Proctor and Gamble 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Core earnings per share for fi scal year were $., which

is % below the prior-year level. The EPS benefi ts from sales

growth, cost savings and share repurchase this past year were

more than offset by a combination of headwinds from higher raw

material costs, geographic mix, a higher effective core tax rate

and increased investments to support our accelerated portfolio

expansion into developing markets.

Free cash fl ow for the fi scal year was $. billion. Adjusted free

cash fl ow productivity was %, consistent with our target. During

the fi scal year, we returned $ billion of cash to shareholders

through $ billion of dividends and $ billion of share repurchase.

We paid a dividend for the nd consecutive

year, making P&G one of only nine publicly

traded companies headquartered in the U.S.

to have delivered uninterrupted dividends

for years or more.

We also increased the dividend by %. This was the th

consecutive year we have increased the dividend, one of only six

companies to have done this.

Over the last years, P&G has paid out $ billion in dividends.

Excluding $ billion of share repurchase associated with the

Gillette acquisition, we have repurchased $ billion of stock.

In total, through dividends and share repurchase, we have returned

$billion of cash to our shareholders, which is % of reported

net earnings.

Returning capital to shareholders, through

both dividends and share repurchase,

remains a central pillar of our efforts to

create superior shareholder value.

I’m proud of the extraordinary efforts P&G people have made to

keep our Company growing through a very demanding economic

period. We know, however, that we have not delivered suffi cient

growth to rank among the best performers in our industry.

To do this, we must get back on a path toward our long-term

annual objective of high single-digit to low double-digit EPS growth

and total shareholder return in the top third of our competitive

peer group.

/

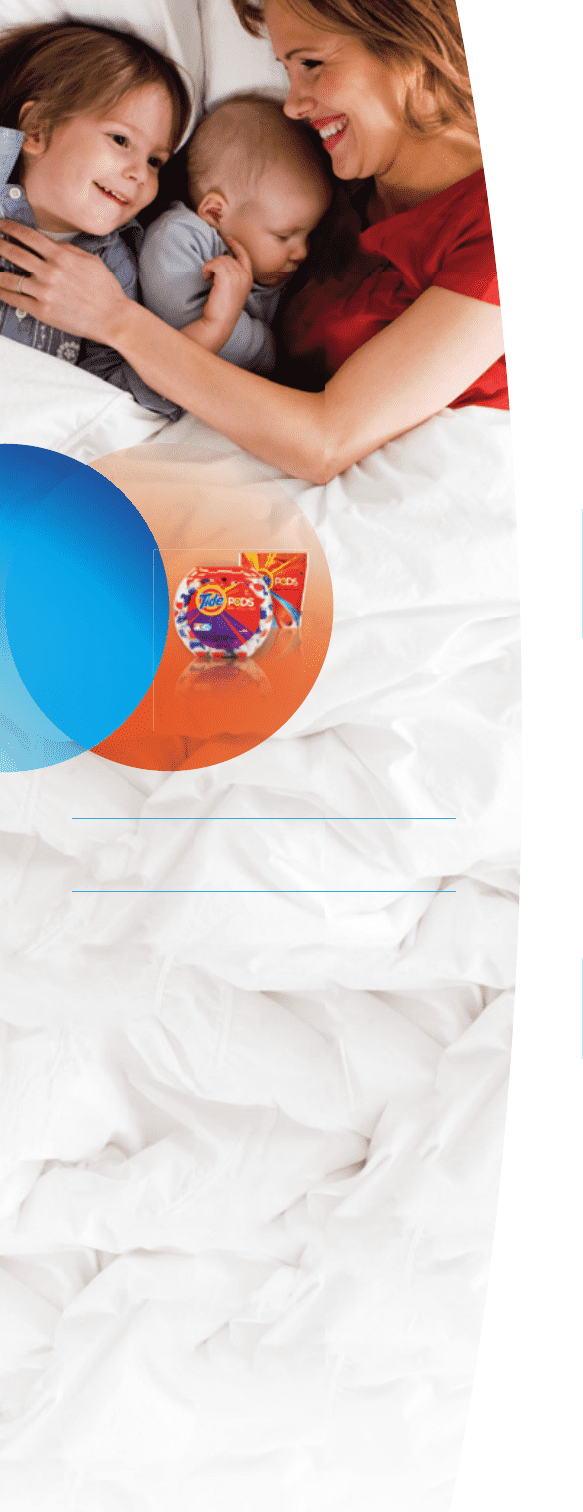

Innovation that

Sets New Standards

TIDE PODS IS AN EXAMPLE OF P&G innovation

that obsoletes existing products or creates entirely

new product categories. The innovative, three-

chamber, pre-measured packet can simply be dropped

in the wash

—

no measuring, no worrying

—

and it

even dissolves in cold water.

Since launching in the U.S. in February , TidePODS

has had a very strong performance

—

ahead of our

expectations. Since we began shipping PODS, the unit

dose laundry segment has more than doubled to %

of total laundry share

—

and TidePODS is over two-

thirds of this segment.

It’s an innovation that’s making laundry day easier

—

and is saving consumers loads of time.

4 The Procter & Gamble Company