North Face 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

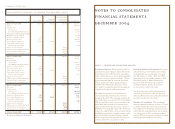

61vf corporation 2004 Annual Report

In 2002, cash provided by discontinued operations

totaled $69.9 million from the sale of the Jantzen busi-

ness and related assets and from liquidation of working

capital from the Jantzen and knitwear businesses.

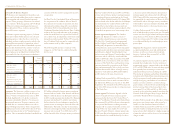

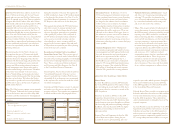

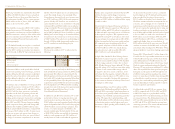

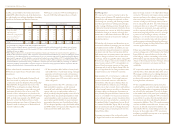

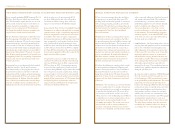

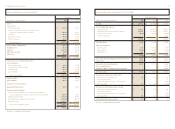

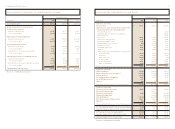

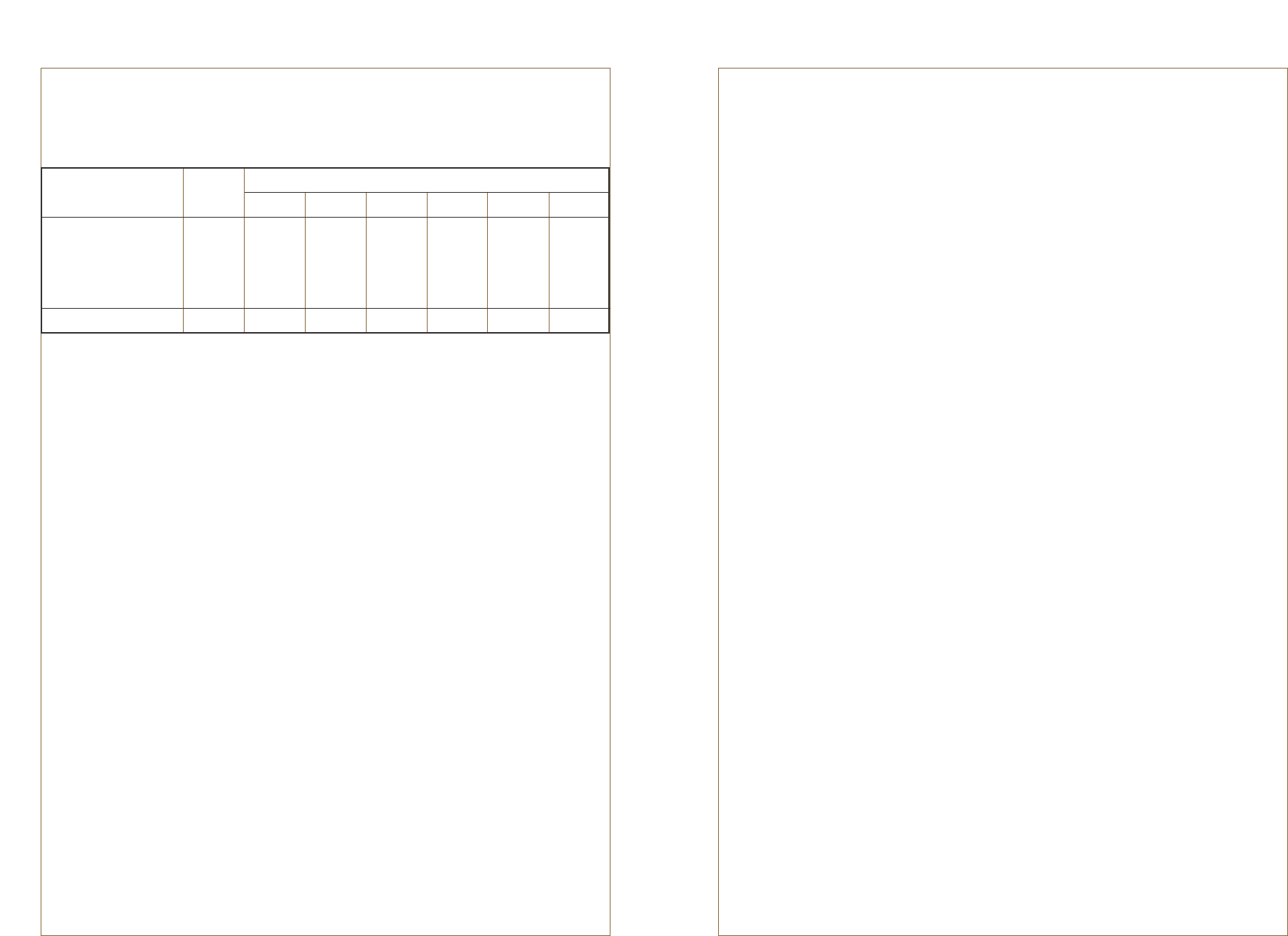

Following is a summary of VF’s fixed obligations at

the end of 2004 that will require the use of funds:

Payments Due or Forecasted by Period

In millions Total 2005 2006 2007 2008 2009 Thereafter

Long-term debt* $1,622 $ 464 $ 69 $ 69 $ 36 $ 35 $ 949

Operating leases 415 98 84 66 53 39 75

Minimum royalty payments 66 14 17 16 14 5 -

Inventory obligations** 817 682 15 15 15 15 75

Other obligations*** 885 221 111 91 88 87 287

Total $ 3,805 $ 1,479 $ 296 $ 257 $ 206 $ 181 $ 1,386

*Long-term debt service obligations include both principal and related interest.

** Inventory purchase obligations represent commitments for raw material, sewing labor and finished goods in the ordinary course of business

that are payable upon satisfactory receipt of the inventory by VF, plus a commitment to purchase $15.0 million per year through 2013 of

finished goods from one supplier.

***Other obligations represent other commitments for the expenditure of funds, many of which do not meet the criteria for recognition as a

liability for financial statement purposes. These commitments include forecasted amounts related to (1) contracts not involving the purchase

of inventories, such as advertising and the noncancelable portion of service or maintenance agreements, (2) capital expenditures for approved

projects and (3) components of Other Liabilities, as presented and classified as noncurrent liabilities in VF’s Consolidated Balance Sheet,

that will require the use of cash. Projected cash requirements for components of Other Liabilities include (1) portions of those liabilities recorded

in Current Liabilities, (1) discretionary funding contributions to our pension plan trust of $55 million per year through 2009 based on

information provided by our independent actuary and management’s current intent and (3) payments of deferred compensation and other

employee-related benefits based on forecasted activity and prior experience.

We have other financial commitments at the end of

2004 that may require the use of funds under certain

circumstances:

•Shares of Series B Redeemable Preferred Stock

have been issued to participants as matching

contributions under the Employee Stock Ownership

Plan (“ESOP”). If requested by the trustee of the

ESOP, VF has an obligation to redeem Preferred

Stock held in participant accounts and to pay each

participant the value of his or her account. The

amounts of these redemptions vary based on the

conversion value of the Preferred Stock. In 2004 and

2003, no funds were required as the ESOP trustee

elected to convert the Preferred Stock of with-

drawing participants into shares of Common Stock.

Payments made for redemption of Preferred Stock

were $5.8 million in 2002.

•VF has entered into $80.5 million of surety bonds

and standby letters of credit representing contingent

guarantees of performance under self-insurance

and other programs. These commitments would

only be drawn upon if VF were to fail to meet its

claims obligations.

Management believes that VF’s cash balances and

funds provided by operations, as well as unused

committed bank credit lines, additional borrowing

capacity and access to equity markets, taken as a

whole, provide (1) adequate liquidity to meet all of its

obligations when due, (2) adequate liquidity to fund

capital expenditures and to maintain our dividend

payout policy and (3) flexibility to meet investment

opportunities that may arise. Specifically, we believe

VF has adequate liquidity to repay the $100.0 million

and $300.0 million of long-term debt obligations due

in June and October 2005, respectively.

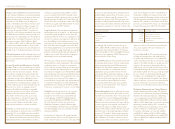

Risk Management

VF is exposed to a variety of market risks in the

ordinary course of business. We regularly assess these

potential risks and manage our exposures to these

risks through our operating and financing activities

and, when appropriate, by utilizing natural hedges

and by creating offsetting positions through the use

of derivative financial instruments. Derivative finan-

cial instruments are contracts in which the payments

are linked to changes in currency exchange rates,

interest rates or other financial measures. We do not

use derivative financial instruments for trading or

speculative purposes.

We limit the risk of interest rate fluctuations on net

income and cash flows by managing our mix of fixed

and variable interest rate debt. In addition, we may

also use derivative financial instruments to minimize

our interest rate risk. Since our long-term debt has

fixed interest rates, our primary interest rate exposure

relates to changes in interest rates on short-term

borrowings, which averaged $96 million during 2004.

However, any change in interest rates would also affect

interest income earned on VF’s cash equivalents on

deposit. Based on average amounts of short-term

borrowings and of cash on deposit during 2004, the

effect of a hypothetical 1.0% change in interest rates

on reported net income would not be material.

Approximately 23% of our business is conducted

in international markets. Our foreign businesses

operate in functional currencies other than the

United States dollar (except in Turkey, where we

use the United States dollar because of the high

inflation rate in that country). Assets and liabilities

in these foreign businesses are subject to fluctuations

in foreign currency exchange rates. Investments in

these primarily European and Latin American busi-

nesses are considered to be long-term investments,

and accordingly, foreign currency translation effects

on those net assets are included in a component of

Accumulated Other Comprehensive Income (Loss)

in Common Stockholders’ Equity. We do not hedge

these net investments and do not hedge the transla-

tion of foreign currency operating results into the

United States dollar.

A growing percentage of the total product needs

to support our businesses are manufactured in our

plants in foreign countries or by independent foreign

contractors. We monitor net foreign currency market

exposures and may in the ordinary course of business

enter into foreign currency forward exchange

contracts to hedge specific foreign currency transac-

tions or anticipated cash flows. Use of these financial

instruments allows us to reduce VF’s overall exposure

to exchange rate movements, since gains and losses

on these contracts will offset losses and gains on the

transactions being hedged. Our practice is to hedge

a portion of our net foreign currency cash flows

(relating to cross-border inventory purchases and

production costs, product sales and intercompany

royalty payments anticipated during the following

12 months) by buying or selling United States dollar

contracts against various currencies.

If there were a hypothetical adverse change in foreign

currency exchange rates of 10% relative to the United

States dollar, the expected effect on the fair value

of the hedging contracts outstanding at the end of

2004 would be approximately $23 million. Based on

changes in the timing and amount of foreign currency

exchange rate movements, actual gains and losses

could differ.

VF is exposed to market risks for the pricing of cotton

and other fibers, which indirectly affects fabric prices.

We manage our fabric prices by ordering denim and

other fabrics several months in advance, but we have

not historically managed commodity price exposures

by using derivative instruments.

VF has nonqualified deferred compensation plans

in which liabilities accrued for the plans’ participants

are based on market values of investment funds that

are selected by the participants. The risk of changes

in the market values of the participants’ underlying

investment selections is hedged by VF’s investments

in a portfolio of securities that substantially mirrors

the investment selections underlying the deferred

compensation liabilities. These VF-owned investment

securities are held in irrevocable trusts. Increases and

decreases in deferred compensation liabilities are

substantially offset by corresponding increases and

decreases in the market value of VF’s investments,

resulting in a negligible net exposure to our operating

results and financial position.