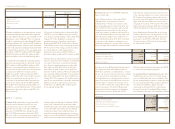

North Face 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85vf corporation 2004 Annual Report

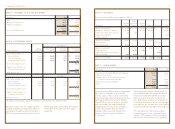

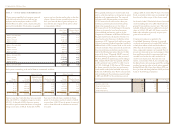

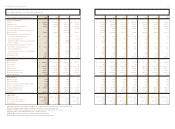

Amortization expense was $15.4 million in 2004

(including an impairment charge of $1.1 million for

a miscellaneous intangible asset) and $3.6 million in

2003. Estimated amortization expense for the years

2005 through 2009 is $14.6 million, $14.2 million,

$13.5 million, $10.4 million and $8.1 million,

respectively.

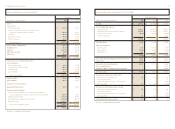

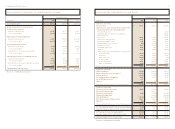

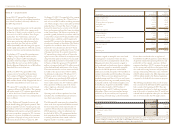

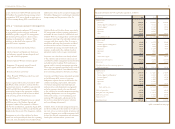

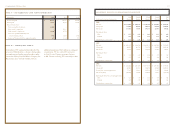

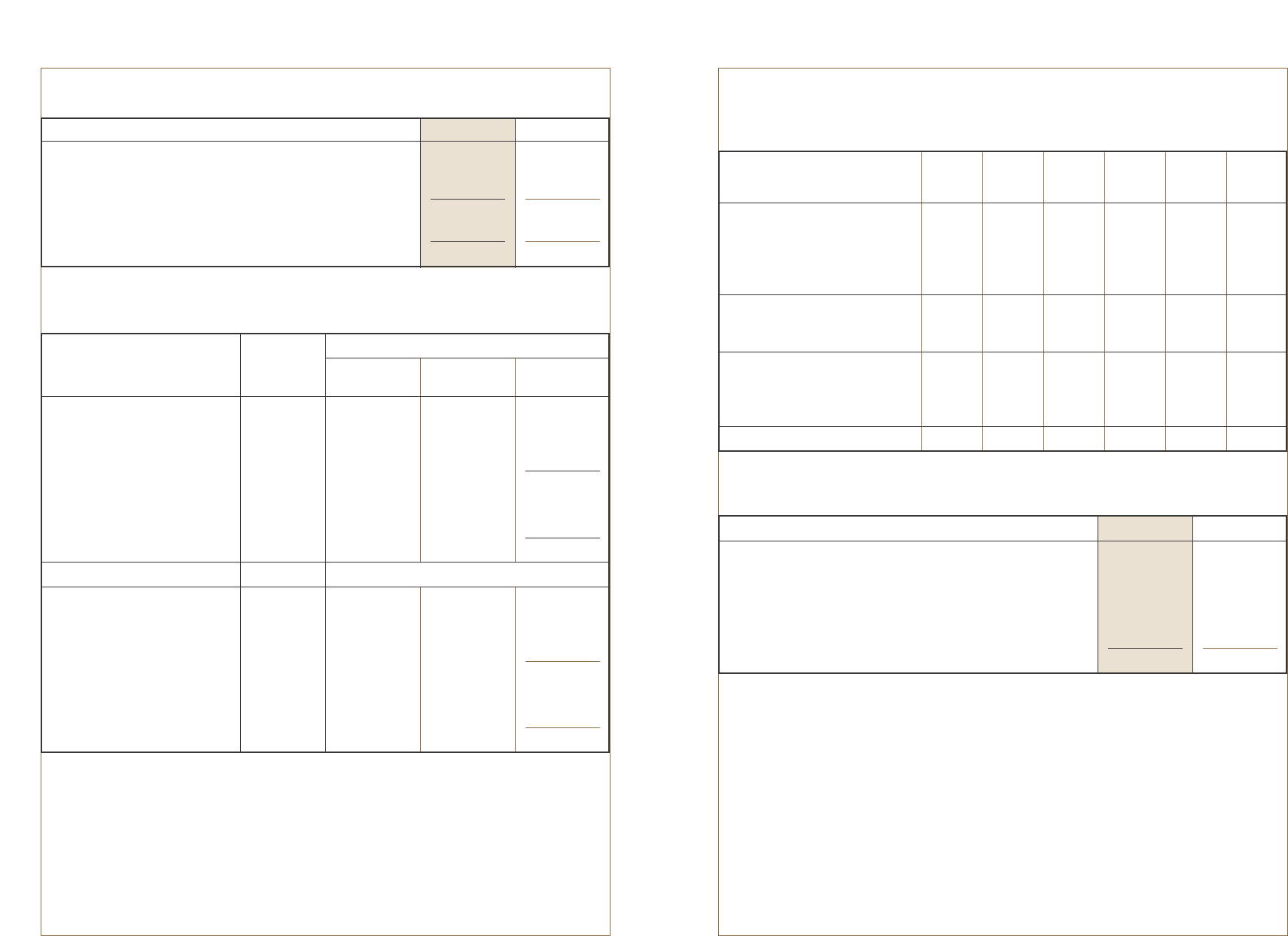

note h – goodwill

Activity is summarized by business segment as follows:

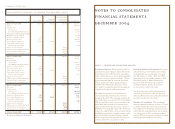

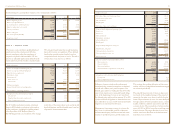

note i – other assets

Outdoor

Jeanswear Apparel and Intimate

In thousands Apparel Equipment Apparel Imagewear Sportswear Other

Balance, December 2001 $ 253,841 $ 110,036 $ 221,343 $ 351,374 $ – $ 61,452

Change in accounting policy (Note A) (63,199) – (109,751) (295,128) – (59,176)

Adjustments to purchase price allocation (275) (924) – – – –

Impairment loss (Note C) –––––(2,276)

Currency translation 6,038 – – – – –

Balance, December 2002 196,405 109,112 111,592 56,246 – –

2003 acquisitions ––––217,178 –

Currency translation 10,439 – – – – –

Balance, December 2003 206,844 109,112 111,592 56,246 217,178 –

2004 acquisitions – 310,175 6,000 – 24 –

Adjustments to purchase price allocation ––––(2,934) –

Currency translation 4,411 12,946 – – – –

Balance, December 2004 $ 211,255 $ 432,233 $ 117,592 $ 56,246 $ 214,268 $ –

In thousands 2004 2003

Investment securities held for deferred compensation plans $ 167,715 $ 158,074

Other investment securities 45,116 36,800

Computer software, net of accumulated amortization

of $45,057 in 2004 and $35,343 in 2003 63,810 61,499

Pension plan intangible asset (Note N) 46,960 17,919

Other 46,265 34,007

$ 369,866 $ 308,299

note g – intangible assets

December 2004

Weighted Gross Carrying Accumulated Net Carrying

Dollars in thousands Average Life Amount Amortization Amount

Amortizable intangible assets*:

License agreements 25 years $ 114,623 $ 7,343 $ 107,280

Customer relationships 21 years 71,305 2,797 68,508

Trademarks, backlog and other 6 years 13,111 7,646 5,465

Amortizable intangible assets, net 181,253

Indefinite-lived intangible assets:

Trademarks and tradenames 458,267

Intangible assets, net $ 639,520

December 2003

Amortizable intangible assets*:

License agreements 30 years $ 89,500 $ 1,148 $ 88,352

Customer relationships 24 years 10,200 233 9,967

Trademarks, backlog and other 5 years 5,090 2,175 2,915

Amortizable intangible assets, net 101,234

Indefinite-lived intangible assets:

Trademarks and tradenames 217,400

Intangible assets, net $ 318,634

*Amortization of license agreements and customer relationships – accelerated methods; other– straight-line method.

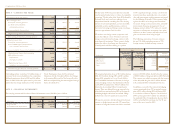

In thousands 2004 2003

Land $ 52,989 $ 52,124

Buildings and improvements 502,369 479,725

Machinery and equipment 984,132 1,027,997

1,539,490 1,559,846

Less accumulated depreciation 967,236 968,166

$ 572,254 $ 591,680

note f – property, plant and equipment

Investment securities held for deferred compensation

plans consist of marketable securities and life

insurance contracts. These securities substantially

mirror the participant-directed investment selections

underlying the deferred compensation liabilities

(Note M). These securities, held in an irrevocable

trust, are recorded at fair value. Realized and

unrealized gains and losses on these investment

securities are recorded in the Consolidated

Statements of Income and substantially offset

changes in deferred compensation liabilities

to participants.

Other investment securities are held primarily to

support liabilities under the supplemental defined

benefit pension plan (Note M). These securities,

held in an irrevocable trust, are recorded at fair

value. Realized gains and losses are recorded in the

Consolidated Statements of Income, and unrealized

gains and losses, net of income taxes, are recorded in

Accumulated Other Comprehensive Income (Loss).

VF is the beneficiary of life insurance policies

mentioned above on certain current and former

members of VF management. Policy loans against

the cash value of these policies are not significant.