North Face 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77vf corporation 2004 Annual Report

Foreign Currency Translation: Financial statements

of most foreign subsidiaries are measured using the

local currency as the functional currency. Assets and

liabilities denominated in a foreign currency are

translated into U.S. dollars using exchange rates

in effect at the balance sheet date, and revenues and

expenses are translated at average exchange rates

during the year. Translation gains and losses are

reported in Accumulated Other Comprehensive

Income (Loss). For foreign subsidiaries that use the

U.S. dollar as their functional currency, the effects of

remeasuring assets and liabilities into U.S. dollars is

included in the Consolidated Statements of Income.

Net transaction gains of $0.5 million in 2004,

$5.3 million in 2003 and $3.1 million in 2002 arising

from transactions denominated in a currency other

than the functional currency of a particular entity are

included in the Consolidated Statements of Income.

Cash and Equivalents includes demand deposits and

temporary investments that are readily convertible

into cash and will mature within three months of

their purchase.

Accounts Receivable and Allowance for Doubtful

Accounts: Trade accounts receivable are recorded at

invoiced amounts, less amounts accrued for returns,

discounts and sales incentive programs. Royalty

receivables are recorded at amounts earned based

on sales of licensed products, subject in some cases

to minimum amounts from individual licensees.

VF maintains an allowance for doubtful accounts

for estimated losses resulting from the inability of

customers and licensees to make required payments.

All accounts are subject to ongoing review for

ultimate collectibility. An allowance is provided

for specific customer accounts where collection is

doubtful and for the inherent risk in ultimate

collectibility of total balances due at any point

in time. Receivables are charged off against the

allowance when it is probable the amounts will

not be recovered. There is no off-balance sheet

credit exposure related to customer receivables.

Inventories are stated at the lower of cost or market.

Cost is determined on the first-in, first-out (“FIFO”)

method for 71% of total 2004 inventories and 66%

of total 2003 inventories. For remaining inventories,

cost is determined on the last-in, first-out (“LIFO”)

method (primarily due to Internal Revenue Service

conformity requirements where LIFO is used for

income tax purposes). The LIFO method is used

for jeanswear, wholesale sportswear and occupational

apparel inventories located in the United States and

Canada. The value of inventories stated on the LIFO

method is not significantly different from the value

determined under the FIFO method.

Long-lived Assets: Property, plant and equipment

and intangible assets are stated at cost. Depreciation is

computed using the straight-line method over the

estimated useful lives of the assets, ranging from 3 to

10 years for machinery and equipment and up to 40

years for buildings. Leasehold improvements are

amortized over the shorter of their estimated useful

lives or the lease term. Intangible assets, other than

those having indefinite lives, are amortized over their

estimated useful lives using straight-line or accelerated

methods consistent with the expected realization of

benefits to be received. The useful lives of property

and intangible assets are reviewed annually.

VF’s policy is to evaluate property, intangible assets

and goodwill for possible impairment at least annually

or whenever events or changes in circumstances

indicate that the carrying amount of such assets may

not be recoverable. An impairment loss is recorded

for property or intangible assets with identified useful

lives (and therefore are being amortized) if projected

undiscounted cash flows to be generated by the asset

or asset group are not expected to be adequate to

recover the assets’ carrying value. An impairment loss

is recorded for intangible assets with indefinite lives

(and therefore are not being amortized) or goodwill

if the assets’ carrying value is in excess of its fair value.

Goodwill represents the excess of costs over the

fair value of net tangible assets and identifiable

intangible assets of businesses acquired. Effective

at the beginning of 2002, VF adopted Financial

Accounting Standards Board (“FASB”) Statement

No. 142, Goodwill and Other Intangible Assets.

Under this Statement, goodwill and intangible

assets with indefinite useful lives are not amortized,

and other intangible assets are amortized over their

estimated useful lives.

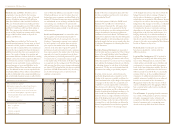

In adopting the Statement, VF engaged an inde-

pendent valuation firm to assist management in its

review of the fair value of its business units and, where

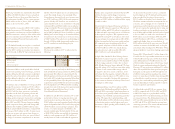

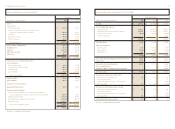

Accordingly, VF recorded a noncash charge of

$527.3 million ($4.69 per diluted share), which was

recognized as the Cumulative Effect of a Change

in Accounting Policy in the Consolidated Statement

of Income at the beginning of 2002. There was no

income tax effect for this charge.

Accrued Self-insurance: VF is primarily self-insured

for employee group medical, workers’ compensation,

vehicle, property and general liability exposures.

Liabilities for self-insured exposures are accrued

on a discounted basis, in consultation with an

independent actuary, based on historical trends

and actuarial data for projected settlements of claims

filed and for incurred but not yet reported claims.

Accruals for self-insured exposures are included

in current and noncurrent liabilities based on

the expected period of payment. Excess liability

insurance has been purchased to cover claims in

excess of self-insured amounts.

Revenue Recognition: Sales to wholesale customers

are recognized when the risks and rewards of owner-

ship have been transferred, which is when the product

is received by the customer. Shipping and handling

costs billed to customers are included in Net Sales.

Allowances for estimated returns, discounts and sales

incentive programs are recognized as reductions of

sales when the sales are recorded. Sales incentive

programs with retailers include stated discounts and

discounts based on the retailer agreeing to advertise

or promote VF products. Sales incentive programs

directly with consumers include rebate and coupon

offers. Allowances are based on customer commit-

ments, specific product circumstances and historical

claim rates. Sales at VF-owned and operated retail

stores are recognized at the time of purchase of

products by consumers.

Cost of Goods Sold for VF-manufactured goods

includes all materials, labor and overhead costs

incurred in the production process. Overhead allo-

cated to manufactured product is based on the normal

capacity of our plants and does not include amounts

related to idle capacity or abnormal production

inefficiencies. Cost of Goods Sold for contracted or

purchased finished goods includes the purchase costs

and related overhead. In both cases, overhead includes

all costs related to obtaining the finished goods,

including costs of planning, purchasing, quality

control, freight and duties. For product lines having

a lifetime warranty, a provision for estimated future

repair or replacement costs, based on historical

experience, is recorded when these products are sold.

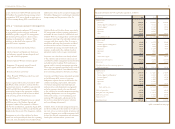

Marketing, Administrative and General Expenses

includes marketing and advertising, VF-operated

retail store costs, warehousing, shipping and handling

,

administrative and general expenses. Advertising

costs are expensed as incurred and totaled $314.1

million in 2004, $258.6 million in 2003 and $244.7

million in 2002. Advertising costs include cooperative

advertising payments made to VF’s customers as

direct reimbursement of advertising costs incurred

by those retailers for advertising VF’s products.

Cooperative advertising costs were $43.4 million

in 2004, $42.0 million in 2003 and $40.0 million

in 2002. Shipping and handling costs totaled $199.0

million in 2004, $183.3 million in 2003 and $177.0

million in 2002.

there was an indication that the recorded amount of

goodwill might be greater than its fair value, to assist

management in determining the amount of the

possible write-down in value. This evaluation indi-

cated that recorded goodwill exceeded its fair value at

several business units where performance had not met

management’s expectations at the time of their acqui-

sition. The resulting write-downs of goodwill were

attributable to differences between the fair value

approach under this Statement and the undiscounted

cash flow approach used under previous accounting

literature. The amount of write-downs, and the busi-

ness units accounting for the charges, are summarized

by reportable segment as follows (in thousands):

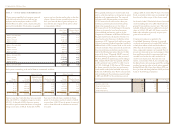

business segment amount business unit

Jeanswear $63,199 Latin American jeanswear

Intimate Apparel 109,751 European intimate apparel

Imagewear 295,128 Workwear and licensed knitwear

Other 59,176 Childrenswear