North Face 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Nautica

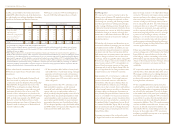

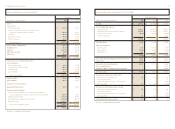

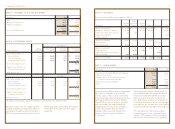

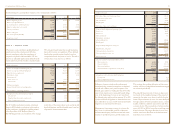

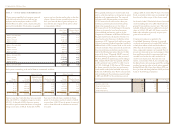

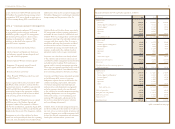

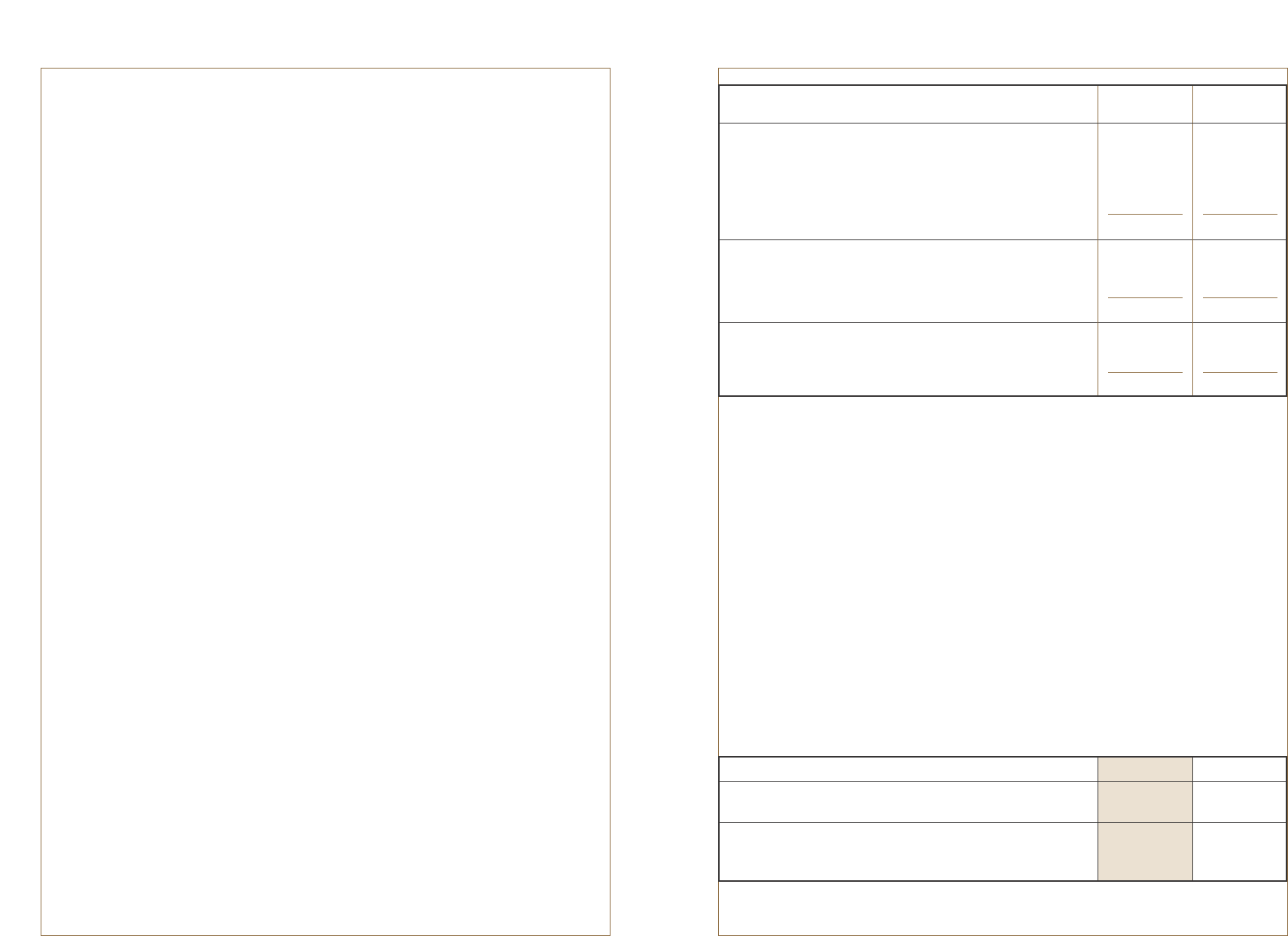

In thousands Acquisitions Acquisition

Cash and equivalents $ 59,899 $ 75,597

Other current assets 159,343 247,675

Property, plant and equipment 20,034 52,197

Intangible assets 323,500 319,700

Other assets 48,867 10,954

Total assets acquired 611,643 706,123

Current liabilities 171,979 172,751

Long-term debt 1,619 18,092

Other liabilities, primarily deferred income taxes 86,745 48,595

Total liabilities assumed 260,343 239,438

Net assets acquired 351,300 466,685

Goodwill 316,199 217,178

Purchase price $ 667,499 $ 683,863

81vf corporation 2004 Annual Report

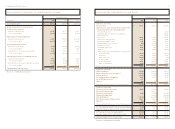

Amounts assigned to intangible assets were based

on management’s evaluation of their fair values,

with assistance from an independent valuation firm.

Management believes that amounts assigned to

major trademarks and tradenames have an indefinite

life. Amounts assigned to amortizable intangible

assets for the 2004 Acquisitions totaled $90.4

million and consisted principally of $57.2 million of

customer relationships and $24.4 million of licensing

contracts. These assets were determined to have

weighted average useful lives of 21 years and 8 years,

respectively, and are being amortized primarily using

accelerated methods. Amortizable intangible assets

for the Nautica Acquisition totaled $102.3 million

and consisted principally of $89.5 million of

licensing contracts and $9.7 million of customer

relationships. These assets have weighted average

useful lives of 30 years and 24 years, respectively,

and are being amortized using accelerated methods.

Factors that contributed to the recognition of

Goodwill for the 2004 Acquisitions and the Nautica

Acquisition included (1) expected growth rates and

profitability of the acquired companies, (2) their

experienced workforce, (3) VF’s strategies for growth

in sales, income and cash flows in the various whole-

sale, retail and licensing businesses and (4) expected

synergies with existing VF business units. Goodwill

of $48.0 million related to the 2004 Acquisitions and

of $51.6 million related to the Nautica Acquisition

is expected to be deductible for income tax purposes.

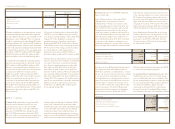

The following unaudited pro forma results of opera-

tions assume that the 2004 and the 2003 acquisitions

had occurred at the beginning of 2003. These pro

forma amounts should not be relied on as an indica-

tion of the results of operations that VF would have

achieved had the acquisitions taken place at a different

date or of future results that VF might achieve:

In thousands, except per share amounts 2004* 2003*

Net sales $6,278,790 $ 6,062,955

Net income 460,311 343,726

Earnings per common share:

Basic $4.17 $ 3.17

Diluted 4.08 3.12

*Pro forma operating results for 2004 include expenses totaling $59.6 million ($0.41 basic and $0.40 diluted per share) and for 2003 include

expenses totaling $35.6 million ($0.24 basic and $0.23 diluted EPS) for settlement of stock options, management contracts and other

transaction expenses incurred by the acquired businesses related to their acquisition by VF.

During 2004, VF acquired the following four

businesses for a total cash cost, including transaction

costs, of $667.5 million (collectively referred to as

the “2004 Acquisitions”):

•The most significant transaction was the acquisition

on June 30, 2004 of 100% of the common stock

of Vans, Inc. (“Vans”) at a price of $20.55 per share,

for a total cost of $373.1 million. Vans designs

and markets Vans® performance and casual

footwear and apparel for skateboarders and other

action sports participants and enthusiasts. In its

most recent fiscal year, Vans had sales of $344

million (unaudited), with sales being split approxi-

mately equally among domestic wholesale accounts,

domestic retail stores and international operations.

•A subsidiary of VF acquired the operating assets

of Kipling® bags, backpacks and accessories

(“Kipling”) on June 14, 2004. Including the

acquisition of the brand rights in the United States

in late 2004, the total cost was $185.0 million.

Based in Belgium, Kipling had sales of $69 million

(unaudited) in its most recent year.

•On May 31, 2004, VF acquired 100% of the

common stock of Green Sport Monte Bianco

S.p.A., makers of Napapijri® premium casual

outdoor sportswear (“Napapijri”), for a total cost of

$103.4 million. Based in Italy, Napapijri had sales of

$76 million (unaudited) in its most recent year.

•VF acquired 51% ownership of a newly formed

company in Mexico for $6.0 million. This company

will market several of VF’s intimate apparel brands,

as well as the Ilusión® brand licensed from the

minority partner, to discount stores and department

stores in Mexico.

The Vans, Kipling and Napapijri businesses add

lifestyle brands having global growth potential. Their

brands are targeted to specific consumer groups, and

their products extend across multiple categories. Vans

and Kipling provide expertise and growth opportuni-

ties in two new product categories for VF – footwear

and women’s accessories. In addition, the sportswear

design talent at Napapijri is being used to assist in

the European launch of Nautica® apparel in 2005.

On August 27, 2003, VF acquired all of the common

stock of Nautica Enterprises, Inc. (“Nautica”) for a

total cash cost of $587.6 million, including transaction

costs. Nautica designs, sources and markets sportswear

under the Nautica® brand. The Nautica® brand is

licensed for apparel and accessories in the United

States and internationally and for home furnishings

in the United States. The Nautica acquisition (1)

provided a growth platform for sportswear, which was

a new product category for VF, (2) provided broader

lifestyle product capabilities and (3) significantly

expanded VF’s presence in the department store and

specialty store channels of distribution. The Nautica

acquisition also included a chain of 115 Nautica®

retail outlet stores, the premium Earl Jean® brand

of jeans and sportswear and the John Varvatos® brand

of designer sportswear. In a separate transaction,

VF acquired from a former officer of Nautica his

rights to receive 50% of Nautica’s net royalty income,

along with other rights in the Nautica® name, trade-

marks and intellectual property owned, held or used

by Nautica. Under this agreement, VF paid $38.0

million at closing and will pay $33.0 million on each

of the third and fourth anniversaries of the closing.

The future amounts do not bear interest and were

recorded at their present value of $58.3 million.

As additional consideration, VF will pay 31.7%

of Nautica’s gross royalty revenues in excess of

$34.7 million in any year through 2008, with such

excess payments to be recorded as Goodwill.

Gross royalty revenues were $33.7 million in 2004.

The acquisitions of Nautica and of the former

officer’s rights are collectively referred to herein

as the “Nautica Acquisition.”

Operating results of these acquisitions have been

included in the consolidated financial statements

since their respective dates of acquisition.

The following table summarizes the estimated fair

values of the assets acquired and liabilities assumed

for these transactions at their respective dates of

acquisition. The purchase price allocation for the

2004 Acquisitions is subject to adjustment over

the first half of 2005 as VF management finalizes

their integration plans. In addition, management

is awaiting information from outside counsel on

litigation related to one of the acquisitions.

note b – acquisitions