Navy Federal Credit Union 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

2

N F C U

C S O

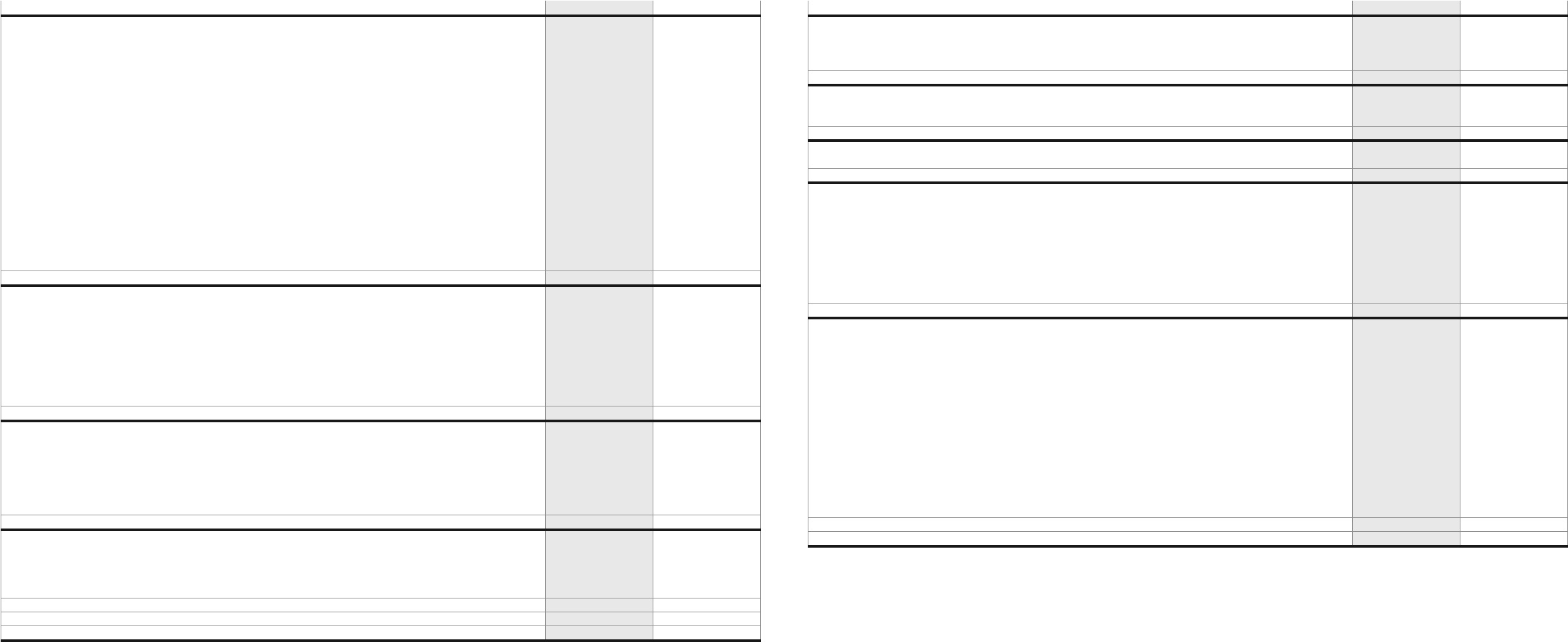

(dollars in thousands)

e accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

N F C U

C S F C

(dollars in thousands)

e accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

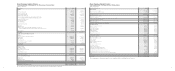

Years Ended December 31 2006 2005

Interest income

Interest on loans to members $ 1,290,002 $ 1,032,533

Interest on securities available-for-sale 169 181

Interest on securities held-to-maturity 219,822 218,255

Total interest income 1,509,993 1,250,969

Dividend and interest expense

Dividends to members 552,228 412,268

Interest on securities sold under repurchase agreements and notes payable 131,095 92,772

Total dividend and interest expense 683,323 505,040

Net interest income 826,670 745,929

Provision for loan losses (120,567) (244,370)

Net interest income after provision for loan losses 706,103 501,559

Non-interest income

Gain on mortgage loan sales, net 12,992 11,677

Mortgage servicing 50,292 43,155

Credit card interchange 82,323 70,891

Check card interchange 98,695 84,139

ATM interchange 17,522 24,922

Overdrawn check fee 87,758 79,026

Mortgage loan origination 7,312 2,997

Other 54,603 44,514

Total non-interest income 411,497 361,321

Non-interest expense

Salaries and employee benefits 337,220 276,725

Office operating 118,417 94,838

Loan servicing 120,213 91,467

Professional and outside services 34,832 33,448

Office occupancy 36,572 30,763

Loan protection life insurance 3,741 5,884

Life savings insurance 1,465 1,677

Education and marketing 11,639 8,939

Impairment of mortgage servicing assets –4,973

Amortization of mortgage servicing assets –20,672

Fair value adjustment of mortgage servicing assets 21,147 –

Unrealized (gain)/loss on mortgage loans awaiting sale (891) 914

Unrealized (gain)/loss from derivative and economic hedging activities (2,537) 2,744

Other 34,194 23,499

Total non-interest expense 716,012 596,543

Net income $ 401,588 $ 266,337

December 31 2006 2005

ASSETS

Cash $ 356,657 $ 349,216

Short term investments 2,195,036 2,816,010

Securities available-for-sale 2,897 7,891

Securities held-to-maturity 1,916,900 2,875,428

Mortgage loans awaiting sale 90,597 241,209

Loans to members, net of allowance for loan losses of $176,326

at December 31, 2006 and $201,102 at December 31, 2005 20,403,815 16,502,095

Investment in FHLB-Atlanta 76,107 26,458

Interest-bearing deposits 606,367 579,594

Other investments 3,209 2,221

Accounts receivable 461,057 455,096

Accrued interest receivable 102,111 90,769

Fixed assets 339,160 257,871

NCUSIF deposit 173,057 164,484

Mortgage servicing assets, at fair value at December 31, 2006 and

net of accumulated amortization and impairment at December 31, 2005 198,707 131,667

Prepaid expenses 167,428 121,929

Other assets 28,787 22,419

Total assets $ 27,121,892 $ 24,644,357

LIABILITIES AND MEMBERS’ EQUITY

Liabilities

Securities sold under repurchase agreements $ 1,824,147 $ 2,690,873

Notes payable 1,135,700 32,400

Drafts payable 169,777 168,421

Dividends payable –106

Accrued expenses and accounts payable 138,199 111,852

Accrued interest payable 12,076 5,898

Other liabilities 693 2,102

Total liabilities 3,280,592 3,011,652

Members’ Equity

Members’ accounts

Share savings accounts 5,353,844 6,255,682

Money market savings accounts 3,061,374 2,142,609

Checking accounts 3,248,313 3,173,550

Share certificate accounts 6,567,735 5,153,089

Individual retirement accounts 2,474,822 2,215,345

Total members’ accounts 20,706,088 18,940,275

Reserves and undivided earnings

Regular reserve 349,808 349,406

Capital reserve 2,735,507 2,323,133

Undivided earnings 50,000 20,000

Accumulated other comprehensive income (103) (109)

Total reserves and undivided earnings 3,135,212 2,692,430

Total members’ equity 23,841,300 21,632,705

Total liabilities and members’ equity $ 27,121,892 $ 24,644,357