Proctor and Gamble 1999 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1999 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company and Subsidiaries

21

ORGANIZATION 2005

As more fully described in Note 2 to the consol-

idated financial statements, under the heading

Organization 2005, the Company has begun a

major reorganization of its operations, moving

from a geographical structure to product-based

Global Business Units (GBUs) that will stream-

line management decision making, strategic

planning and manufacturing. Consistent with

this change, segment reporting will be restated

starting in the first quarter of fiscal 2000 to reflect

the following product-based segments: Fabric and

Home Care, Paper, Beauty Care, Food and

Beverage and Health Care. The GBU structure

will be complemented by eight Market

Development Organizations (MDOs) intended

to maximize the business potential of the entire

product portfolio in each local market. The new

organization structure was effective July 1, 1999,

although certain strategic planning activities

began effective January 1, 1999. Organization

2005 will also streamline and standardize the

Company’s global essential business services, such

as accounting, employee benefits management,

order management and information technology

services, to a common Global Business Services

organization.

The intention to redesign the Company’s

management and operating structures was first

announced in September 1998. Organization

plans and new operating procedures were final-

ized during the April-June quarter, 1999. As a

result of the significant changes associated with

the Organization 2005 program, the Company

identified a number of restructuring projects that

encompass manufacturing consolidations and

standardization, enrollment reductions and other

related costs. The Organization 2005 program,

which was approved by the Board of Directors in

June 1999, is expected to result in total charges of

approximately $2.6 billion ($1.9 billion after tax)

over six years. The Company recorded a current

year charge of $481 million ($385 million after

tax) and expects additional costs of approximately

$1.5 billion ($1.0 billion after tax) during the

next two years, approximately two-thirds of

which will be incurred in fiscal 2000. The balance

of the charges related to the Organization 2005

program are expected to be incurred after fiscal

2001. Costs to be incurred in future years are

subject to varying degrees of estimation for key

assumptions, such as normal employee attrition

levels, the actual timing of the execution of plans

and other variables. Thus, the amount and

timing of future anticipated charges could

change. Significant changes in estimated future

charges will be disclosed as they occur.

Significant savings from the program are

expected to begin accruing in fiscal 2001, reaching

going annual levels of approximately $900 million

after tax by fiscal 2004.

Charges incurred under Organization 2005

will consist primarily of costs related to the

consolidation of manufacturing facilities (includ-

ing accelerated depreciation, asset write-downs

and contract termination costs) and employee

separation costs.

The non-cash costs of the program, primar-

ily related to manufacturing consolidations and

asset write-offs, accounted for approximately

88% of current year charges and will account for

approximately 30% of the remaining total

program costs. Approximately half of the plant

or production module closings will take place

through fiscal 2000 and the balance the following

year. Costs associated with the manufacturing

consolidation portion of the program are included

in cost of products sold. A small portion of these

costs, as well as the balance of the costs under the

program will represent cash charges, and will be

funded with cash from operations.

Organization 2005 charges recorded in

fiscal 1999, all of which are included in Corporate

& Other in the Company’s segment reporting

disclosure, are comprised of the following before-

tax amounts:

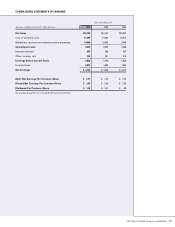

Organization 2005 Fiscal 1999 Charges

Cash Amount

Spent Charged

Total During Against Ending

Charges Period Assets Reserves

Employee

separations $ 45 $(10) $ – $35

Asset write-downs 217 – (217) –

Accelerated

depreciation 208 – (208) –

Other 11 (2) – 9

481 (12) (425) 44