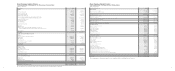

Navy Federal Credit Union 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

6

N : S S

A P

Navy Federal Credit Union is a member-owned, not-for-

profit financial institution formed to provide a variety of

savings and lending programs to those individuals in its

field of membership which includes military and civilian

personnel who are or were employed by the Department of

the Navy and their families.

Navy Federal Financial Group (NFFG), a wholly-owned credit

union service organization, provides investment, insurance,

mortgage settlement and other financial services to members

of Navy Federal Credit Union. NFRES and Navy Federal

Brokerage Services are wholly-owned subsidiaries of NFFG.

In this Annual Report, Navy Federal Credit Union and

NFFG (consolidated) are called Navy Federal.

e significant accounting policies are:

Basis of Accounting

Navy Federal maintains its accounting records on the accrual

basis, which is in accordance with accounting principles

generally accepted in the United States of America (GAAP).

Consolidation

e consolidated financial statements include the accounts of

Navy Federal and NFFG. Significant intercompany accounts

and transactions were eliminated in consolidation.

Change in Accounting Principle

In March 2006, the Financial Accounting Standards Board

(FASB) released Statement of Financial Accounting Standards

(SFAS) No. 156, Accounting for Servicing of Financial Assets.

is statement requires all separately recognized servicing rights

to be initially measured at fair value and allows an entity an

election to subsequently measure servicing rights at fair value,

with the changes in fair value recorded in current earnings.

Navy Federal early-adopted SFAS No. 156 as of January 1,

2006, and elected to use the fair value method for subsequent

measurement for its mortgage servicing rights. As far as the

fair value election under SFAS No. 156 is concerned, Navy

Federal determined that all mortgage servicing rights belong

to one class. See Note 5 for details.

Use of Estimates

e preparation of consolidated financial statements in

conformity with GAAP requires management to make esti-

mates and assumptions that affect the reported amounts of

assets, liabilities, revenues and expenses and the disclosure of

contingent assets and liabilities in the consolidated financial

statements and accompanying notes. Actual results could dif-

fer from those estimates.

Cash

For purposes of the consolidated financial statements,

cash includes cash and balances due from banks and other

credit unions.

Short Term Investments

For purposes of the consolidated financial statements, short

term investments include federal funds sold and securities

purchased under agreements to resell, all of which have

original maturities of 90 days or less. As of December 31,

2006 and 2005, all short term investments were recorded

at cost which approximated market value.

Securities

Investment securities are classified as held-to-maturity or

available-for-sale in compliance with SFAS No. 115,

Accounting for Certain Investments in Debt and Equity

Securities. Investments classified as held-to-maturity are

carried at cost, adjusted for the amortization of premiums

and accretion of discounts. Management has the ability

and intent to hold these securities to maturity.

Securities classified as available-for-sale are carried at fair

value, with any unrealized gains and losses recorded as a

separate component of members’ equity (see Note 16).

Gains and losses on dispositions are computed using the

specific identification method. Resale and repurchase agree-

ments are treated as financing transactions and are carried at

the amounts at which the securities were initially acquired

or sold. Navy Federal takes title to securities purchased

under resale agreements, monitors the fair value of the

underlying securities, which are primarily U.S. Government

and federal agency securities, and requests additional collateral

when appropriate.

Declines in the fair value of held-to-maturity and available-

for-sale securities below their cost that are deemed to be

other than temporary are reflected in earnings as realized

losses. In estimating other-than-temporary impairment

losses, management considers (1) the length of time and

the extent to which the fair value has been less than cost,

(2) the financial condition and near-term prospects of the

issuer, (3) the intent and ability to retain the investment

for a period of time that is sufficient to allow for any

anticipated recovery in fair value, and (4) materiality.

Mortgages Held for Sale

Mortgage loans held for sale are carried at the lower of orig-

inal cost or market value in compliance with SFAS No. 65,

Accounting for Certain Mortgage Banking Activities. Market

value is determined on a loan-by-loan basis. Net unrealized

losses are recognized through a valuation allowance by

charges to income. All sales are made without recourse.

Mortgage loans held for sale are sold with the mortgage

servicing rights retained by Navy Federal.

Credit Enhanced Mortgage Loans

In February 2004, Navy Federal entered into an agreement

with Charlie Mac, LLC, an investor subsidiary of U.S.

Central Credit Union, and NFFG in which Charlie Mac

purchases up to $200 million of credit enhanced mortgage

loans from Navy Federal while Navy Federal retains the

mortgage servicing rights. Should a credit enhanced loan

default, Charlie Mac will recover the loan amount from

NFFG. e maximum total credit enhancement liability

allowed in this agreement is $8.5 million. Of that total, $1

million is set aside by NFFG as non-current restricted cash

with a designated financial institution. For the remaining

amount of $7.5 million, Navy Federal issued an irrevocable

transferable standby letter of credit to Charlie Mac as part

of the agreement. In 2004, the aggregate amount of credit

enhanced mortgage loans purchased by Charlie Mac had

reached the $200 million limit. All loans purchased pursuant

to the agreement had, at the time of origination, FICO

credit score, loan-to-value ratio and debt-to-income ratio

greater than those required by the agreement. During 2006

and 2005, no new loans were sold to Charlie Mac under

this agreement. e total principal balance of these loans as

of December 31, 2006 and 2005 was $149 million and

$162 million, respectively. To date, no loans under this

agreement have defaulted. Navy Federal has not accrued an

estimated loss regarding the credit enhanced mortgage loans

for it is less than probable that a liability had been incurred

at the date of the financial statements. Any liability reason-

ably expected to result from this agreement is not expected

to be material to Navy Federal.

Loans and Leases

Loans, except for mortgages held for sale, are stated at the

amount of unpaid principal less an allowance for loan losses.

Interest on loans is recognized on an accrual basis except

for credit card interest which is recognized on the member’s

statement date. Interest on loans is calculated using the sim-

ple-interest method on the principal amount outstanding

except for credit cards. Interest on credit cards is calculated

by applying the periodic rate to the average daily balance

outstanding. Accrual of interest on all loans is discontinued

where management believes collectibility is uncertain or

payments of principal or interest are past due by more than

90 days. All interest accrued but not collected on loans that

are placed in non-accrual status is reversed against interest

income. e interest on these loans is accounted for on the

cash-basis until the loans return to accrual status. Loans are

returned to accrual status when all the principal and interest

amounts contractually due are brought current and future

payments are reasonably assured. Funding fees for certain

mortgage loan products are deferred and amortized over

the term of the loans under SFAS No. 91, Accounting for

Nonrefundable Fees and Costs Associated With Originating

or Acquiring Loans and Initial Direct Costs of Leases. All

other origination fees and associated expenses are recognized

immediately in current earnings.

Navy Federal currently uses the direct financing method to

account for all leases. Under this method, lease contracts

receivables are the total minimum lease payments plus

residual value of the leased automobiles, net of unearned

interest revenue and deferred origination fees. Interest

revenue is recognized monthly on receipt of rental payment

and origination fees deferred are amortized to revenue over

the contractual life of the leased automobile.

Allowance for Loan Losses

Navy Federal accrues estimated losses in accordance with

SFAS No. 5, Accounting for Contingencies. e allowance for

loan losses is established through a provision for loan losses

charged to expense. Loan principal is charged against the

allowance for loan losses when management believes that

the collectibility of the amount is unlikely; subsequent

recoveries are credited to the allowance for loan losses. Navy

Federal’s loan portfolio consists mainly of large groups of

smaller balance homogeneous loans that are collectively

evaluated for impairment. e allowance for loan losses is

maintained at a level that, in management’s judgment, is

sufficient to absorb losses inherent in the portfolio, based

on evaluations of the collectibility of loans and prior loan

loss experience. e evaluations take into consideration such

factors as changes in the value of loans outstanding, prior

history of charge-offs and recoveries, overall delinquency

and delinquencies by loan product, and current economic

conditions and trends that may affect the borrowers’ ability

to pay. e allowance for loan and lease losses is reviewed

on a monthly basis and the provision that is charged to

expense is adjusted accordingly.

Fixed Assets

Land is carried at cost. Building, leasehold improvements,

furniture, fixtures, and equipment are carried at cost, less

accumulated depreciation and amortization. Buildings,

furniture, fixtures and equipment are depreciated using

the straight-line method over their estimated useful lives.

e cost of leasehold improvements is amortized over

the lease term or the useful life of the improvement,

whichever is shorter.

Useful Life

Buildings........................24to40years

Furniture and equipment . . . . . . . . . . . . .5 to 7 years

Computer equipment . . . . . . . . . . . . . . . .2 to 5 years

Computer software . . . . . . . . . . . . . . . . . . . . . .5 years

NCUSIF Deposit

e deposit in the National Credit Union Share Insurance

Fund (NCUSIF) is in accordance with the Federal Credit

Union Act and the National Credit Union Administration

(NCUA) regulations, which require the maintenance of a

deposit by each insured credit union in an amount equal to

one percent of its insured shares. e deposit would be

refunded to Navy Federal if its insurance coverage is termi-

nated, it converts to insurance coverage from another

source, or the operations of the fund are transferred from

the NCUA Board.

Goodwill

Goodwill represents the excess of purchase price over the

fair value of net assets acquired in business combinations.

SFAS No. 142, Goodwill and Other Intangible Assets,

provides that intangible assets with finite useful lives be

amortized and that goodwill and intangible assets with

indefinite lives not be amortized, but rather be tested at

least annually for impairment. Navy Federal tests goodwill

for impairment quarterly in compliance with SFAS No.

142. Impairment exists when the carrying amount of the

goodwill exceeds its implied fair value.

Derivative Financial Instruments

In compliance with SFAS No. 133, Accounting for

Derivative Instruments and Hedging Activities, all derivative

financial instruments are recognized on the balance sheet at

fair value. Changes in the fair value of derivative financial

instruments are recorded in current earnings. Navy Federal

owned the following derivative financial instruments at

December 31, 2006 and 2005: mortgage loan commit-

ments to members at specified interest rates and forward

sales contracts to offset the risk of making the mortgage

loan commitments at specified interest rates. See Note 6

for details.