Proctor and Gamble 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The model works. Funding it with productivity savings and executing

it broadly and consistently with discipline is the proven way for

P&G to deliver the business and fi nancial results to which we’ve

committed. This is what we are doing.

Fiscal Year Financial Results

Developing-market organic sales growth and cash fl ow productivity

were both strong in . Developed-market organic sales growth

and earnings progress were not.

In fi scal , we delivered % organic

sales growth overall. P&G has averaged

% organic sales growth over the past

three years, achieving % to % organic

sales growth for consecutive quarters.

In just three years, we’ve added organic sales of $. billion,

the equivalent of adding a Fortune company to our portfolio.

Growth continues to be very strong in developing markets, which

now generate % of P&G’s sales and % of our unit volume.

It’s a $ billion business for P&G, the largest developing-market

business of any consumer products company. We see signifi cant

remaining growth opportunities as our business in developing

markets is still smaller as a percent of sales than the developing

market businesses of some of our competitors, and we will continue

to focus on growing our business in the largest and most important

of these markets.

Our growth in developed markets has been weaker, resulting from

slower market growth and declining market shares. The share

declines in these markets were driven primarily by consumer value

issues on key brands in several large categories due to a combina-

tion of price increases taken to recover higher commodity costs,

which our competitors did not take, and increased promotional

activity by competitors. Developed markets represent about %

of our sales and % of operating profi ts, so it’s essential that

they are healthy and growing. Consequently, developed-market

businesses

—

including fabric care and baby care in the United States

and the largest markets in Western Europe, as well as the United

States oral care, skin care, hair care, shave care and feminine care

categories

—

are a disproportionate focus of strengthened plans

that we began to implement earlier this year. We are ensuring we

have product offerings from each of these businesses that provide

superior value

—

at the right price and with innovation that is

strong

—

supported by marketing that effectively communicates the

superiority of our products.

*

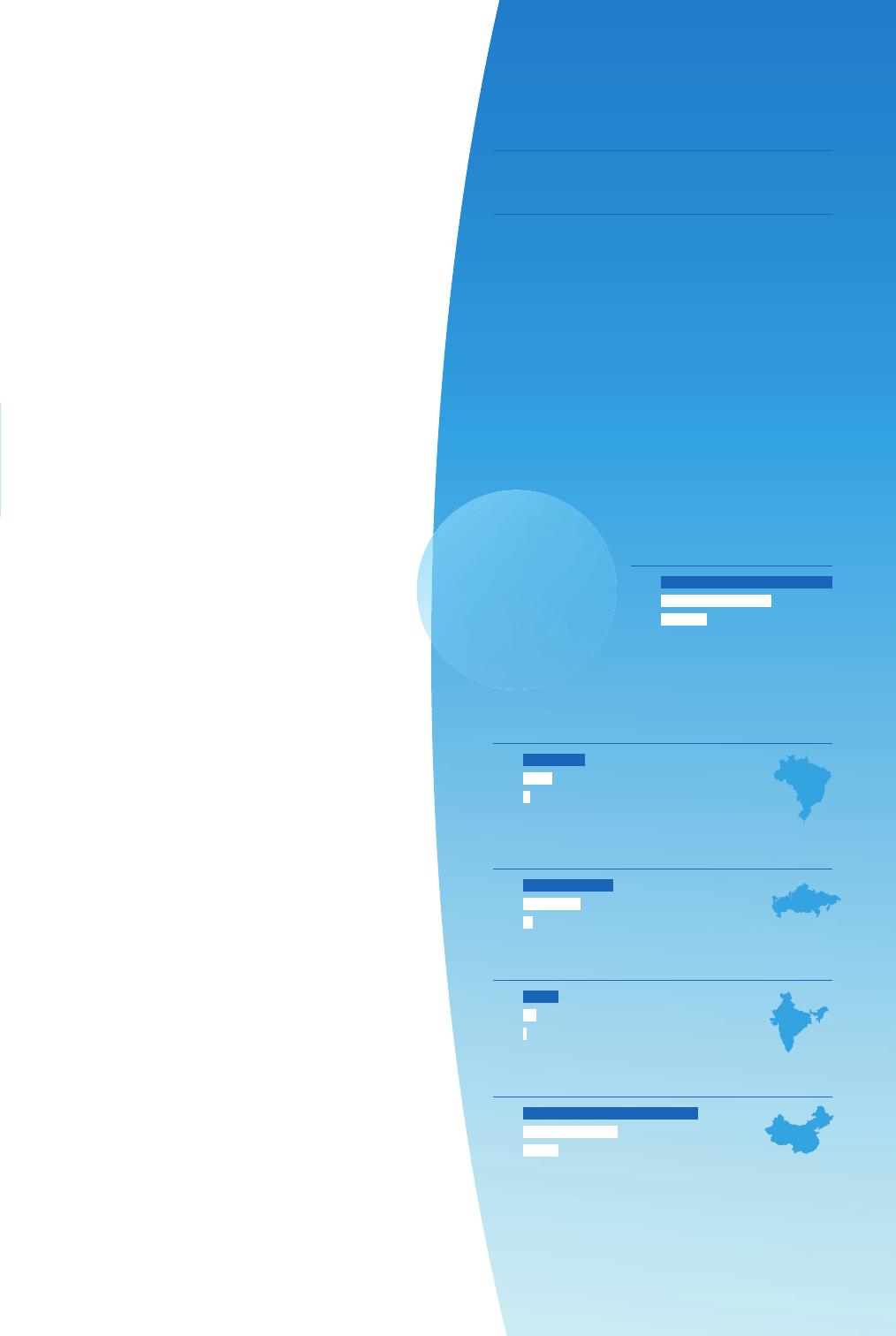

Strong Growth in

Developing Markets

OUR DEVELOPING-MARKET SALES growth has been

very strong over the past ten years. Three years ago,

we made an intervention to expand further in these

markets, and we’re growing at nearly double the rate

of the underlying markets. Developing markets are

now a $ billion business for P&G, generating %

of sales and % of our unit volume.

We’re focused on our top developing markets

where growth prospects are highest, including the

important “BRIC” markets of Brazil, Russia, India and

China, where sales have grown an average of %

over the past decade.

>

%

P&G has a strong track record

of successful developing-

market growth

—

averaging

>% growth over the

pastdecade.

%

compound

annual growth

%

compound

annual growth

%

compound

annual growth

*

%

compound

annual growth

* Bars represent net sales in U.S. dollars.

The Procter & Gamble Company 3