North Face 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

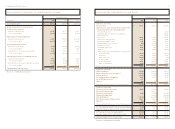

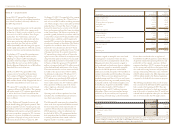

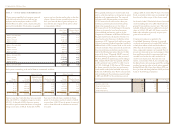

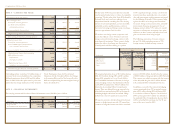

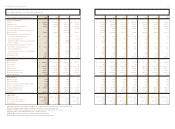

Shares Under Weighted Average

Options Exercise Price

Balance, December 2001 9,009,981 $ 35.87

Options granted 2,453,000 40.90

Options exercised (1,326,026) 30.29

Options canceled (343,265) 41.16

Balance, December 2002 9,793,690 37.70

Options granted 2,448,480 34.75

Options exercised (921,710) 29.99

Options canceled (417,850) 41.70

Balance, December 2003 10,902,610 37.54

Options granted 1,755,890 44.80

Options exercised (3,015,044) 36.78

Options canceled (13,500) 38.20

Balance, December 2004 9,629,956 $ 39.10

93vf corporation 2004 Annual Report

VF may grant nonqualified stock options, restricted

stock units and restricted stock to officers, key

employees and nonemployee members of VF’s

Board of Directors under a stock compensation plan

approved by stockholders. Stock options are granted

at prices not less than fair market value on the date

of grant. Options become exercisable from one to

three years after the date of grant and expire ten

years after the date of grant. Stock option activity

is summarized as follows:

Options to purchase 7,664,766 shares were exercisable

at the end of 2003 at a weighted average exercise price

of $38.23. At the end of 2002, there were options

exercisable to purchase 6,061,240 shares at a weighted

average exercise price of $36.20. At the end of 2004,

there were 9,186,248 shares available for future

grants of stock options and stock awards, of which

no more than 2,582,575 may be grants of restricted

stock or shares delivered in settlement of restricted

stock units.

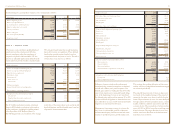

VF has granted performance-based restricted stock

units to certain key employees as a long-term incentive

under the stock compensation plan. The restricted

stock units entitle the participants to receive shares

of VF Common Stock at the end of a three year

performance period. Each restricted stock unit has

a final value ranging from zero to two shares of

VF Common Stock. For the 2004 grants, the number

of shares to be earned is based on achievement

of preestablished performance goals set by the

Compensation Committee of the Board of Directors.

For grants in prior years, the number of shares to be

earned was based on three year stockholder return

comparisons of VF Common Stock with a peer group

of apparel companies. Dividend equivalents, payable in

additional shares of VF Common Stock, accrue on the

restricted stock units. Shares earned at the end of each

three year performance period are issued to partici-

pants in the following year, unless they elect to defer

receipt of the shares. VF granted 280,007 restricted

stock units having a grant date fair value per unit of

$43.18 in 2004 for the performance period ending in

2006; similarly, 49,147 units were granted at $36.10

in 2003 and 44,143 units at $39.27 in 2002. A total

of 23,727, 25,064 and 57,188 shares of VF Common

Stock were earned for the three year performance

periods ended in 2004, 2003 and 2002, respectively.

At the end of 2004, there were 49,147 restricted stock

units outstanding for the performance period ending

in 2005 and 280,007 for the performance period

ending in 2006. A total of 101,943 shares of Common

Stock are issuable in future years to participants who

have elected to defer receipt of their shares earned.

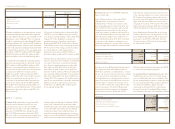

At the end of 2004, VF had 62,611 shares of restricted

stock outstanding that vest in 2005, which had been

granted to key employees in prior years. This total

included dividends payable in additional restricted

shares of 1,328, 1,579 and 1,425 shares accrued in

2004, 2003 and 2002, respectively, on prior years’

grants of restricted stock.

Compensation expense recognized in the

Consolidated Statements of Income for restricted

stock units and restricted stock totaled $11.0 million

in 2004, $1.6 million in 2003 and $1.0 million in

2002. Since all stock options are granted at market

value, compensation expense is not required. Note A

presents pro forma net income and earnings per share

that would have resulted if compensation had been

recorded based on the fair value method for all

stock-based compensation. Fair value for stock

options, as presented in Note A, was estimated using

the Black-Scholes option-pricing model. The resulting

weighted average fair value of stock options granted

during 2004 was $11.64 per share, during 2003 was

$8.33 per share and during 2002 was $10.51 per share,

based on the following assumptions:

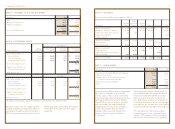

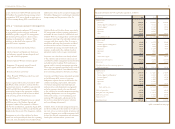

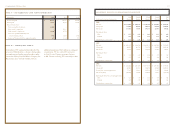

Stock options outstanding at the end of 2004 are summarized as follows:

Options Outstanding Options Exercisable

Weighted Average

Range of Number Remaining Years Weighted Average Number Weighted Average

Exercise Prices Outstanding Contractual Life Exercise Price Exercisable Exercise Price

$25–30 624,700 4.5 $ 26.16 624,700 $ 26.16

30 – 35 1,966,340 6.1 34.58 1,439,676 34.57

35 – 40 1,413,446 7.2 35.87 1,353,446 35.89

40 – 45 5,625,470 6.8 42.93 3,616,550 42.17

$ 25– 45 9,629,956 6.6 $ 39.10 7,034,372 $ 37.98

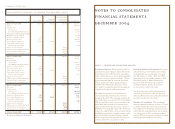

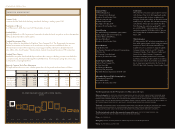

note p – stock-based compensation

2004 2003 2002

Risk-free interest rate 2.6%2.6%4.0%

Expected dividend yield 2.4%2.9%2.7%

Expected volatility 35%36%36%

Expected life (years) 444