Proctor and Gamble 1999 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 1999 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

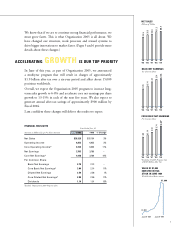

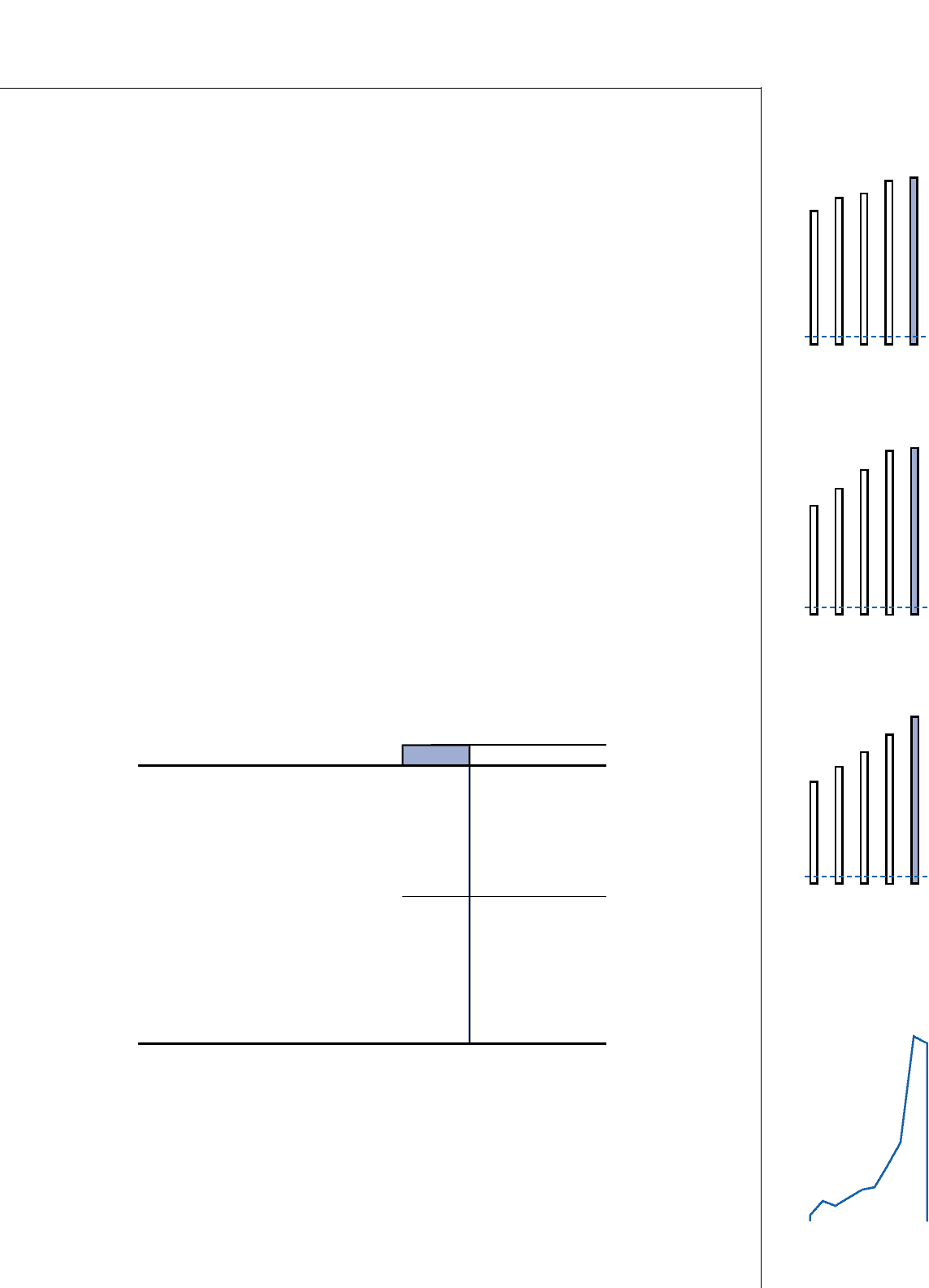

1.85

2.14

2.43

2.74

3.04*

’95 ’96 ’97 ’98 ’99

’95 ’96 ’97 ’98 ’99

1

We know that if we are to continue strong financial performance, we

must grow faster. This is what Organization 2005 is all about. We

have changed our structure, work processes and reward systems to

drive bigger innovations to market faster. (Pages 5 and 6 provide more

details about these changes.)

ACCELERATING GROWTH IS OUR TOP PRIORITY

$7,800

June ’89 June ’99

33.5

35.3

35.8

37.2

38.1

’95 ’96 ’97 ’98 ’99

1.85

2.14

2.43

2.74

2.75

BASIC NET EARNINGS

Per Common Share

NET SALES

Billions of Dollars

CORE BASIC NET EARNINGS

Per Common Share

FINANCIAL HIGHLIGHTS

VALUE OF $1,000

INVESTED IN P&G

STOCK IN JUNE 1989

With Dividend Reinvestment

Years Ended June 30

Amounts in Millions Except Per Share Amounts 1999 1998 % Change

Net Sales $38,125 $37,154 3%

Operating Income 6,253 6,055 3%

Core Operating Income* 6,734 6,055 11%

Net Earnings 3,763 3,780 –

Core Net Earnings* 4,148 3,780 10%

Per Common Share

Basic Net Earnings 2.75 2.74 –

Core Basic Net Earnings* 3.04 2.74 11%

Diluted Net Earnings 2.59 2.56 1%

Core Diluted Net Earnings* 2.85 2.56 11%

Dividends 1.14 1.01 13%

*Excluding O-2005 Program Costs

of $385 Million After Tax

$1,000

In June of this year, as part of Organization 2005, we announced

a multiyear program that will result in charges of approximately

$1.9 billion after tax over a six-year period and affect about 15,000

positions worldwide.

Overall, we expect the Organization 2005 program to increase long-

term sales growth to 6-8% and accelerate core net earnings per share

growth to 13-15% in each of the next five years. We also expect to

generate annual after-tax savings of approximately $900 million by

Fiscal 2004.

I am confident these changes will deliver the results we expect.

*Excludes Organization 2005 Program Costs