Proctor and Gamble 1999 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1999 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

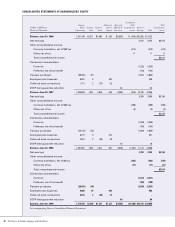

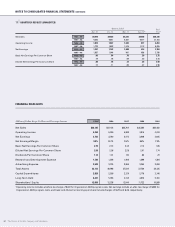

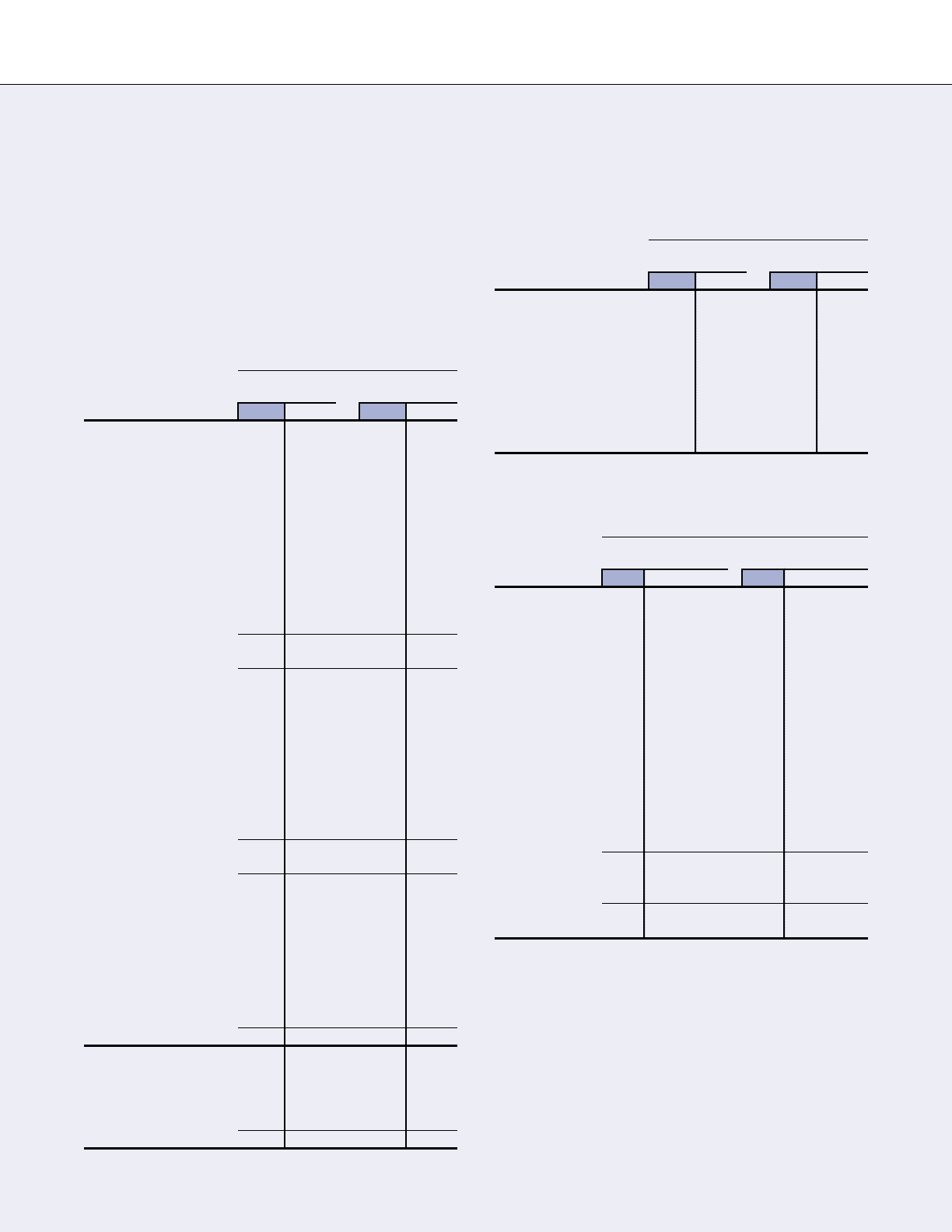

Millions of Dollars Except Per Share Amounts

The Procter & Gamble Company and Subsidiaries

39

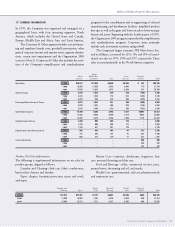

service requirements. Generally, the health care plans require

contributions from retirees and pay a stated percentage of

expenses, reduced by deductibles and other coverages. Retiree

contributions change annually in line with health care cost

trends. These benefits are partially funded by an ESOP, as well

as certain other assets contributed by the Company.

Certain other employees, primarily outside the U.S., are

covered by local defined benefit pension, health care and life

insurance plans.

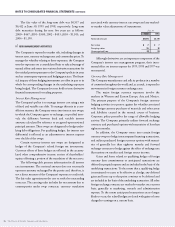

The elements of the net amount recognized for the

Company’s postretirement plans are summarized below:

Years Ended June 30

Other

Pension Benefits Retiree Benefits

1999 1998 1999 1998

Change in Benefit Obligation

Benefit obligation at

beginning of year $2,282 $1,991 $ 1,465 $ 1,460

Service cost 111 106 49 42

Interest cost 140 148 97 102

Participants’ contributions 4317 11

Amendments (5) 21 (1) (6)

Actuarial loss (gain) 164 87 (356) (71)

Acquisitions 4154 01

Curtailments (3) 13 00

Currency exchange (73) (85) (1) (7)

Benefit payments (136) (156) (71) (67)

Benefit obligation at

end of year 2,488 2,282 1,199 1,465

Change in Plan Assets

Fair value of plan assets

at beginning of year 1,523 1,229 2,611 1,828

Actual return on plan assets 111 243 (49) 803

Acquisitions 4131 00

Employer contributions 95 103 837

Participants’ contributions 4317 11

Currency exchange (46) (30) 0(1)

Benefit payments (136) (156) (71) (67)

Fair value of plan assets

at end of year 1,555 1,523 2,516 2,611

Funded Status

Funded status at end of year (933) (759) 1,317 1,146

Unrecognized net

actuarial loss (gain) 17 (163) (2,384) (2,354)

Unrecognized transition

amount 27 32 00

Unrecognized prior

service cost 37 75 (21) (21)

Net amount recognized (852) (815) (1,088) (1,229)

Prepaid benefit cost $59 $34 $1 $1

Accrued benefit cost (936) (849) (1,089) (1,230)

Accumulated other

comprehensive income 25 000

Net liability recognized (852) (815) (1,088) (1,229)

The Company’s stock comprised $2,346 and $2,443

of other retiree plan assets, net of Series B ESOP debt, as of

June 30, 1999 and 1998, respectively.

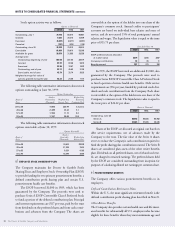

Assumptions for the postretirement benefit calculations

are as follows:

Years Ended June 30

Other

Pension Benefits Retiree Benefits

1999 1998 1999 1998

Weighted average

assumptions

Discount rate 6.0% 7.0% 7.5% 6.8%

Expected return

on plan assets 8% 9% 10% 9%

Rate of compensation

increase 5% 5% ––

Initial health care cost

trend rate* ––6% 8%

*Assumed to decrease to 5% by 2006 and remain at that level thereafter.

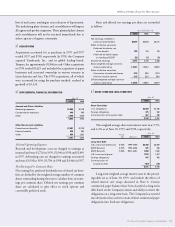

Components of the net periodic benefit cost are as follows:

Years Ended June 30

Other

Pension Benefits Retiree Benefits

1999 1998 1997 1999 1998 1997

Components of

Net Periodic

Benefit Cost

Service cost $ 111 $ 106 $100 $49 $42 $45

Interest cost 140 148 131 97 102 109

Expected return

on plan assets (105) (103) (87) (218) (171) (138)

Amortization of

prior service cost 875(2) (2) (2)

Amortization of

transition amount 330000

Curtailment loss 012 0 000

Recognized net

actuarial

loss (gain) 40 (7) (58) (41) (18)

Gross benefit cost 161 173 142 (132) (70) (4)

Dividends on ESOP

preferred stock 000(78) (78) (79)

Net periodic

benefit cost 161 173 142 (210) (148) (83)

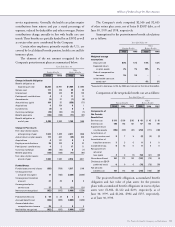

The projected benefit obligation, accumulated benefit

obligation and fair value of plan assets for the pension

plans with accumulated benefit obligations in excess of plan

assets were $1,382, $1,122 and $233, respectively, as of

June 30, 1999, and $1,206, $984 and $155, respectively,

as of June 30, 1998.