Proctor and Gamble 1999 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 1999 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

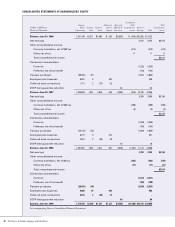

40

The Procter & Gamble Company and Subsidiaries

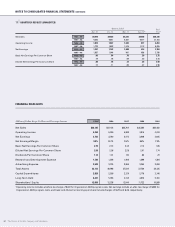

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

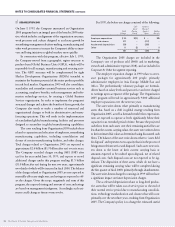

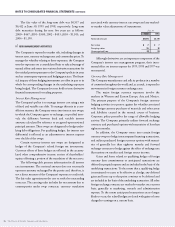

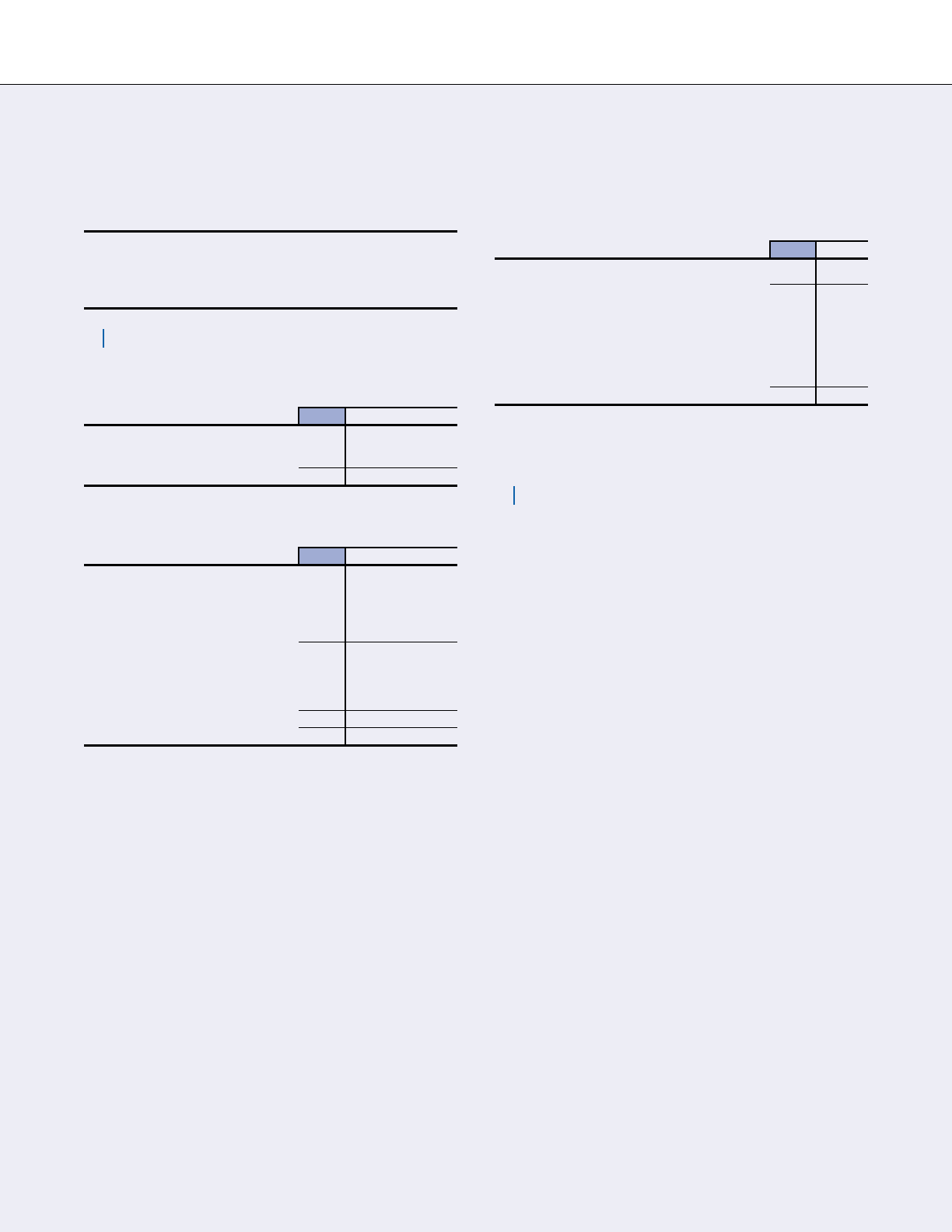

Assumed health care cost trend rates have a significant

effect on the amounts reported for the health care plans. A

one percentage point change in assumed health care cost

trend rates would have the following effects:

One Percentage One Percentage

Point Increase Point Decrease

Effect on total of service and

interest cost components $ 28 $ (23)

Effect on postretirement

benefit obligation 162 (136)

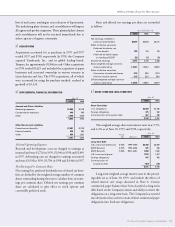

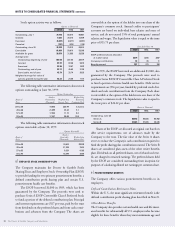

10 INCOME TAXES

Earnings before income taxes consist of the following:

Years Ended June 30

1999 1998 1997

United States $3,474 $3,632 $3,232

International 2,364 2,076 2,017

5,838 5,708 5,249

The income tax provision consists of the following:

Years Ended June 30

1999 1998 1997

Current Tax Expense

U.S. Federal $1,080 $ 996 $ 967

International 934 918 805

U.S. State & Local 121 115 88

2,135 2,029 1,860

Deferred Tax Expense

U.S. Federal (74) 51 1

International & other 14 (152) (27)

(60) (101) (26)

Total 2,075 1,928 1,834

Taxes credited to shareholders’ equity for the years ended

June 30, 1999 and 1998 were $222 and $147, respectively.

Undistributed earnings of foreign subsidiaries that are consid-

ered to be reinvested indefinitely were $7,764 at June 30, 1999.

The effective income tax rate was 35.5%, 33.8% and

34.9% in 1999, 1998 and 1997, respectively, compared to the

U.S. statutory rate of 35.0%. Excluding the Organization

2005 program costs and related tax effects, the effective tax

rate was 34.4%.

Deferred income tax assets and liabilities are comprised of

the following:

June 30

1999 1998

Current deferred tax assets $ 621 $ 595

Non-current deferred tax assets (liabilities)

Depreciation $(979) $(1,058)

Postretirement benefits 392 435

Loss and other carryforwards 206 167

Other 19 28

(362) (428)

Included in the above are total valuation allowances of

$140 and $177 in 1999 and 1998, respectively.

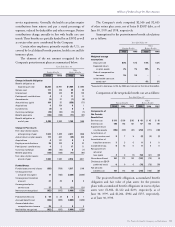

11 COMMITMENTS AND CONTINGENCIES

The Company has purchase commitments for materials,

supplies, and property, plant and equipment incidental to the

ordinary conduct of business. In the aggregate, such commit-

ments are not at prices in excess of current market.

The Company is subject to various lawsuits and claims

with respect to matters such as governmental regulations,

income taxes and other actions arising out of the normal

course of business. The Company is also subject to contin-

gencies pursuant to environmental laws and regulations that

in the future may require the Company to take action to

correct the effects on the environment of prior manufacturing

and waste disposal practices. Accrued environmental liabilities

for remediation and closure costs at June 30, 1999 were $58

and, in management’s opinion, such accruals are appropriate

based on existing facts and circumstances. Current year

expenditures were not material.

While the effect on future results of these items is not

subject to reasonable estimation because considerable uncer-

tainty exists, in the opinion of management and Company

counsel, the ultimate liabilities resulting from such claims will

not materially affect the Company’s financial statements.