Qantas 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

138 Qantas Annual Report 2008

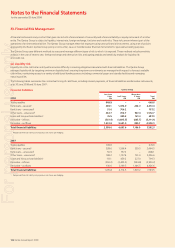

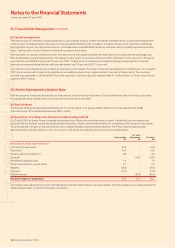

Notes to the Financial Statements

for the year ended 30 June 2008

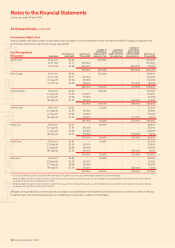

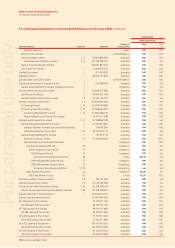

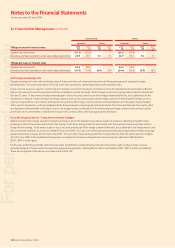

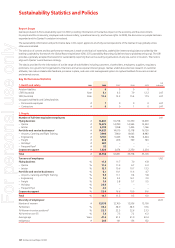

Qantas Group Qantas

Net profi tEquity Net profi tEquity

100bps increase in interest rates 2008

$M

2007

$M

2008

$M

2007

$M

2008

$M

2007

$M

2008

$M

2007

$M

Variable rate instruments (24.2) (25.6) ––(24.2) (25.4) ––

Derivative and fi xed rate debt in a fair value hedge relationship 24.9 30.1 9.0 7.7 24.9 30.1 9.0 7.7

100bps decrease in interest rates

Variable rate instruments 24.2 25.6 ––24.2 25.4 ––

Derivative and fi xed rate debt in a fair value hedge relationship (24.6) (31.6) (8.8) (8.1) (24.6) (31.6) (8.8) (8.1)

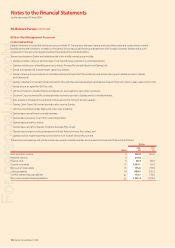

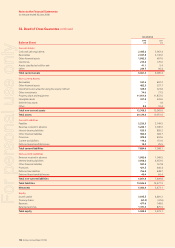

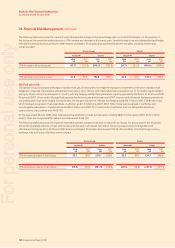

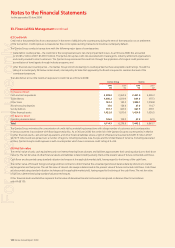

(ii) Foreign exchange risk

Foreign exchange risk is the risk that the fair value of future cash fl ows of a fi nancial instrument will fl uctuate because of changes in foreign

exchange rates. The source and nature of this risk arises from operations, capital expenditures and translation risks.

Cross-currency swaps are used to convert long-term foreign currency borrowings to currencies in which the Qantas Group has forecast suffi cient

surplus net revenue to meet the principal and interest obligations under the swaps. These foreign currency borrowings have a maturity of between

one and 12 years. To the extent a foreign exchange gain or loss is incurred, and the cash fl ow hedge is deemed effective, this is deferred until the

net revenue is realised. Forward foreign exchange contracts and currency options are used to hedge a portion of remaining net foreign currency

revenue or expenditure in accordance with Qantas Group policy. Net foreign currency revenue and expenditure out to fi ve years may be hedged

within specifi c parameters, with any hedging outside these parameters requiring approval by the Board. Purchases and disposals of property, plant

and equipment denominated in a foreign currency are hedged using a combination of forward foreign exchange contracts and currency options

at the date a fi rm commitment is entered into to buy or sell currency unless otherwise approved by the Board.

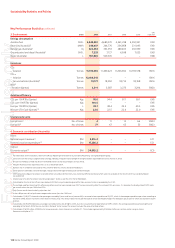

Unrealised gains/losses – long-term revenue hedges

Where long-term borrowings are held in foreign currencies in which the Qantas Group derives surplus net revenue, offsetting forward foreign

exchange contracts have been used to match the timing of cash fl ows arising under the borrowings with the expected revenue surpluses used to

hedge the borrowings. To the extent a gain or loss is incurred, and the cash fl ow hedge is deemed effective, this is deferred in the hedge reserve until

the net revenue is realised. As at 30 June 2008, 67.6 per cent (2007: 52.1 per cent) of forecast operational and capital expenditure foreign exchange

exposures less than one year and 20.4 per cent (2007: 10.3 per cent) of exposures greater than one year but less than fi ve years have been hedged.

As at 30 June 2008, total unrealised exchange gains on hedges of net revenue designated to service long-term debt were $424.8 million

(2007: $410.7 million gain).

For the year ended 30 June 2008, other fi nancial assets and liabilities include derivative fi nancial instruments used to hedge foreign currency,

including hedging of future capital and operating expenditure payments, totalling $615.0 million (net liability) (2007: $331.9 million (net liability)).

These are recognised at fair value in accordance with AASB 139.

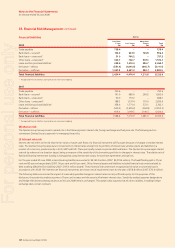

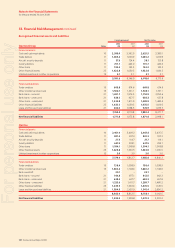

33. Financial Risk Management continued

For personal use only