North Face 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

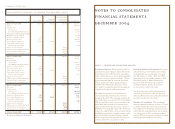

63vf corporation 2004 Annual Report

We are currently evaluating FASB Statement No. 123

(R), Share-Based Payment, which was issued in late

2004. This Statement requires that the cost of stock

options, based on the fair value of such options at

the date of grant, be recognized as compensation

expense over the vesting period. This Statement

also changes the method of expense recognition for

our performance-based restricted stock units.

The new Statement, which must be adopted no later

than the beginning of the third quarter of 2005, has

two methods of adoption. VF may elect to recognize

compensation expense for options granted prior to

but not vested as of the date of adoption, in which

case prior periods would remain unchanged and pro

forma disclosures would continue to be provided for

those periods. Alternatively, VF may elect to restate

either all prior periods presented, or all periods since

the beginning of 2005, by recognizing compensation

expense in the amounts previously reported in the

pro forma disclosures.

Management has not yet determined which method

of adoption it will use for the new Statement.

The estimated effect of adopting the new rules for

all unvested stock options and other stock-based

compensation will be to reduce reported earnings per

share by approximately $0.05 for each quarter of 2005

following adoption. In addition, if the first method

above is selected, we would record a noncash charge

at the date of adoption for the cumulative effect of

applying the new rules for all unvested stock options,

which we estimate to be approximately $0.10

per share. Although the new rules will result in

a reduction in future earnings, there will be no

impact on total Common Stockholders’ Equity.

As described in Note A to the Consolidated Financial

Statements, in accordance with applicable accounting

pronouncements to date, compensation expense has

not been recognized for stock options but has been

recorded for other forms of equity compensation.

If compensation expense in 2004 and prior years had

been recognized for stock options based on the fair

value-based method, reported earnings per share

would have been reduced by $0.11 in 2004 and $0.12

in 2003. The pro forma effect in 2004 was slightly

less than 2003 due primarily to the reduced number

of stock options granted in 2004, offset in part by the

higher fair value of those options.

Compensation expense recorded in the financial

statements for performance-based restricted stock

units was $0.06 per share in 2004, compared with

$0.01 per share in 2003. Compensation expense

increased for these performance-based restricted

stock units during 2004 due to (1) a shift in the overall

mix of long-term executive compensation, with an

increased number of restricted stock units granted

in 2004 offset by a reduced number of stock options

granted, (2) the increased price of VF Common Stock

and (3) the high level of performance relative to

targets previously established by the Compensation

Committee of the Board of Directors.

stock-based compensation; change in accounting policy effective in 2005

We have chosen accounting policies that we believe

are appropriate to accurately and fairly report VF’s

operating results and financial position in conformity

with accounting principles generally accepted in the

United States. We apply these accounting policies in a

consistent manner. Our significant accounting policies

are summarized in Note A to the Consolidated

Financial Statements.

The application of these accounting policies requires

that we make estimates and assumptions that affect

the reported amounts of assets, liabilities, revenues and

expenses, and related disclosures. These estimates and

assumptions are based on historical and other factors

believed to be reasonable under the circumstances.

We evaluate these estimates and assumptions on an

ongoing basis and may retain outside consultants to

assist in our evaluation. If actual results ultimately

differ from previous estimates, the revisions are

included in results of operations in the period in

which the actual amounts become known.

We believe the following accounting policies involve

the most significant management judgments and

estimates used in preparation of our Consolidated

Financial Statements or are the most sensitive to

change from outside factors. We have discussed the

application of these critical accounting policies and

estimates with the Audit Committee of our Board

of Directors.

•Inventories – Our inventories are stated at the lower

of cost or market value. Cost includes all material,

labor and overhead costs incurred to manufacture

or purchase the finished goods. We review all of

our inventory each quarter on the basis of indi-

vidual style-size-color stockkeeping units (“SKUs”)

to identify excess or slow moving products, discon-

tinued and to-be-discontinued products, and

off-quality merchandise. This review covers inven-

tory on hand, as well as current production or

purchase commitments. For those units in inven-

tory that are so identified, we estimate their market

value or expected selling price based on historical

and current realization trends. This evaluation,

performed using a systematic and consistent

methodology, requires forecasts of future demand,

market conditions and selling prices. If the

forecasted selling price is less than cost, we

provide an allowance to reflect the lower value

of that inventory. This methodology recognizes

inventory exposures, on an individual SKU basis,

at the time such losses are evident rather than at

the time goods are actually sold.

•Long-lived assets – Our depreciation policies for our

property, plant and equipment and our amortization

policies for our definite-lived intangible assets

reflect judgments on the estimated economic lives

of these assets. We review these assets for possible

impairment whenever events or circumstances

indicate that the carrying amount of an asset may

not be fully recoverable. We measure recoverability

of the carrying value of these assets by comparison

with undiscounted cash flows expected to be

generated by the assets. These evaluations have not

resulted in any significant impairment adjustments

during the past three years.

In connection with our adoption of FASB Statement

No. 142, Goodwill and Other Intangible Assets, as

of the beginning of 2002, we performed a review

of our goodwill for possible impairment. The review

required that we estimate the fair value of our

business units having goodwill. Fair value was based

on the present value of expected future cash flows,

which required judgment and estimation about

future market conditions, future sales and prof-

itability, and a discount rate commensurate with

the risk inherent in each business unit. We engaged

an independent valuation firm to assist us in

determining the fair value of these business units.

The write-down resulting from this review was

recorded as the cumulative effect of a change in

accounting policy as of the beginning of 2002.

critical accounting policies and estimates