North Face 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79vf corporation 2004 Annual Report

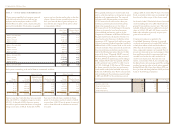

Royalty Income and Other: Royalty income is

recognized at rates specified in the licensing

contracts, based on the licensees’ sales of licensed

products. Royalty income was $49.9 million in

2004, $28.6 million in 2003 and $20.5 million in

2002, net of related expenses (including amortiza-

tion of licensing intangible assets) of $18.2 million

in 2004, $7.6 million in 2003 and $4.6 million in

2002. This category also includes the equity in

income of 50%-owned joint ventures and, in 2004,

charges of $9.5 million related to disposal of a

business unit (Note C).

Income Taxes are provided on Net Income for

financial reporting purposes. Income taxes are based

on amounts of taxes payable or refundable in the

current year and on expected future tax consequences

of events that are recognized in financial statements

in different periods than they are recognized in tax

returns. As a result of timing of recognition and

measurement differences between financial accounting

standards and income tax laws, temporary differences

arise between the amounts of pretax financial

statement income and taxable income and between

reported amounts of assets and liabilities in the

Consolidated Balance Sheets and their respective tax

bases. Net deferred income tax assets reported in the

Consolidated Balance Sheets reflect estimated future

tax effects attributable to these temporary differences

and carryforwards, based on tax rates in effect for the

years in which the differences are expected to reverse.

Valuation allowances are used to reduce these net

deferred tax assets to amounts considered likely to be

realized. U.S. deferred income taxes are not provided

on undistributed income of foreign subsidiaries where

such earnings are considered to be permanently

invested. The provision for Income Taxes also includes

estimated interest expense related to tax deficiencies

and assessments.

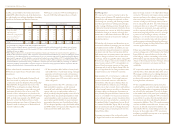

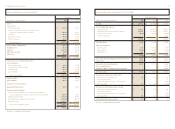

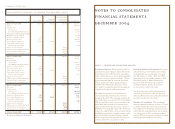

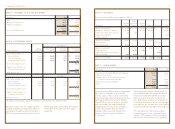

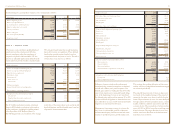

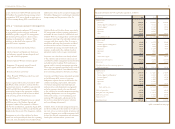

Stock-based Compensation is accounted for under

the recognition and measurement principles of

APB Opinion No. 25, Accounting for Stock Issued to

Employees. Compensation expense is not required

for stock options, as all options have an exercise

price equal to the market value of the underlying

common stock at the date of grant. For grants of

performance-based restricted stock units, compensa-

tion expense equal to the market value of the shares

expected to be issued is recognized over the three

year performance period being measured. For grants

of restricted stock, compensation expense equal

to the market value of the shares at the date of grant

is recognized over the vesting period. The following

table presents the effects on net income and earnings

per share if VF had applied the fair value recognition

provisions of FASB Statement No. 123, Accounting

for Stock-Based Compensation, to all stock-based

employee compensation:

Details of the stock compensation plans and of the

fair value assumptions used above for stock options

are described in Note P.

In the fourth quarter of 2004, the FASB issued

Statement No. 123 (R), Share-Based Payment.

This revision to Statement No. 123 requires that

compensation expense be recognized for the fair

value of stock options over their vesting period and

changes the method of expense recognition for

performance-based stock awards. The Statement is

required to be adopted no later than the third quarter

of 2005 and applies to all outstanding stock options

and stock awards that have not yet vested at the date

of adoption. Management is evaluating the effects

of this Statement.

Derivative Financial Instruments are measured at

their fair value and are recognized as Other Current

Assets or Accrued Liabilities in the Consolidated

Balance Sheets. VF formally documents hedged

transactions and hedging instruments, and assesses,

both at the inception of a contract and on an ongoing

basis, whether the hedging instruments are effective

in offsetting changes in cash flows of the hedged

transactions. VF does not use derivative financial

instruments for trading or speculative purposes.

If certain criteria are met, a derivative may be

specifically designated and accounted for as (1)

a hedge of the exposure to variable cash flows for

a forecasted transaction or (2) a hedge of the exposure

to changes in the fair value of a recognized asset

or liability or an unrecognized firm commitment.

The criteria used to determine if hedge accounting

treatment is appropriate are (1) to designate and

identify the appropriate hedging instrument to be

used to reduce an identified exposure and (2) to

determine if there is a high correlation between the

value of the hedging instrument and the identified

exposure. Changes in the fair value of derivatives

accounted for as cash flow hedges are deferred in

Other Comprehensive Income and recognized in

Net Income as an offset to the earnings impact

of the hedged transaction at the time in which the

hedged transaction affects earnings. Changes in

the fair value of derivatives accounted for as fair

value hedges are recognized in Miscellaneous Income

or Expense as an offset to the earnings impact of the

hedged item. The changes in fair value, as evaluated

and adjusted each quarter, are deferred in Other

Comprehensive Income or reported in earnings,

depending on the nature and effectiveness of the

hedged item or the risk. Any ineffectiveness in a

hedging relationship is recorded immediately in

earnings. For those limited number of derivatives

that do not meet the criteria for hedge accounting,

changes in fair value are recognized in Miscellaneous

Income or Expense as they occur.

Reclassifications: Certain prior year amounts

have been reclassified to conform with the

2004 presentation.

Legal and Tax Contingencies: VF is involved in

legal and tax proceedings and claims arising from

time to time. Management, in connection with

outside advisers, periodically assesses liabilities and

contingencies in connection with these matters,

based on the latest information available. For those

matters where it is probable that a loss has been or

will be incurred, we record the loss, or a reasonable

estimate of the loss, in the consolidated financial

statements. As additional information becomes

available, estimates of probable losses are adjusted

based on an assessment of the circumstances.

Management believes that the outcome of these

matters, individually and in the aggregate, will not

have a material adverse effect on the consolidated

financial statements.

Use of Estimates: In preparing financial statements

in accordance with generally accepted accounting

principles, management makes estimates and

assumptions that affect amounts reported in the

financial statements and accompanying notes.

Actual results may differ from those estimates.

In thousands, except per share amounts 2004 2003 2002

Net income (loss), as reported $ 474,702 $397,933 $ (154,543)

Add employee compensation expense for performance –

based restricted stock units and restricted stock

included in reported net income, net of income taxes 6,793 990 627

Less total stock-based employee compensation expense

determined under the fair value-based method,

net of income taxes (18,757) (13,648) (15,512)

Pro forma net income (loss) $ 462,738 $385,275 $ (169,428)

Earnings (loss) per common share:

Basic –as reported $4.30 $3.67 $ (1.49)

Basic –pro forma 4.19 3.55 (1.63)

Diluted – as reported $4.21 $3.61 $ (1.38)

Diluted – pro forma 4.10 3.49 (1.52)