Proctor and Gamble 1999 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 1999 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

The Procter & Gamble Company and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

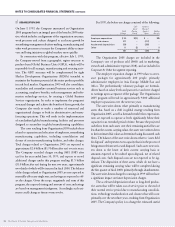

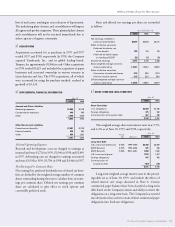

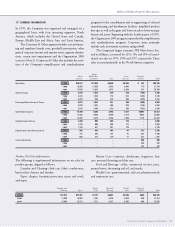

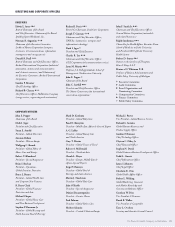

Stock option activity was as follows:

Options in Thousands

1999 1998 1997

Outstanding, July 1 79,918 68,514 66,657

Granted 7,026 20,315 10,409

Exercised (9,397) (8,477) (8,357)

Canceled (737) (434) (195)

Outstanding, June 30 76,810 79,918 68,514

Exercisable 61,664 59,610 58,098

Available for grant 39,874 31,558 28,538

Average price

Outstanding, beginning of year $45.58 $31.00 $24.79

Granted 89.72 83.26 58.72

Exercised 22.36 18.57 16.02

Outstanding, end of year 52.11 45.58 31.00

Exercisable, end of year 43.79 32.74 26.03

Weighted average fair value of

options granted during the year 32.23 24.56 17.14

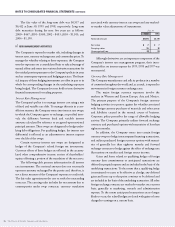

The following table summarizes information about stock

options outstanding at June 30, 1999:

Options Outstanding

Number Weighted-Avg

Range of Outstanding Weighted-Avg Remaining

Prices (Thousands) Exercise Price Contractual Life

$15 to 26 19,642 $22.99 2.3 years

28 to 46 21,899 35.24 5.7

57 to 83 17,822 71.10 8.0

84 to 94 17,447 86.66 10.6

The following table summarizes information about stock

options exercisable at June 30, 1999:

Options Exercisable

Number

Range of Exercisable Weighted-Avg

Prices (Thousands) Exercise Price

$15 to 26 19,642 $22.99

28 to 46 21,899 35.24

57 to 83 9,824 61.65

84 to 94 10,299 84.59

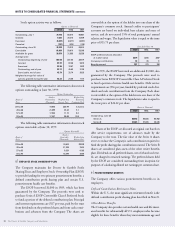

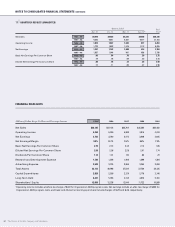

8EMPLOYEE STOCK OWNERSHIP PLAN

The Company maintains the Procter & Gamble Profit

Sharing Trust and Employee Stock Ownership Plan (ESOP)

to provide funding for two primary postretirement benefits: a

defined contribution profit sharing plan and certain U.S.

postretirement health care benefits.

The ESOP borrowed $1,000 in 1989, which has been

guaranteed by the Company. The proceeds were used to

purchase Series A ESOP Convertible Class A Preferred Stock

to fund a portion of the defined contribution plan. Principal

and interest requirements are $117 per year, paid by the trust

from dividends on the preferred shares and from cash contri-

butions and advances from the Company. The shares are

convertible at the option of the holder into one share of the

Company’s common stock. Annual credits to participants’

accounts are based on individual base salaries and years of

service, and do not exceed 15% of total participants’ annual

salaries and wages. The liquidation value is equal to the issue

price of $13.75 per share.

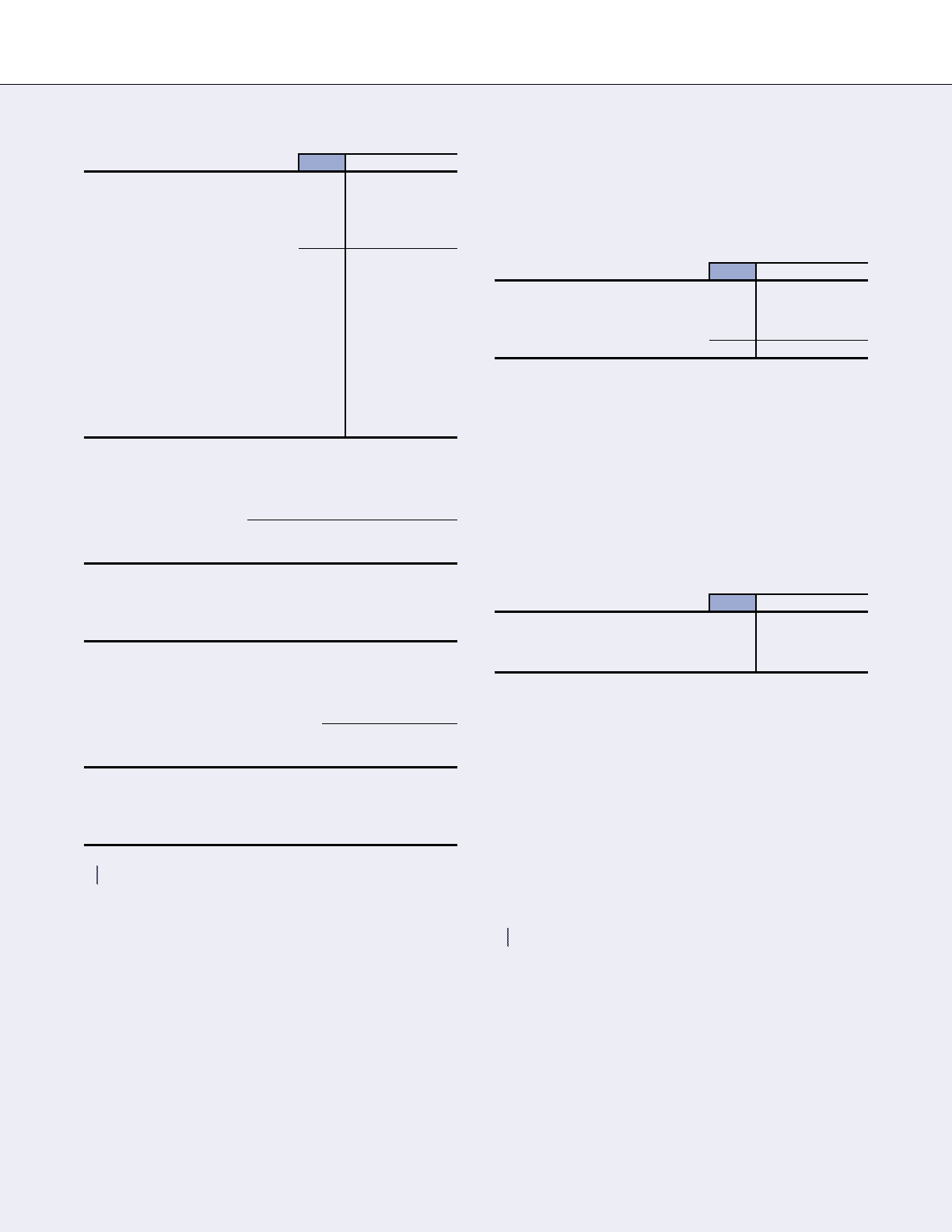

Years Ended June 30

1999 1998 1997

ESOP preferred shares allocated

at market value $279 $235 $247

Company contributions 18 35 11

Benefits earned 297 270 258

In 1991, the ESOP borrowed an additional $1,000, also

guaranteed by the Company. The proceeds were used to

purchase Series B ESOP Convertible Class A Preferred Stock

to fund a portion of retiree health care benefits. Debt service

requirements are $94 per year, funded by preferred stock divi-

dends and cash contributions from the Company. Each share

is convertible at the option of the holder into one share of the

Company’s common stock. The liquidation value is equal to

the issue price of $26.12 per share.

Shares in Thousands

1999 1998 1997

Outstanding, June 30

Series A 58,342 60,635 62,952

Series B 37,485 37,805 38,045

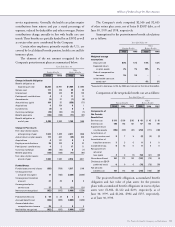

Shares of the ESOP are allocated at original cost based on

debt service requirements, net of advances made by the

Company to the trust. The fair value of the Series A shares

serves to reduce the Company’s cash contribution required to

fund the profit sharing plan contributions earned. The Series B

shares are considered plan assets of the other retiree benefits

plan. Dividends on all preferred shares, net of related tax bene-

fit, are charged to retained earnings. The preferred shares held

by the ESOP are considered outstanding from inception for

purposes of calculating diluted net earnings per common share.

9POSTRETIREMENT BENEFITS

The Company offers various postretirement benefits to its

employees.

Defined Contribution Retirement Plans

Within the U.S., the most significant retirement benefit is the

defined contribution profit sharing plan described in Note 8.

Other Retiree Benefits

The Company also provides certain health care and life insur-

ance benefits for substantially all U.S. employees who become

eligible for these benefits when they meet minimum age and