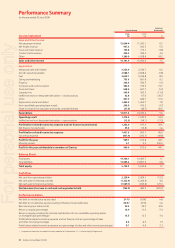

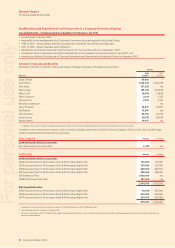

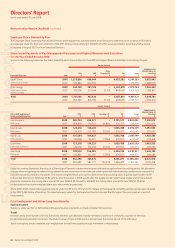

Total Reward Mix

Consistent with market practice, the proportion of remuneration attributable to each component of the Performance Plan is dependent on the level

of responsibility of the Executive. The Board obtains independent advice on market practice and relevant benchmarking data from its external

advisors in setting target reward amounts and mix.

The total reward mix on average is as follows:

% of Total Reward Opportunity (‘at Target’)

FAR

%

Performance

Cash Plan

%

Performance

Equity Plan (PSP

and PRP)

%

Chief Executive Offi cer 40 30 30

Chief Financial Offi cer/Executive General Manager Qantas/Chief Executive Offi cer Jetstar 45 30 25

Other Executive General Managers 50 30 20

Other Executives depending on level of responsibility 55 – 85 7.5 – 20 7.5 – 25

The above table is used to determine the allocation of performance-based remuneration and is based on the Executive’s FAR at the date of the

allocation. This target reward mix is based on the value of equity grants, assuming vesting conditions are met and does not necessarily refl ect

the actual remuneration received by the Executive in the current year.

For those Executives selected to participate in the PRP, the ‘at target’ component of the Performance Equity Plan is presumed to be delivered

in equal proportions via the PSP and the PRP.

The reward mix excludes any awards under the RP, which are made on an individual basis, and separately from the fi xed versus variable considerations

for each of the Executive levels.

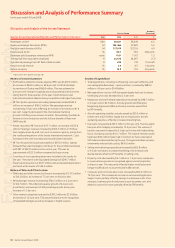

Operation of Incentive Plans

Under all the Executive Incentive Plans operating within Qantas, the CEO may recommend changes to the Plans to the Board. The Board has

discretion to amend the operation of the plans as appropriate, given changes in business circumstances or to recognise a particular degree of

diffi culty or the effects of events external to management, in any year. It is the Board’s intention that any such change and its outcome for reward

would be disclosed in the re levant Qantas Annual Report.

The Board has instituted a cap on the PCP pool of 200 per cent and a cap on the PSP pool of 120 per cent.

Qantas Code of Conduct & Ethics – Employee Share Trading Policy, Margin Loans and Hedging

The Terms & Conditions of the Qantas Deferred Share Plan (DSP) (which govern awards under the PSP, PRP and RP) specifi cally prevent the granting

of any security interest over, disposing of, or otherwise dealing with any unvested, unconverted or deferred equity entitlements. Once equity

entitlements vest and convert to unrestricted shareholdings in the name of each participant under the relevant equity plan, participants are free

to deal with their shareholdings subject to the Qantas Code of Conduct & Ethics and Employee Share Trading Policy.

In April 2008, the Board amended the Qantas Code of Conduct & Ethics to prohibit certain Nominated Qantas Employees from entering into any

hedging or margin lending arrangement or otherwise granting a charge over the securities of any Qantas Group Listed Entity, where control of any

sale process relating to those securities may be lost.

Continuous Improvement

As mentioned above, Qantas regularly reviews all elements of its Executive remuneration philosophy and objectives to ensure they are appropriate

from the perspective of governance, disclosure, reward and market conditions.

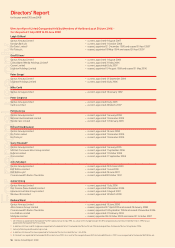

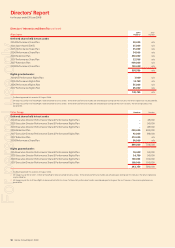

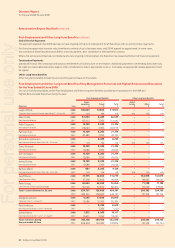

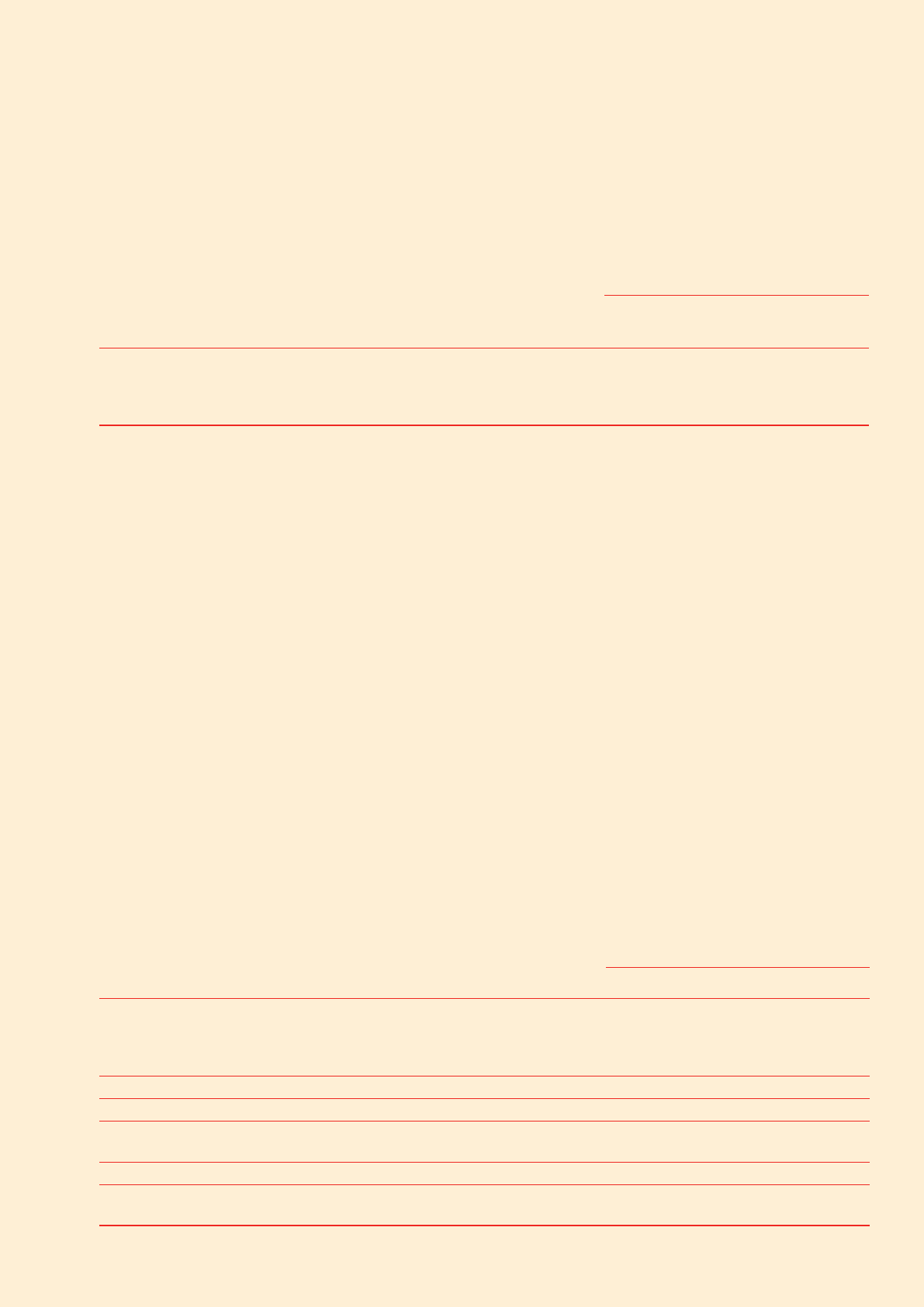

Summary of Eligibility

Set out below is a summary of each of the elements of remuneration provided to Key Management Personnel:

Key Management Personnel

Elements of Remuneration

Non-Executive

Directors

Executive

Directors Executives

Fixed remuneration Fixed Annual Remuneration ✓✓✓

Superannuation contributions ✓✓✓

Travel entitlements ✓✓✓

Other benefi ts ✓✓✓

Short-term incentives Performance Cash Plan –✓✓

Medium-term incentives Performance Share Plan –✓✓

Long-term incentives Performance Rights Plan –✓✓

Retention Plan –✓✓

Legacy plans Executive Director/Senior Manager Long-Term Incentive Plan –✓✓

Post employment/Other End of service payments (discontinued) ––✓

Long-term Benefi ts Travel entitlements ✓✓✓

For personal use only