North Face 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

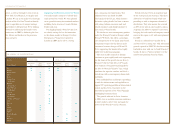

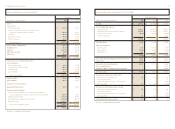

21.2 22.3 22.1

2004 2003 2002

1.05 1.01 .97

2004 2003 2002

53vf corporation 2004 Annual Report

The remaining 0.2% of the increase was due to lower

sales volume in our core businesses without a propor-

tionate decline in expenses.

Operating results in 2004 included $40 million of

expense (0.7% of net sales) related to growth and

cost reduction initiatives. Of this total, approximately

$36 million related to Marketing, Administrative and

General Expenses, with the balance related to Cost

of Goods Sold. Approximately 40% of this spending

related to new or expanded advertising programs and

market research associated with our Nautica® and

other brands. Approximately 45% of the spending

related to cost reduction actions and consulting

related to future cost reduction opportunities. For

example, we entered into an information technology

outsourcing agreement with a major third party

service provider, and we incurred charges for the

closure of a production plant and for consolidation

of distribution centers. And finally, approximately

10% of the spending related to additional positions

to drive growth. We added four new executive posi-

tions, and will be adding supporting staff positions,

dedicated to working more closely with our major

customers, driving increased strategic planning

for brand development and pursuing targeted

acquisition efforts.

We include cooperative advertising, retail store

and distribution costs in Marketing, Administrative

and General Expenses, as stated in our significant

accounting policies in Note A to the Consolidated

Financial Statements. Some other companies may

classify cooperative advertising costs as a reduction

of Net Sales, while some may classify retail store and

distribution costs in Cost of Goods Sold. Accordingly,

our gross margins and operating expenses may not be

directly comparable with those companies.

Royalty Income and Other increased by $12.7 million

in 2004 and $7.0 million in 2003. Net royalty income

was $49.9 million in 2004, $28.6 million in 2003

and $20.5 million in 2002. The increase in both years

was primarily from higher levels of licensing activity

related to Nautica, acquired in August 2003. Also

included in this caption is $9.5 million of net charges

related to the disposition of VF Playwear in 2004.

Goodwill Impairment consisted of a charge of $2.3

million in our VF Playwear reporting unit in 2002

based on a revised forecast of its profits and cash flows.

Interest Expense (including amortization of debt

discount, debt issuance costs and gain/loss on interest

rate hedging contracts) increased by $14.7 million

in 2004 and decreased by $10.0 million in 2003. The

increase in 2004 was primarily due to higher average

borrowings, and the decrease in 2003 was primarily

due to lower average interest rates. Average interest-

bearing debt outstanding totaled approximately

$1,050 million for 2004, $810 million for 2003 and

$770 million for 2002. The weighted average interest

rate was 7.0% for 2004, 7.3% for 2003 and 8.1% for

2002. Interest Income in 2003 included $5.7 million

related to the settlement of federal income tax issues.

The effective income tax rate for continuing opera-

tions was 33.3% in 2004, compared with 33.5% in

2003 and 35.1% in 2002. The effective income tax

rate declined in 2004 relative to 2003 primarily due

to increased income in international jurisdictions that

was taxed at lower rates. The effective tax rate declined

in 2003 relative to the prior year due to (1) higher

nontaxable income related to investments held for

employee benefit plans, (2) lower foreign operating

losses with no related tax benefit and (3) favorable

settlements in 2003 of prior years’ federal and state

income tax returns.

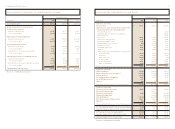

Income from continuing operations was $474.7 million

($4.21 per share) in 2004. This compares with income

from continuing operations of $397.9 million ($3.61

per share) in 2003 and $364.4 million ($3.24 per

share) in 2002. Income from continuing operations

increased 19% in 2004, while earnings per share

increased 17%, reflecting a larger number of shares

outstanding due to exercises of stock options. In 2003,

income from continuing operations increased 9% over

the prior year, while earnings per share increased 11%,

reflecting the benefit of shares repurchased during

2003 and 2002. In translating foreign currencies into

the U.S. dollar, the weaker U.S. dollar had a $0.09

favorable impact on earnings per share in 2004

compared with the prior year and a $0.14 favorable

impact in 2003 compared with the prior year. The

2004 Acquisitions had a $0.14 favorable impact on

2004 operating results, and the acquisition of Nautica

in 2003 had a $0.16 per share favorable impact on

2003 results.

In 2002, VF exited the Private Label Knitwear and

the Jantzen swimwear businesses. Both businesses met

the criteria for treatment as discontinued operations.

Accordingly, their operating results and cash flows

are separately presented as discontinued operations in

the accompanying consolidated financial statements.

During 2002, these businesses contributed net income

of $8.3 million ($0.07 per share), primarily due to

gains on disposal of real estate.

VF adopted FASB Statement No. 142, Goodwill and

Other Intangible Assets, at the beginning of 2002.

In adopting this Statement, we estimated the fair value

of our individual business reporting units on a

discounted cash flow basis. This evaluation, and the

related valuation of net assets of each reporting unit,

indicated that recorded Goodwill exceeded its fair

value at several business units where performance had

not met management’s expectations established at

their acquisition dates. More specifically, the European

intimate apparel, childrenswear, occupational apparel

and licensed sportswear business units had been

profitable in prior years but at a lower level than

anticipated at the dates of their respective acquisitions.

The Latin American jeanswear business units had not

been profitable due to deteriorating economic condi-

tions in South America, but profitability was expected

in the future. In each case, recorded Goodwill was

expected to be recoverable from future undiscounted

operating cash flows. The write-down of Goodwill

upon adoption of this Statement was attributable to

differences between the fair value approach under this

Statement and the undiscounted cash flow approach

used under previous accounting literature. The adop-

tion of this Statement resulted in a noncash charge of

$527.3 million in 2002, without tax benefit ($4.69 per

share). See Note A to the Consolidated Financial

Statements for additional details.

VF reported net income of $474.7 million ($4.21

per share) in 2004, compared with $397.9 million

($3.61 per share) in 2003. Including the effect of

the above accounting change and the discontinued

operations discussed in the preceding paragraphs,

VF reported a net loss of $154.5 million ($1.38

per share) in 2002.

dividends per share

(Dollars)

return on average common equity

(Percent)