Navy Federal Credit Union 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

8

Members’ Accounts

Members’ accounts are classified as equity to denote the

ownership interest of the members in Navy Federal. e

American Institute of Certified Public Accountants opined

that credit union savings accounts should be classified as

liabilities consistent with the prevailing practice in mutually

owned savings and loan associations and banks. Navy

Federal does not agree with this opinion and believes

that the AICPA did not consider that credit unions are

fundamentally dissimilar to such institutions, which (for

example) accept deposits from the general public and are

not democratically controlled by their “owners.”

Pension Accounting and Retirement Benefit Plans

Navy Federal has defined benefit pension plans, 401(k)

and 457(b) savings plans and a non-qualified supplemental

retirement plan. Navy Federal also provides a contributory

group medical plan for retired employees. Navy Federal

accounts for its defined benefit pension plans in accordance

with SFAS No. 87, Employers’ Accounting for Pensions.

Non-pension postretirement benefits are accounted for in

accordance with SFAS No. 106, Employers’ Accounting for

Postretirement Benefits Other an Pensions. In 2004, Navy

Federal adopted SFAS 132, Employers’ Disclosures about

Pensions and Other Postretirement Benefits. See Note 12

for details.

Income Taxes

Pursuant to the Federal Credit Union Act, Navy Federal

is exempt from the payment of Federal and state income

taxes. NFFG is a limited liability corporation and did

not incur Federal or state income tax liability.

Dividends

Dividend rates on members’ accounts are set by the Board

of Directors and dividends are charged to operations.

Dividends on all share products are paid monthly.

Reclassifications

Certain amounts in the prior year have been reclassified to

conform to current year presentation.

N : R C

Navy Federal is required to maintain balances with

corporate credit unions that are classified as membership

shares that are uninsured and require a three-year notice

before withdrawal. e required balance for Navy Federal

at December 31, 2006 and 2005 was $22.7 million and

$18.8 million, respectively.

e Board of Governors of the Federal Reserve System

(FRB) requires Navy Federal to maintain a cash reserve

balance to cover transactions processed by the FRB for

Navy Federal. At December 31, 2006 and 2005, Navy

Federal’s clearing balance requirement was $50 million

and $60 million, respectively.

In February 2004, Navy Federal Financial Group set aside

$1 million as non-current restricted cash as part of the

agreement it entered into with Charlie Mac, LLC. NFFG

continued to set $1 million aside as non-current restricted

cash in 2006 and 2005.

N : I

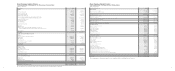

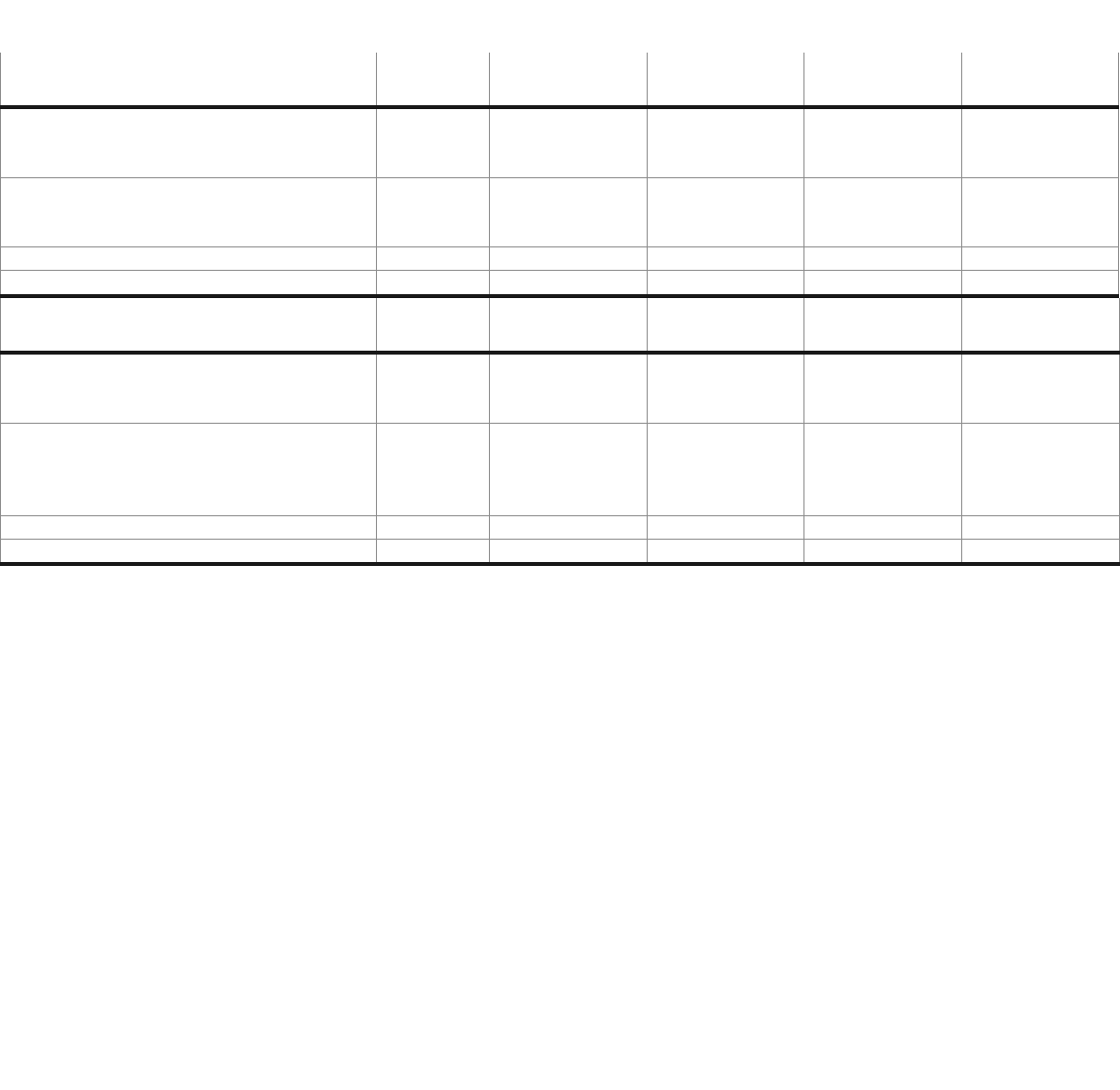

A summary of held-to-maturity and available-for-sale securities is as follows (dollars in thousands):

At December 31, 2006 and 2005, respectively, Navy Federal’s securities, excluding $269 million and $327 million in mortgage-backed securities

and $305 million and $88 million in other securities, were predominantly short-term in nature; $3.49 billion and $3.96 billion maturing within

one year, and $735 million and $1.93 billion maturing from one through three years.

Navy Federal held $76.1 million and $26.5 million of Federal Home Loan Bank of Atlanta (FHLBA) stock as of December 31, 2006 and 2005. FHLBA

stock is a restricted investment and is carried at cost, which is par value. As a member of the FHLBA, Navy Federal has access to a $2.9 billion line of

credit facility. e FHLBA stock paid a 5.90% and 4.60% dividend in the 4th quarter of 2006 and 2005, respectively.

All debt securities were reviewed individually to determine whether the unrealized losses associated with them were caused by a decline other-than-

temporary in the value of such investments. At December 31, 2006 and 2005, there was no decline considered "other-than-temporary" in the value

of U.S. Government and federal agency securities owned by Navy Federal.

Other investments represent capital required to maintain partnerships with credit union organizations.

Investments pledged as collateral for borrowed funds were $1.85 billion and $2.69 billion at December 31, 2006 and 2005, respectively.

December 31, 2005

Weighted

Average

Yield Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

(Losses) Estimated

Fair Value

Held-to-maturity

U.S. Government and federal agency securities 3.17% $ 2,548,583 $–$ (42,250) $ 2,506,333

Mortgage-backed securities 4.75% 326,845 960 (657) 327,148

Total held-to-maturity 2,875,428 960 (42,907) 2,833,481

Available-for-sale

Auction Rate Securities 4.36% 5,000 – – 5,000

Mutual Funds 3.62% 3,000 –(109) 2,891

Total available-for-sale 8,000 – (109) 7,891

Total securities $ 2,883,428 $ 960 $ (43,016) $ 2,841,372

December 31, 2006

Weighted

Average

Yield Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

(Losses) Estimated

Fair Value

Held-to-maturity

U.S. Government and federal agency securities 3.43% $ 1,648,340 $ 13 $ (18,915) $ 1,629,438

Mortgage-backed securities 5.80% 268,560 960 (783) 268,737

Total held-to-maturity 1,916,900 973 (19,698) 1,898,175

Available-for-sale

Mutual funds 4.78% 3,000 –(103) 2,897

Total available-for-sale 3,000 – (103) 2,897

Total securities $ 1,919,900 $ 973 $ (19,801) $ 1,901,072