North Face 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99vf corporation 2004 Annual Report

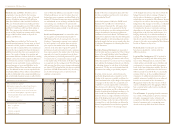

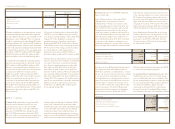

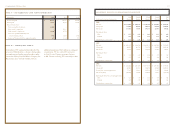

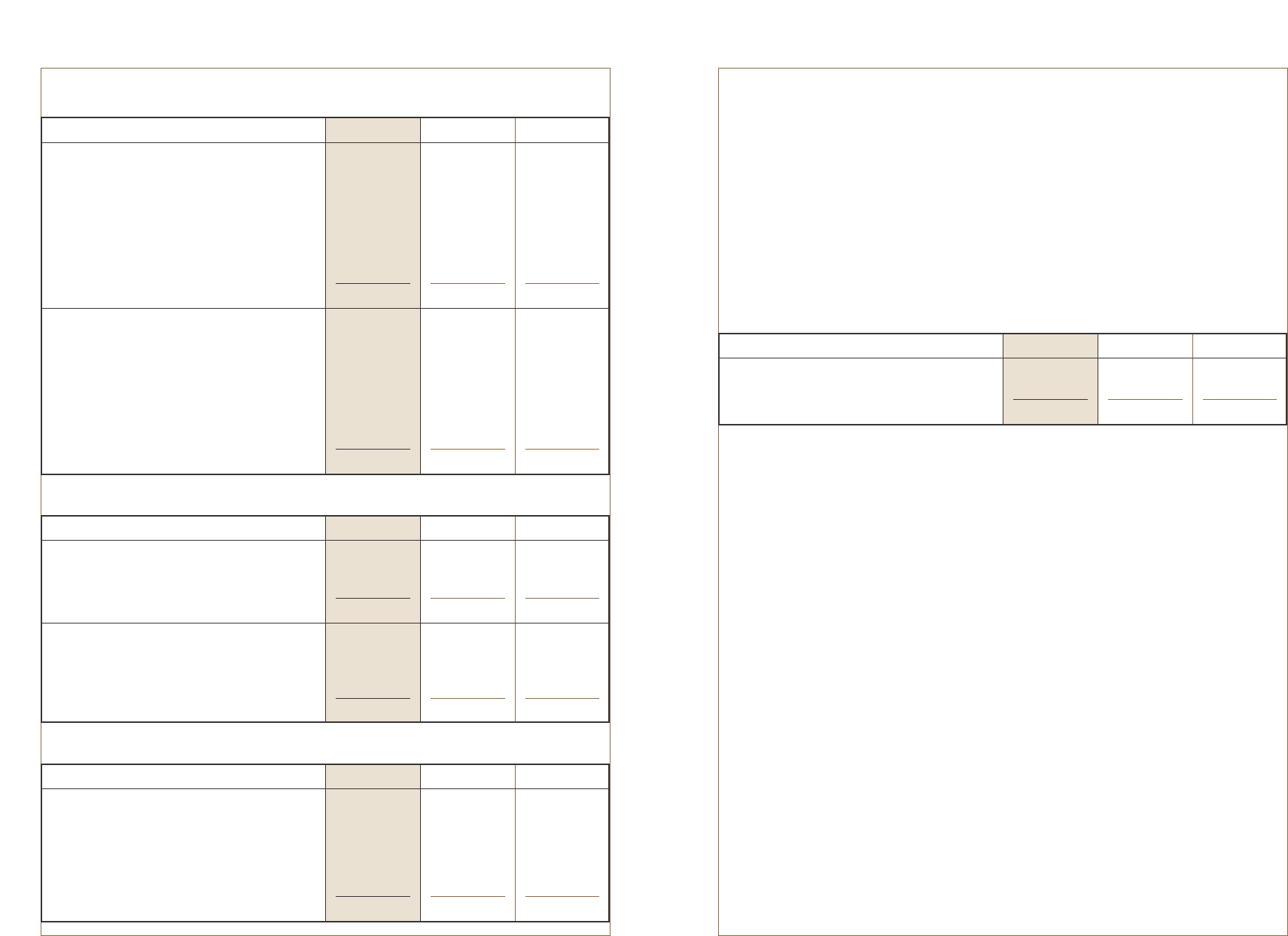

In thousands 2004 2003 2002

Net sales:

United States $4,678,593 $ 4,090,749 $ 4,078,385

Foreign, primarily Europe 1,375,943 1,116,710 1,005,138

Total $6,054,536 $ 5,207,459 $ 5,083,523

Property, plant and equipment:

United States $ 354,274 $ 381,619 $ 346,637

Mexico 94,489 109,681 125,525

Other foreign, primarily Europe 123,491 100,380 94,384

Total $ 572,254 $ 591,680 $ 566,546

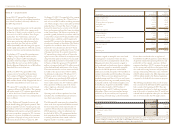

In thousands 2004 2003 2002

Capital expenditures:

Jeanswear $ 37,587 $ 41,495 $ 33,819

Outdoor Apparel and Equipment 8,237 6,889 5,318

Intimate Apparel 7,269 7,660 7,189

Imagewear 3,441 1,578 1,951

Sportswear 8,871 2,845 –

Other 6,567 3,512 3,903

Corporate 9,438 22,640 12,323

Total $ 81,410 $ 86,619 $ 64,503

Depreciation expense:

Jeanswear $ 52,317 $ 53,830 $ 54,068

Outdoor Apparel and Equipment 8,617 3,860 9,545

Intimate Apparel 10,207 9,860 11,358

Imagewear 8,869 13,724 12,275

Sportswear 8,369 2,976 –

Other 10,108 9,538 9,554

Corporate 12,381 10,855 10,598

Total $ 110,868 $ 104,643 $ 107,398

(table continued from previous page)

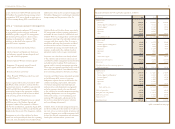

Information by geographic area is presented below, with sales based on the location of the customer:

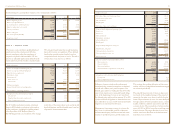

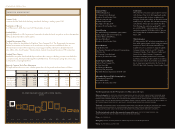

Sales to Wal-Mart Stores, Inc., substantially all in the

Jeanswear and Intimate Apparel coalitions, comprised

15.0% of consolidated sales in 2004, 16.5% in 2003

and 16.2% in 2002. Trade receivables from this

customer totaled $93.2 million at the end of 2004

and $75.4 million at the end of 2003.

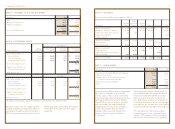

VF enters into noncancelable operating leases for

retail stores and other facilities and for equipment.

Leases for real estate typically have initial terms

ranging from 5 to 15 years, some with renewal

options. Leases for equipment typically have initial

terms ranging from 2 to 5 years. Most leases have

fixed rentals; expense for leases having lease incentives

or escalating rentals are recorded on a straight-line

basis over the minimum lease terms. Certain of the

leases contain requirements for additional rental

payments based on sales volume or for payments

of real estate taxes and other occupancy costs.

Rent expense included in the Consolidated Statements

of Income was as follows:

Future minimum lease payments are $97.7 million,

$83.7 million, $65.8 million, $52.8 million and

$38.6 million for the years 2005 through 2009,

respectively, and $76.6 million thereafter.

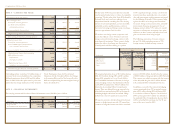

VF enters into licensing agreements that provide

VF rights to market products under trademarks

owned by other parties. Royalties under these

agreements are recognized in Cost of Goods Sold

in the Consolidated Statements of Income.

Certain of these agreements contain provisions

for the payment of minimum royalties. Future

minimum royalty payments, including any required

minimum advertising payments, are $14.3 million,

$16.6 million, $16.2 million, $13.8 million and $4.7

million for the years 2005 through 2009, respectively.

VF in the ordinary course of business enters into

purchase commitments for raw materials, sewing labor

and finished product inventories. These agreements,

typically ranging from 2 to 6 months in duration,

require total payments of $667.2 million in 2005. In

addition, VF has committed to purchase $15.0 million

of finished product in each of the next 10 years in

connection with the sale of a business (Note C).

VF has also entered into commitments for capital

spending, advertising and service and maintenance

agreements for its management information

systems. Future payments under these agreements

are $90.0 million, $8.0 million, $3.2 million,

$1.4 million and $0.1 million for the years

2005 through 2009, respectively.

The trustee of the Employee Stock Ownership Plan

may require VF to redeem Series B Redeemable

Preferred Stock held in participant accounts and

to pay each participant the value of their account,

upon retirement or withdrawal from the ESOP.

The amounts of these redemptions vary based on the

conversion value of the Preferred Stock. Since 2002,

no redemption payments have been required as the

ESOP trustee has converted shares of Series B

Redeemable Preferred Stock for withdrawing

participants into shares of Common Stock.

VF has entered into $80.5 million of surety bonds

and standby letters of credit representing contingent

guarantees of performance under self-insurance

and other programs. These commitments would

only be drawn upon if VF were to fail to meet its

claims obligations.

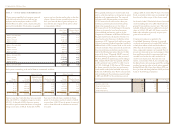

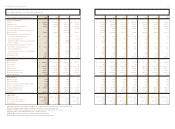

In thousands 2004 2003 2002

Minimum rent expense $ 95,103 $ 74,367 $ 62,408

Contingent rent 3,669 1,953 381

Rent expense $ 98,772 $ 76,320 $ 62,789

note s – commitments

Worldwide sales by product category are as follows:

In thousands 2004 2003 2002

Jeans and related apparel $2,661,946 $ 2,666,815 $ 2,788,486

Outdoor products 1,003,851 580,663 508,020

Intimate apparel 903,552 830,225 839,786

Sportswear 604,879 248,967 –

Occupational apparel 471,176 450,511 492,798

Other apparel 409,132 430,278 454,433

Total $6,054,536 $ 5,207,459 $ 5,083,523