North Face 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

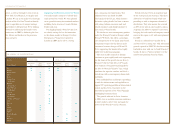

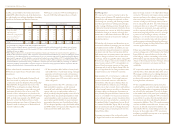

730

544

646

2004 2003 2002

15.8 16.6 16.9

2004 2003 2002

return on capital

(Percent)

51vf corporation 2004 Annual Report

Acquisitions

VF acquired Vans, Kipling and Napapijri in 2004.

The Vans®,Kipling® and Napapijri® brands are

lifestyle brands that we believe have global growth

potential. In addition, VF acquired a controlling

interest in a newly formed intimate apparel

marketing company in Mexico to expand our

presence in that growing market.

The total cost of these acquisitions was $667.5 million

in cash. These acquisitions added $303.0 million to

sales and $0.14 to earnings per share in 2004. These

four businesses are expected to contribute at least

$200 million in additional sales and could contribute

an additional $0.14 to earnings per share in 2005.

See Note B to the Consolidated Financial Statements

for more information on the 2004 Acquisitions and

on the acquisition of Nautica in 2003.

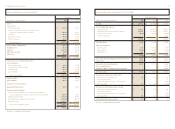

Consolidated Statements of Income

The following table presents a summary of the

changes in our Net Sales in the last two years:

analysis of results of continuing operations

2004 Compared 2003 Compared

In millions with 2003 with 2002

Net sales – prior year $ 5,207 $ 5,084

Core businesses 235 (110)

Acquisitions in prior year (to anniversary date) 367 –

Acquisitions in current year 303 264

Disposition of VF Playwear (57) (31)

Net sales – current year $ 6,055 $ 5,207

Sales increased in most core businesses in 2004 due to

unit volume increases, particularly in our outdoor and

intimate apparel businesses, and the favorable effects

of foreign currency translation. Substantially all of the

sales decline in our core businesses during 2003 was

due to decreases in unit volume, offset in part by the

effects of foreign currency translation. Sales in core

businesses in 2003 declined by $126 million resulting

from two major customers operating under bankruptcy

protection and their store closures: Kmart Corporation,

which filed for bankruptcy protection in January 2002

and emerged from bankruptcy in May 2003 as Kmart

Holding Corporation, and Ames Department Stores,

Inc., which operated under bankruptcy protection

until its liquidation in the second half of 2002.

Additional details on sales are provided in the

section titled Information by Business Segment.

The 2004 Acquisitions added 6% to sales in 2004.

The acquisition of Nautica in August 2003 added 7%

(prior to the 2004 anniversary date of its acquisition)

to 2004 sales and contributed 5% to 2003 sales.

In translating foreign currencies into the U.S. dollar,

the weaker U.S. dollar in relation to the functional

currencies where VF conducts the majority of its

business (primarily the European euro countries)

improved sales comparisons by $96 million in

2004 relative to 2003. For 2003, sales comparisons

benefited by $128 million relative to 2002. The

average translation rate for the euro was $1.23 per

euro during 2004, compared with $1.12 during 2003

and $0.94 during 2002. Based on the translation rate

of $1.36 per euro at the end of 2004, reported sales in

2005 may also receive a translation benefit compared

with 2004.

The following table presents the percentage relation-

ship to Net Sales for components of our Consolidated

Statements of Income:

2004 2003 2002

Gross margin (net sales less cost of goods sold) 39.8%37.4%36.0%

Marketing, administrative and general expenses (27.7) (25.6) (24.2)

Royalty income and other 0.7 0.6 0.4

Operating income 12.8%12.4%12.2%

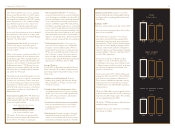

Gross margins increased to 39.8% of sales in 2004,

compared with 37.4% in 2003 and 36.0% in 2002.

Approximately 1.8% of the 2004 increase was in

our core businesses, including changes in the mix of

our businesses as we have experienced sales growth

in our higher margin outdoor businesses, benefits of

cost reduction actions and operating efficiencies. The

additional 0.6% increase in gross margin as a percent

of sales was due to higher gross margins of the 2004

Acquisitions and the 2003 acquisition of Nautica

(prior to its anniversary date). Approximately 1.0% of

the 2003 increase in gross margin was due to changes

in the mix of our businesses, as we experienced sales

growth in our higher margin outdoor and interna-

tional jeans businesses, and from the acquisition of

Nautica. The remaining 0.4% improvement related to

benefits of our cost reduction initiatives and lower

restructuring costs incurred relative to 2002.

Over the last five years, we closed a significant number

of manufacturing facilities in the United States and

shifted production to lower cost sources. As a result

of this shift in sourcing, the amount of sales in the

United States derived from products manufactured

in lower cost locations outside the United States has

increased each year over the last three years. During

2004, 3% of the units we sold in the United States

were manufactured in VF-owned plants in the

United States. In contrast, at the end of 2000,

approximately one-third of our products sold in the

United States were manufactured in our United

States plants. Today, of the total products supporting

sales to customers in the United States, 38% were

manufactured in VF-owned facilities in Mexico and

the Caribbean Basin and 59% were obtained from

contractors, primarily in Asia. We believe this

combination of VF-owned and contracted produc-

tion from different geographic regions provides

a competitive advantage in our product sourcing.

Marketing, Administrative and General Expenses

increased as a percent of sales to 27.7% in 2004,

compared with 25.6% in 2003 and 24.2% in 2002.

During 2004, approximately 1.4% of the increase was

due to the higher cost to sales relationship of the 2004

Acquisitions and Nautica (prior to the anniversary

date of its acquisition) than other VF businesses. The

remaining 0.7% is due to spending on the growth and

cost reduction initiatives discussed in the following

paragraph, increased incentive compensation expense

and increased advertising as a percent of sales, offset

in part by favorable effects of higher volume and cost

reduction efforts. During 2003, approximately 0.7% of

the increase in these expenses as a percent of sales was

due to changes in the mix of our businesses, with a

larger portion of sales coming from businesses having

a higher expense percentage. In addition, increased

pension cost in 2003 resulted in a 0.5% increase.

cash provided by operations

(Dollars in millions)