North Face 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87vf corporation 2004 Annual Report

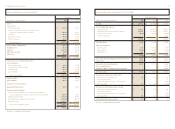

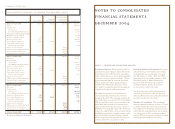

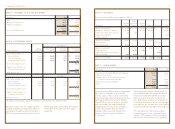

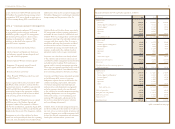

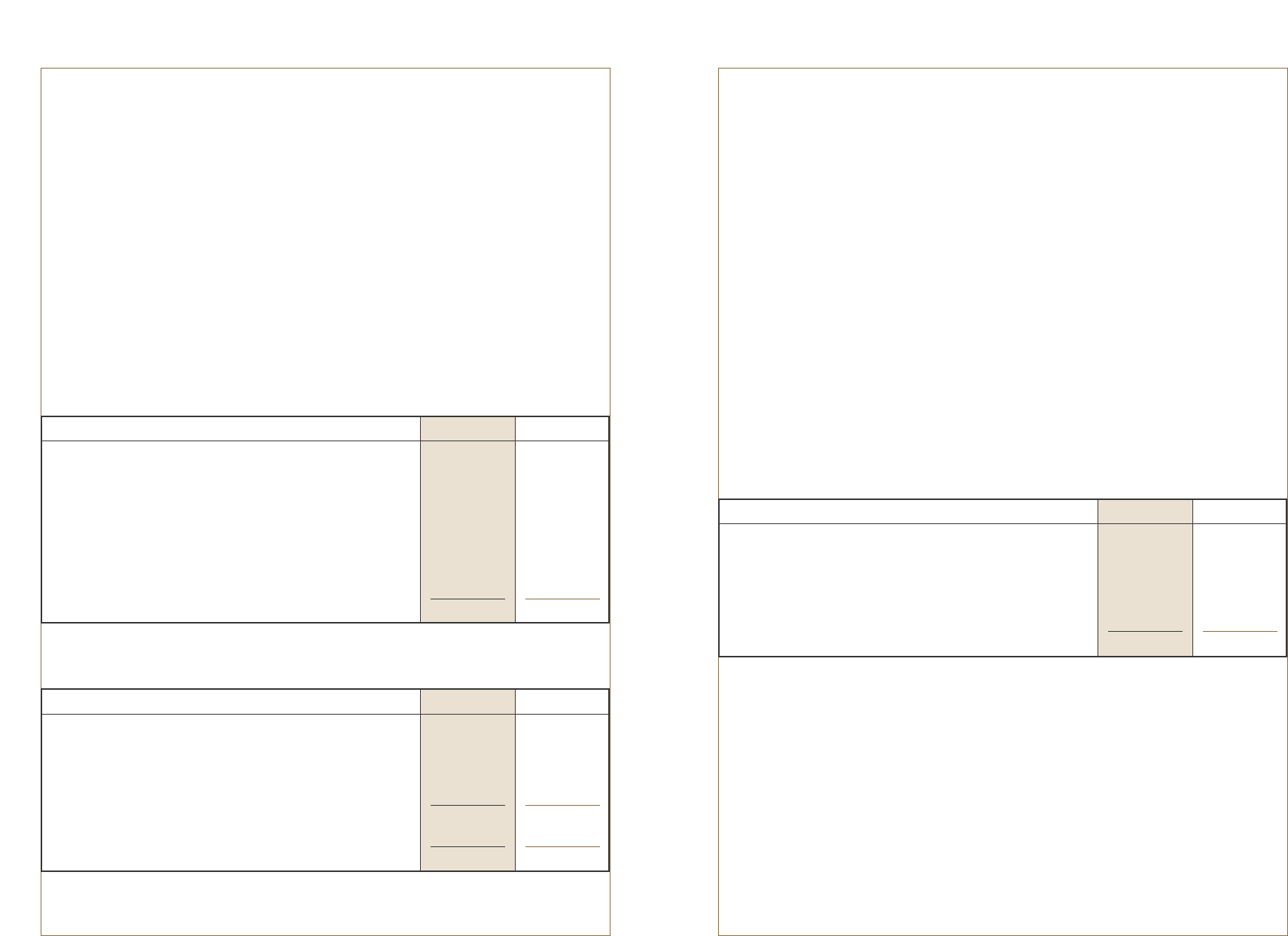

note k – accrued liabilities

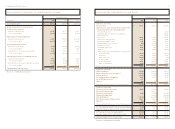

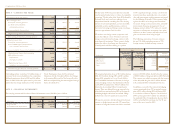

note l – long-term debt

In thousands 2004 2003

6.75% notes, due 2005 $ 100,000 $ 100,000

8.10% notes, due 2005 300,000 300,000

8.50% notes, due 2010 200,000 200,000

6.00% notes, due 2033 292,230 292,133

Other 65,641 65,394

957,871 957,527

Less current portion 401,232 1,144

$ 556,639 $ 956,383

In thousands 2004 2003

Compensation $ 141,584 $ 89,856

Income taxes 39,750 21,520

Other taxes 51,829 32,432

Minimum pension liability (Note N) 55,000 55,000

Advertising 29,374 34,742

Insurance 25,831 18,212

Interest 14,989 14,789

Product warranty claims (Note M) 7,193 8,426

Other 192,665 163,962

$ 558,215 $ 438,939

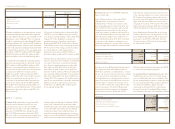

The notes contain customary covenants and events

of default, including limitations on liens and sale-

leaseback transactions and a cross-acceleration event

of default. The cross-acceleration is triggered for all

notes if more than $50.0 million of other debt is in

default and has been accelerated by the lenders,

except for the 6.75% notes where the threshold is $5.0

million. If VF fails in the performance of any covenant

under the indenture that governs the respective notes

(after giving effect to any applicable grace period), the

trustee or lenders may declare the principal due and

payable immediately. At the end of 2004, management

believes that VF was in compliance with all covenants.

VF may redeem the 8.10%, the 8.50% and the 6.00%

obligations, in whole or in part, at a price equal to

100% of the principal amount, plus accrued interest

to the redemption date and a premium (if any)

relating to the then-prevailing treasury yield over

the remaining life of the obligations.

The 6.00% notes having a principal balance of $300.0

million were sold at an original issue discount of $7.9

million. The notes are carried net of the unamortized

portion of the discount. These notes have an effective

annual interest cost of 6.19%, including amortization of

the original issue discount, deferred gain on the interest

rate hedging contract (Note U) and debt issuance costs.

Other debt includes $66.0 million payable to a former

officer of Nautica, of which $33.0 million is payable

in each of 2006 and 2007 (Note B). These non-

interest-bearing installments were recorded at discounts

of 3.25% and 3.84%, respectively, reflecting VF’s

incremental borrowing rates for those periods.

The discounts are being amortized as Interest Expense

over the lives of these obligations. The carrying value

of this debt was $61.1 million at the end of 2004

and $59.0 million at the end of 2003.

The scheduled payments of long-term debt are $34.1

million in 2006, $34.2 million in 2007, $0.8 million in

2008 and $0.2 million in 2009.

Short-term borrowings, all from foreign banks,

had a weighted average interest rate of 7.0% at

the end of 2004 and at the end of 2003.

The Company maintains a $750.0 million unsecured

committed revolving bank credit agreement that

supports issuance of up to $750.0 million in com-

mercial paper or is otherwise available for general

corporate purposes. This agreement, which expires

in September 2008, requires VF to pay a facility fee

of .09% per year and contains a financial covenant

requiring VF’s ratio of consolidated indebtedness

to consolidated capitalization to remain below 60%.

The agreement also contains other covenants

and events of default, including limitations on liens,

subsidiary indebtedness and sales of assets, and a

$50.0 million cross-acceleration event of default.

If VF fails in the performance of any covenant under

this agreement (after giving effect to any applicable

grace period), the banks may terminate their obliga-

tion to lend, and any bank borrowings outstanding

under this agreement may become due and payable.

At the end of 2004, management believes that

VF was in compliance with all covenants. Also at

the end of 2004, the entire amount of the credit

agreement was available for borrowing, except for

$11.8 million of standby letters of credit issued

under the agreement on behalf of VF.

note j – short-term borrowings

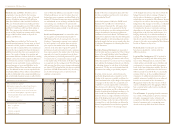

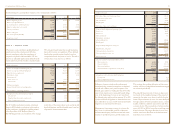

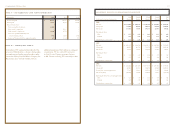

note m – other liabilities

In thousands 2004 2003

Deferred compensation $ 186,834 $ 174,771

Minimum pension liability (Note N) 102,009 144,239

Accrued pension benefits (Note N) 56,512 49,375

Income taxes 83,033 70,201

Product warranty claims 26,976 20,426

Other 80,767 59,613

$ 536,131 $ 518,625

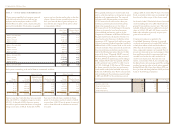

VF maintains deferred compensation plans for the

benefit of eligible employees. These plans allow

participants to defer compensation and, in some

plans, receive matching contributions by VF. Deferred

compensation, including accumulated earnings

on the participant-directed investment options,

is distributable in cash at employee-specified dates

or upon retirement, death, disability or termination

of employment. See Note I for investment securities

owned by VF to fund liabilities under certain of these

deferred compensation plans.