Navy Federal Credit Union 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Annual Report 2006 25

Low rates, new products and flexible loan

options continue to attract record numbers

of members to Navy Federal. The Credit

Committee said “yes” to more than 834,000

requests for credit in 2006, a 16% increase over last

year. That resulted in a total of $20.7 billion in

loans, 22% more than in 2005.

More than 511,700 consumer loans were

approved by the Committee for approximately

$6.4 billion. Over half of that volume, a record

$3.4 billion, was issued for 191,000 auto loans.

Navy Federal’s consumer loan portfolio achieved

record net growth of $951 million for the year,

and outstanding balances reached $7.3 billion.

Combined consumer loan limits were raised to

accommodate rising costs for automobiles, boats,

RVs and other items.

We revamped our credit card line, which now

features three rewards cards with unmatched

benefits— nRewardsSM,goRewardsSM and Flagship

RewardsSM, with more choices for gifts, cash back

and travel. Over 214,600 credit card accounts

were approved for $745 million, an increase of

18% in both the number of accounts and volume

over 2005.

Demand for equity loans and lines of credit

continued to grow, with the Committee approving

a record 58,000 loan requests for approximately

$3.8 billion. Over 80% were fixed equity loans.

Loan limits were increased, which resulted in a

higher average loan amount of $60,000.

More than 49,400 mortgage loans, a 22%

increase over 2005, were approved for $11.6

billion. We raised the loan limit

on our popular HomeBuyers

Choice mortgage and introduced

a 40-year term. To improve member

convenience, Navy Federal also

added mortgage staff in branches,

extended evening and weekend hours for tele-

phone applications and reduced loan processing

times.

Throughout its history, Navy Federal has

provided products and services that bring value

to members, thus engendering their trust for

generations. Today, the credit union effectively

manages members’ pooled savings in order to

support the goals of both present and future

generations of borrowers. This strategy is consis-

tent with the Credit Committee’s commitment

to put members first while preserving the safety

and soundness of Navy Federal.

Patricia A. Jackson

Chairman

24

The Supervisory Committee independently

evaluates the soundness of Navy Federal’s

operations and activities in compliance

with the Federal Credit Union Act and Navy

Federal’s bylaws. The Committee helps to ensure

that management protects and safeguards assets by

implementing sound internal controls and by

maintaining practices and procedures that con-

form to generally accepted accounting principles.

The Committee also ensures

that Navy Federal’s audited financial statements

fairly and accurately represent Navy Federal’s

financial condition.

The Supervisory Committee is assisted in

carrying out its responsibilities by the independent

accounting firm of PricewaterhouseCoopers LLP

(PwC). PwC auditors perform quarterly audit

procedures and a comprehensive end-of-year audit

of Navy Federal’s financial condition. The results

of these audits are reflected in their Report of

Independent Auditors, which appears in this

Annual Report.

The National Credit Union Administration

(NCUA), the regulatory agency for all federally-

chartered credit unions, performs periodic super-

visory examinations. The results of the NCUA

2006 examination confirm that Navy Federal

continues to be financially strong and a leader in

the credit union movement. No significant areas

of concern were identified in the 2006 examination,

and Navy Federal was proud to again receive

NCUA’s highest rating.

The Supervisory Committee also provides an

avenue of open communication for you, the mem-

bers of Navy Federal, and acts as your ombudsman.

The Committee reviews and responds, in writing,

to all letters and e-mails it receives from Navy

Federal members. Both the membership and the

management of Navy Federal benefit from this

open communication because your individual

concerns are addressed on a personal basis, and

your comments help to ensure that Navy Federal

maintains the highest level of member service.

Based on the results of the Examination

Report of NCUA, the quarterly audit procedures

and the Report of Independent Auditors, it is

the opinion of the Supervisory Committee that

Navy Federal continues to be in a strong finan-

cial condition. The Committee can also assure

you that the policies, programs and management

practices of your credit union are sound and

are effectively administered, and that your

Supervisory Committee, the management and

the staff of Navy Federal will continue to provide

world-class service to each and every member.

Michael C. Wholley

Chairman

(clockwise)

Patricia A. Jackson,

Chairman

REPORT FROM

THE CREDIT COMMITTEE

REPORT FROM

THE SUPERVISORY COMMITTTEE

(clockwise)

Michael C. Wholley,

Chairman

Bennie O. Pearce

Vernon Hutton III

Joe R. Campa Jr.

Edward R. Cochrane Jr.

Kenneth R. Burns

Jerry W. Turner

Joan C. Cox

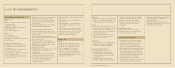

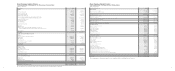

2006 Loan Approvals

# Approved % Change $ Approved

Dollars in millions % Change

Consumer 511,738 15.9% $6,384.2 18.9%

Mortgage 49,436 21.7% $11,636.2 32.4%

Equity 58,474 8.3% $3,809.1 15.0%

Credit Cards 214,603 18.0% $745.1 18.3%