Navy Federal Credit Union 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

14

e anticipated employer contribution in 2007 is $25 mil-

lion for the pension plan and $643,000 for the postretire-

ment benefit plan. e accumulated benefit obligation for

the pension plan was $337 million and $303 million at

December 31, 2006 and 2005, respectively.

e measurement date for the pension and postretirement

benefit plan in 2006 and 2005 was December 31.

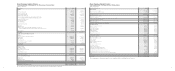

Navy Federal’s pension plan asset allocations by asset

category for 2006 and 2005 and the target allocations

for 2006 were as follows:

Navy Federal employs a total return investment approach

whereby a mix of equities and fixed income investments

are used to maximize the long-term return of plan assets

for a prudent level of risk. e intent of this strategy is to

minimize plan expenses by outperforming plan liabilities

over the long run. Risk tolerance is established through

careful consideration of plan liabilities, plan funded status,

and corporate financial condition. e investment portfolio

contains a diversified blend of equity and fixed income

investments. Investment risk is measured and monitored

on an ongoing basis through annual liability measurements,

periodic asset/liability studies, and quarterly investment

portfolio reviews.

Navy Federal 401(k) Savings Plan

is is a defined contribution plan where employees can

contribute pre-tax money to a 401(k) retirement account

and receive employer matching contributions. e matching

contributions are based on participation in a defined benefit

retirement plan. Employees participating in the Cash

Balance Plan receive a 100% employer match on the first

6% of pay they contribute to their 401(k) account, and

employees participating in the Traditional Plan receive

an employer match of 50% on the first 6% of pay they

contribute to their 401(k) account.

e cost recognized for the 401(k) Plan including matching

contributions and administrative costs was $8.44 million

and $6.89 million for the years ended December 31, 2006

and 2005, respectively.

Deferred Compensation Plan (457)

is is a non-qualified deferred compensation plan as

allowed under Internal Revenue Code Section 457(b). is

plan offers a before-tax savings opportunity to highly-

compensated employees in the Executive and Professional

compensation programs. e annual deferral amount

allowed mirrors the 401(k) plan and contributions are

held by Navy Federal and earn monthly interest based

on Navy Federal’s gross income for the month divided

by the average earnings on assets (loans and investments)

for the month.

Non-Qualified Supplemental Retirement Plan (SERP)

is non-qualified plan is designed to “make up” for benefits

not paid through the defined benefit retirement plan as a

result of limitations imposed by the IRS. e Internal

Revenue Code Section 401(a)(17) limits the amount

of compensation that can be used in the defined benefit

retirement plan’s annuity calculation and Internal Revenue

Code Section 415 limits the amount of monthly annuity

that can be paid by the defined benefit retirement plan.

All benefits are paid from the plan trust. Navy Federal

makes all contributions to the trust in accordance with the

company’s funding policy and in compliance with all federal

laws and regulations.

Navy Federal accrued $2.19 million and $1.44 million to cover

this expense at December 31, 2006 and 2005, respectively.

N : R P

T

In the normal course of business, Navy Federal extends

loans to credit union officials. e total principal amount at

December 31, 2006 and 2005 was $27.1 million and $22.1

million, respectively. Credit union officials are defined as

volunteer members of the Board of Directors and board

committees, and employees with the title of Vice President

and above.

N : M

In May 2006, Gulfport CBC Credit Union was merged

into Navy Federal. Navy Federal accounted for this

merger using the pooling-of-interests method described

in Accounting Principles Board Opinion No. 16, Business

Combinations. As a result of this merger, Navy Federal

obtained $1.5 million in equity.

N : R

U E

Navy Federal is subject to regulatory capital requirements

administered by the NCUA. Failure to meet minimum

capital requirements can initiate certain mandatory—

and possibly additional discretionary—actions by regulators

that, if undertaken, could have a direct material effect on

Navy Federal’s consolidated financial statements. Under

capital adequacy regulations and the regulatory framework

for prompt corrective action, Navy Federal must meet

specific capital requirements that involve quantitative

measures of Navy Federal’s assets, liabilities and certain

commitments as calculated under generally accepted

accounting principles. Navy Federal’s capital amounts

and net worth classification are also subject to qualitative

judgments by the regulators about components, risk

weightings and other factors.

Quantitative measures established by regulation to ensure

capital adequacy require Navy Federal to maintain minimum

amounts and ratios of net worth to total assets. Credit unions

are also required to calculate a risk-based net worth (RBNW)

requirement that establishes whether the credit union will

be considered “complex” under the regulatory framework.

Navy Federal’s RBNW requirement as of December 31,

2006, was 5.36%, which is less than the regulatory threshold

of 6% that would place Navy Federal in the “complex”

category. Management believes, as of December 31, 2006,

that Navy Federal met all RBNW capital adequacy

requirements to which it is subject.

e NCUA categorized Navy Federal as “well capitalized”

under the regulatory framework for prompt corrective

action with a net worth to assets ratio of 11.56% and

10.92% as of December 31, 2006 and 2005, respectively.

Net worth for this calculation is defined as undivided earn-

ings plus regular and capital reserves. To be categorized as

“well capitalized,” Navy Federal must maintain a minimum

net worth ratio of 7% of assets. ere are no conditions or

events since that notification that management believes have

changed the institution’s category.

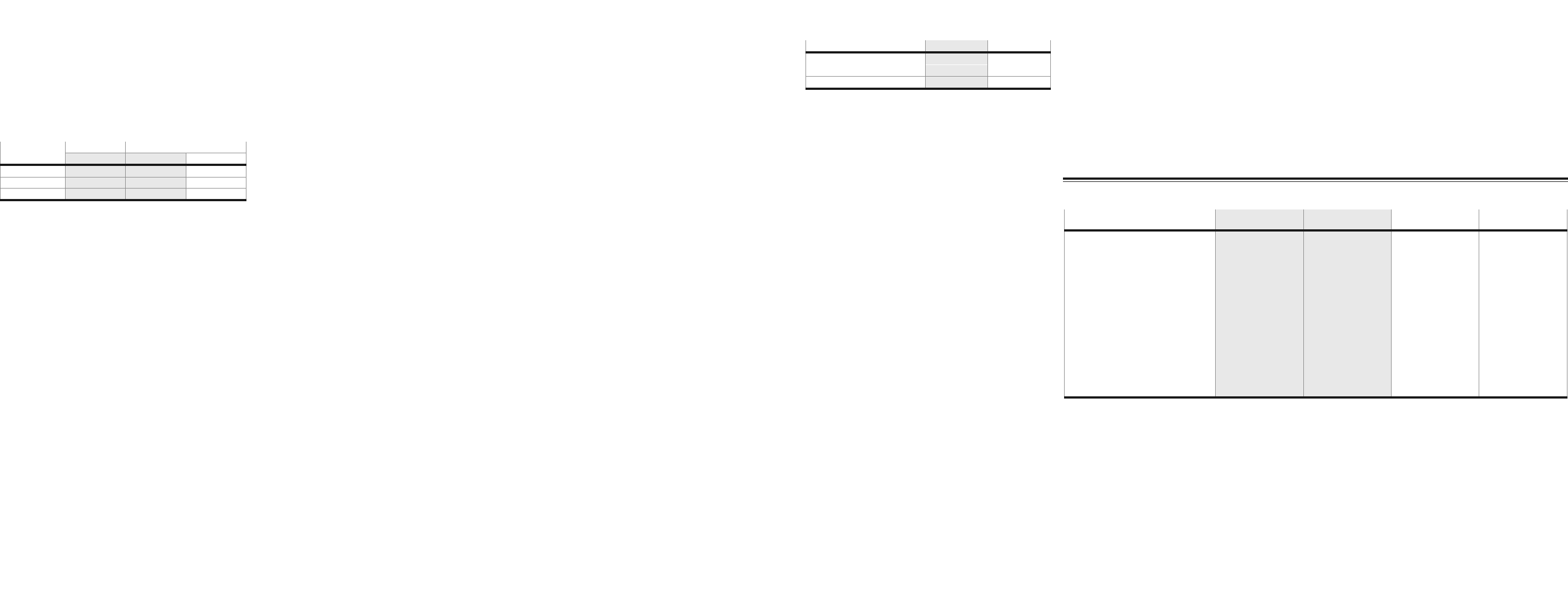

e following is a comparison between Navy Federal’s

actual net worth and the minimum net worth required to

be “well capitalized” (dollars in millions at year end):

N : F V

F I

Navy Federal discloses fair value information of its financial

instruments, whether or not recognized in the Consolidated

Statements of Financial Condition, for which it is practicable

to estimate that value. In cases where quoted market prices

are not available, fair values are based on estimates using

present value or other valuation techniques. ose tech-

niques are significantly affected by the assumptions used,

including the discount rate and estimates of future cash

flows. In that regard, the derived fair value cannot be

substantiated by comparison to independent markets and,

in many cases, could not be realized in immediate settlement

of the instrument. Certain financial instruments and all

non-financial instruments are excluded from disclosure

requirements. Accordingly, the aggregate fair value amounts

presented do not necessarily represent the underlying fair

value of Navy Federal. e following methods and assump-

tions were used in estimating the fair value disclosures for

financial instruments:

Loans to Members

For certain residential mortgages, fair value is estimated

using the quoted market prices for securities backed by

similar loans. e fair value of other types of loans, such as

consumer and equity loans, is estimated by discounting the

future cash flows using the current market rates at which

similar loans would be made to borrowers with similar

credit ratings and for the same remaining maturities.

Investments, Including Mortgage-backed Securities

Fair value is based on quoted market price, if available. If a

quoted market price is not available, fair value is estimated

using quoted market prices for similar securities. For resale

and repurchase agreements, due to their short-term nature,

the carrying amount is a reasonable estimate of fair value.

Cash and Cash Equivalents

Cash and cash equivalents include cash and balances due

from banks, federal funds sold and securities purchased

under agreements to resell, all of which mature within

ninety days. e carrying amount reported approximates

fair value for vault cash and demand balances from other

financial institutions. Fair value for short-term securities is

based on quoted market prices.

Members’ Accounts

e fair value of Share Savings, Money Market Savings,

Checking and Individual Retirement Account (IRA)

share accounts is the amount payable on demand at the

reporting date. For IRA Certificate and Share Certificate

accounts, fair value is estimated using the discounted

value of future cash flows based upon market interest

rates and remaining maturity.

Derivative Instruments and Hedging Activities

Navy Federal does not receive loan commitment fees. e

fair value of loan commitments is based upon differences

between the contracted rate and the current market rate

of comparable mortgage loans. e fair value of forward

contracts is based on the quoted market price of contracts

with similar characteristics. It is the established practice of

Navy Federal to only purchase forward contracts to cover

mortgage loans in process which are anticipated to close for

delivery into these forward contracts. Accordingly, the cost

to terminate existing contracts, which is based on current

market prices, is not material to Navy Federal.

Net Worth 2006 2005

Actual $ 3,135 $ 2,692

Minimum required 1,899 1,725

Excess $ 1,236 $ 967

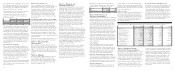

Target Actual

2006 2006 2005

Equity securities 70% 71% 72%

Debt securities 30% 29% 28%

100% 100% 100% e estimated fair values of financial instruments at December 31, 2006 and 2005 were (dollars in thousands):

2006

Carrying Amount

2006

Fair Value

2005

Carrying Amount 2005

Fair Value

Financial assets:

Cash and cash equivalents $ 2,551,693 $ 2,551,693 $ 3,165,226 $ 3,165,226

Securities available-for-sale 2,897 2,897 7,891 7,891

Securities held-to-maturity 1,916,900 1,898,175 2,875,428 2,833,481

Interest-bearing deposits 606,367 604,185 579,594 569,238

Other investments 3,209 3,191 2,221 2,210

Investment in FHLB-Atlanta 76,107 76,094 26,458 26,440

Mortgage servicing assets 198,707 198,707 131,667 131,667

Mortgage loans awaiting sale 90,597 90,864 241,209 241,209

Loans, net of allowance

for loan losses 20,403,815 20,048,409 16,502,095 16,282,352

Financial liabilities and equity:

Securities sold under

repurchase agreements 1,824,147 1,824,456 2,690,873 2,691,153

Members’ accounts 20,706,088 20,560,699 18,940,275 18,293,477

N : R I

A P

In September 2006, the FASB issued SFAS No. 157, Fair

Value Measurements. is statement provides a common

definition of fair value, establishes a framework for measur-

ing fair value and enhances disclosures about fair value

measures. SFAS No. 157 is effective for Navy Federal's

fiscal year beginning January 1, 2008. Navy Federal is

currently evaluating the impact adoption may have on its

financial condition, results of operations and cash flows.

In September 2006, the FASB issued SFAS No. 158,

Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans. is statement requires an entity to

recognize in its statement of financial condition the funded

status of a benefit plan, measured as the difference between

the fair value of the plan assets and the benefit obligation.

SFAS No. 158 also requires an entity to recognize as a

component of accumulated other comprehensive income

the changes in the funded status of a benefit plan to the

extent such changes are not recognized in earnings as

components of net periodic benefit cost of the period.

Effective December 31, 2007, Navy Federal will adopt

SFAS No. 158 to be in compliance with the statement.

Navy Federal is currently evaluating the impact adoption

may have on its financial condition, results of operations

and cash flows.