Navy Federal Credit Union 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

12

N : M’ A

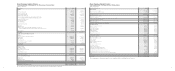

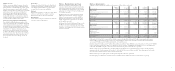

Member deposit accounts as of December 31, 2006 and 2005 were summarized as follows (dollars in thousands):

e total uninsured amount of members’ accounts was $2.86 billion and $2.53 billion at December 31, 2006 and 2005, respectively.

At December 31, 2006, scheduled maturities of share certificates and IRA certificates were as follows (dollars in thousands):

Total dividends on members’ deposit accounts were as follows (dollars in thousands):

N : R B P

Navy Federal Credit Union Employees’ Retirement Plan

is is a defined benefit retirement plan which means that

benefits are based on a set formula. Navy Federal’s plan

converted to a Cash Balance Plan design as of 1 January

2001, but still retains the Traditional Plan design for those

employees who opted to remain in the Traditional Plan.

e following describes how the benefits are calculated:

• Cash Balance Plan–is plan provides either a single

sum payment upon retirement or a monthly annuity

option depending on the amount of the accrued benefit.

• Traditional Plan–is plan is designed to provide a

lifetime of monthly retirement benefits, determined

by a set formula, to vested employees. e formula is

based on the final average earnings (average from the

three highest consecutive years of income) multiplied by

2% multiplied by the length of service.

Retiree Medical Plan

Navy Federal provides postretirement benefits to retired

employees in the form of a contributory group medical plan

and supplemental retirement income to offset the cost of med-

ical insurance premiums or out-of-pocket medical expenses

(Medical Plan). Under the provisions of the Medical Plan, the

retirees are responsible for the full payment of the medical

insurance premiums. e supplemental retirement income

benefit is an annual benefit of $75 multiplied by the number of

years of continuous service the retiree had with Navy Federal.

ere are no assets set aside to pre-fund the liability associated

with the Medical Plan.

Weighted

Average Rate

for 2006

Amount at

December 31, 2006

Weighted

Average Rate

for 2005 Amount at

December 31, 2005

Money market 4.29% $ 3,061,374 2.48% $ 2,142,609

Share savings 1.26% 5,186,140 1.26% 6,070,407

Member escrow 0.48% 82,497 0.48% 79,853

Checking 0.50% 3,248,313 0.50% 3,173,550

Share and IRA certificates 4.57% 8,629,856 4.06% 6,894,307

IRA shares 1.63% 412,701 1.48% 474,127

Investor custodial accounts 0.00% 85,207 0.00% 105,422

Total deposits $ 20,706,088 $ 18,940,275

Years Ending December 31

2007 2008 2009 2010 2011 ereafter

0–2.00% $ 5,496 $ 620 $ 355 $ 209 $ 101 $–

2.01 – 3.00 3,757 – – – – –

3.01 – 4.00 544,923 175,731 11 – – –

4.01 – 5.00 1,377,686 835,349 1,442,365 701,586 – –

5.01 – 6.00 843,392 188,521 296,635 28,110 338,294 231,155

6.01 – 7.00 33 1,615,409 – 95 – 7

7.01 – 8.00% 16 – – – – –

Total $ 2,775,303 $ 2,815,630 $ 1,739,366 $ 730,000 $ 338,395 $ 231,162

2006 2005

Money market $ 112,267 $ 45,222

Share savings 78,671 76,409

Checking 13,784 12,998

Share and IRA certificates 340,377 270,519

IRA shares 7,129 7,120

Total dividends $ 552,228 $ 412,268

Medical cost trends do not impact the determination of the postretirement benefit, as the

benefit amount is a fixed monthly amount based on the number of years of continuous service.

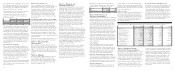

e following table sets forth the funded status of the pension and other

postretirement plans (dollars in thousands):

e weighted-average assumptions used to determine the projected benefit obligation for

the pension and other postretirement benefits were:

e following table sets forth the net benefit cost, contributions received and benefits paid

for the benefit plans (dollars in thousands):

e weighted-average assumptions used to determine the net periodic benefit cost for the

pension and other postretirement benefits were:

e following table discloses the benefits expected to be paid in the next ten years

(dollars in thousands):

Pension Benefits Retiree Medical

2006 2005 2006 2005

Benefit obligation $ 424,799 $ 388,720 $ 20,424 $ 18,923

Fair value of plan assets 472,488 360,679 ––

Funded status 47,689 (28,041) (20,424) (18,923)

Pension Benefits Retiree Medical

2006 2005 2006 2005

Discount rate 5.95% 5.50% 5.95% 5.50%

Rate of compensation increase 5.00% 4.50% ––

Pension Benefits Retiree Medical

2006 2005 2006 2005

Benefit cost $ 19,765 $ 14,809 $ 2,888 $ 2,499

Employer contribution 69,795 34,671 1,155 203

Plan participants’ contributions ––––

Benefits paid 10,530 8,648 1,155 203

Pension Benefits Retiree Medical

2006 2005 2006 2005

Discount rate 5.50% 5.75% 5.50% 5.75%

Expected return on plan assets 8.75% 8.75% ––

Rate of compensation increase 4.50% 4.50% ––

Pension Retiree Medical

2007 $ 13,555 $ 643

2008 15,059 721

2009 16,534 809

2010 18,233 907

2011 19,825 1,011

2012–2016 137,090 6,904

Total benefits expected, next ten years $ 220,296 $ 10,995