Navy Federal Credit Union 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal’s investments in corporate credit unions at

December 31, 2006 and 2005, respectively, exceeded the

federally insured amount. Navy Federal requires these

institutions to maintain their credit ratings above a certain

level and believes that its investments in the corporate

credit unions are sound.

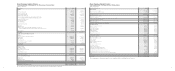

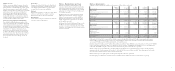

(dollars in thousands):

N : L M

A L L

e composition of loans to members is as follows

(dollars in thousands):

Navy Federal originates mortgage loans both for sale and

for its own portfolio. Navy Federal originated, both for sale

and for its own portfolio, $4.81 billion and $5.58 billion

of first mortgage loans for its members in 2006 and 2005,

respectively. Navy Federal sold $3.34 billion and $4.44

billion of mortgage loans in 2006 and 2005, respectively. At

December 31, $20.4 billion and $17.9 billion of originated

mortgages were being serviced by Navy Federal in 2006 and

2005, respectively.

A summary of the changes in the allowance for loan losses is

as follows (dollars in thousands):

Loans on which the accrual of interest has been discontin-

ued totaled $59.9 million and $73.0 million at December

31, 2006 and 2005, respectively. If interest on those loans

had been accrued at original contracted rates, interest

income would have been approximately $2.04 million and

$2.05 million higher for 2006 and 2005, respectively.

11

10

N : D I

E H A

Navy Federal is an active participant in the production of

mortgage loans which are sold to investors in the secondary

market. is mortgage banking activity involves making

mortgage loan commitments to members at specified interest

rates. Navy Federal is exposed to changes in the value of its

mortgage loan commitments as interest rates may change

between the time that it enters into a mortgage loan commit-

ment and the time that it ultimately delivers mortgage loans

to investors. To protect against this interest rate risk, Navy

Federal enters into forward sales contracts at specified prices

to deliver mortgage loans to investors. ese forward sales

commitments act as an economic hedge against the risk of

changes in the value of both the mortgage loan commitments

and mortgage loans held for sale. As required by SFAS No.

133, Accounting for Derivative Instruments and Hedging

Activities, Navy Federal accounts for both the mortgage loan

commitments and the forward sales contracts as derivative

instruments on its Consolidated Statements of Financial

Condition at fair value with changes in fair value included

in current earnings. ese derivative instruments are eco-

nomic hedges to which Navy Federal does not receive hedge

accounting treatment.

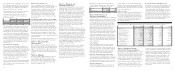

e notional value of the mortgage loan commitments

totaled $104 million and $206 million, respectively, as of

December 31, 2006 and 2005. A gross gain and gross loss

on this derivative at December 31, 2006 and 2005 were

reported as follows (dollars in thousands at year end):

e notional value of the forward sales contracts was

$143 million and $370 million, respectively, as of

December 31, 2006 and 2005. A gross gain and gross

loss on this derivative at December 31, 2006 and 2005 were

reported as follows (dollars in thousands at year end):

Navy Federal recognized the net gain of $2.54 million

and the net loss of $2.74 million in the fair value of

these derivative instruments during 2006 and 2005, respec-

tively, and included it in earnings as “Unrealized loss from

derivative and economic hedging activities” in the

Consolidated Statements of Operations.

N : L C

Navy Federal is a party to various legal actions normally

associated with financial institutions, the aggregate effect of

which, in management’s and legal counsel’s opinion, would

not be material to the financial condition or results of oper-

ations of Navy Federal.

N : C

Navy Federal is a party to conditional commitments to lend

funds in the normal course of business to meet the financing

needs of its members. Unused commitments for loans to

members are amounts which Navy Federal has agreed to

lend a member as long as the member does not default on

existing loans or violate any condition of the loan agreement.

Commitments generally have fixed expiration dates or other

termination clauses. Since many of the commitments are

expected to expire without being drawn upon, the total

commitment amounts do not necessarily represent future

cash requirements. Navy Federal uses the same credit policies

in making commitments as it does for all loans to members

and, accordingly, at December 31, 2006, the credit risk

related to these commitments was similar to that on its

existing loans.

Unused commitment balances as of December 31, 2006

and 2005 were as follows (dollars in thousands at year end):

N : F A

e following is a summary of property and equipment

Navy Federal owned at December 31, 2006 and 2005

(dollars in thousands at year end):

Navy Federal has obligations under a number of non-

cancelable operating leases for premises. e future

minimum payments under the terms of leases as of

December 31, 2006 were (dollars in thousands):

Rent expense was $8.68 million and $6.86 million in 2006

and 2005, respectively. Income from sublease contracts was

$69,000 and $94,000 in 2006 and 2005, respectively.

N : G

e changes in the carrying amount of goodwill were as fol-

lows (dollars in thousands):

Goodwill acquired in business combinations is tested for

impairment quarterly in accordance with SFAS No. 142,

Goodwill and Other Intangible Assets. Navy Federal uses the

number of new accounts opened at acquired office locations and

net income per member to estimate the fair value of the good-

will. e carrying value of the goodwill is included in “Other

assets” in the Consolidated Statements of Financial Condition.

December 31 2006 2005

Consumer loans

Auto $ 5,179,778 $ 4,364,580

Other 1,744,896 1,604,296

NAVchek® lines of credit 229,144 215,717

Federal education loans 289,719 282,565

Vehicle leases 117,329 133,174

Credit card loans 2,651,948 2,110,143

Mortgage loans

Mortgage Loan Investments

Fixed rate 5,350,993 4,525,314

Variable rate 230,601 176,921

Mortgage Loans Awaiting Sale

Fixed rate 79,873 206,516

Variable rate 886 12,474

Mortgage Loans in Process

Mortgage Loan

Investments 12,928 4,992

Mortgage Loans

Awaiting Sale 9,838 22,219

Unamortized Discount Points

(12,757) (12,338)

Equity loans

Fixed equity 3,784,753 2,258,102

Home equity lines of credit

1,000,809 1,039,732

20,670,738 16,944,407

Less: Allowance for loan losses (176,326) (201,102)

Total loans to members $ 20,494,412 $ 16,743,305

2006 2005

Balance, beginning of year $ 201,102 $ 161,889

Provision charged to operations 120,567 244,370

Loans charged off (169,604) (219,259)

Recoveries 24,261 14,102

Balance, end of year $ 176,326 $ 201,102

December 31 2006 2005

Certificates of deposit $ 582,177 $ 605,632

Overnight investments 210,000 200,000

Membership, capital shares 22,689 18,761

Share deposits 11

Total $ 814,867 $ 824,394

Mortgage loan commitments 2006 2005

Gain $ 125 $ 312

Loss (1,018) (1,828)

Net $ (893) $ (1,516)

Forward Sales Contracts 2006 2005

Gain $ 633 $ 107

Loss (34) (1,422)

Net $ 599 $ (1,315)

Unused Commitments: 2006 2005

Credit cards $ 4,397,857 $ 3,958,828

NAVchek® lines of credit 537,943 527,916

Home equity lines of credit 1,234,649 1,101,992

Preapproved auto loans 196,936 160,638

Utility deposit guarantee

programs 3,003 2,855

Letter of credit 7,500 7,500

Total $ 6,377,888 $ 5,759,729

Property and Equipment: 2006 2005

Land and buildings $ 267,064 $ 209,408

Equipment, furniture

and fixtures 379,974 322,566

Leasehold improvements 59,404 47,229

Subtotal 706,442 579,203

Less: Accumulated depreciation (367,282) (321,332)

Total $ 339,160 $257,871

Future Minimum Payments

2007 $ 9,397

2008 9,679

2009 9,970

2010 10,269

2011 10,577

ereafter 11,894

Total $ 60,786

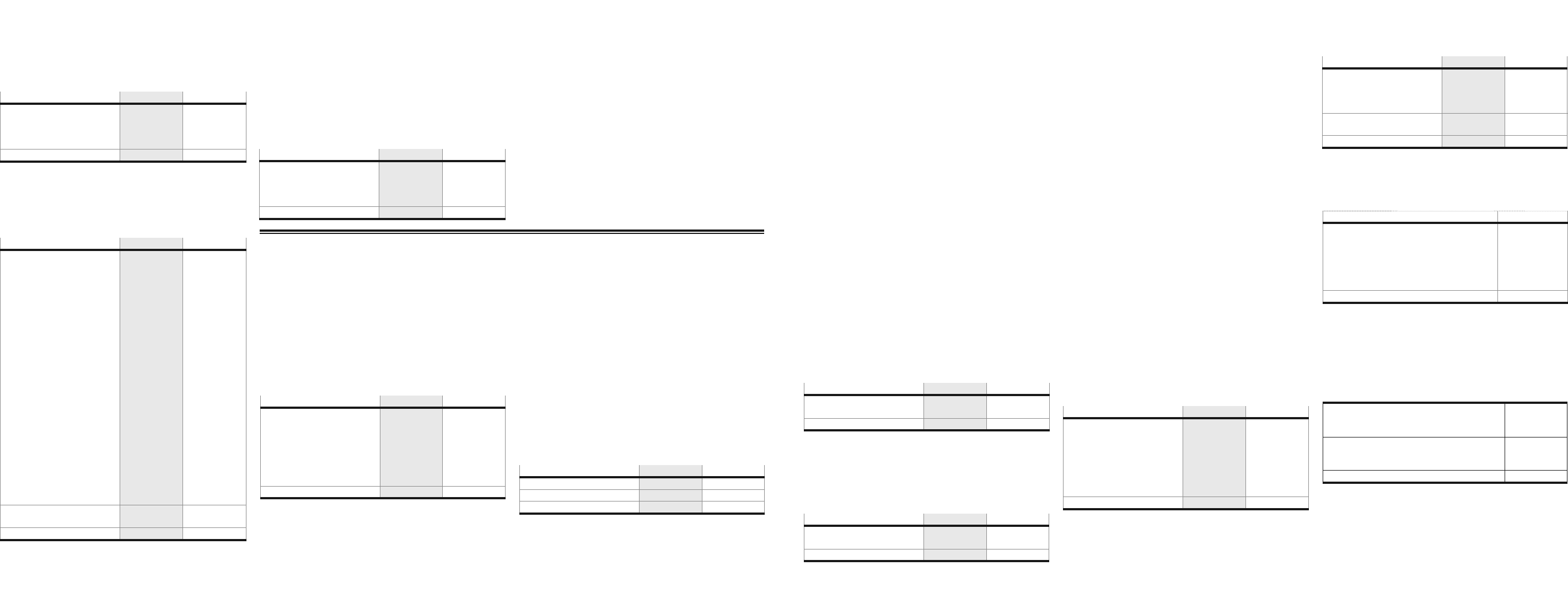

N : M S A

Effective January 1, 2006, upon adoption of SFAS No. 156,

Navy Federal remeasured all of its mortgage servicing rights

(MSRs) at fair value and recognized an adjustment of $39.7

million in its Consolidated Statements of Financial Condition

and also recognized a cumulative effect adjustment of $39.7

million to the beginning balance of undivided earnings in

its Consolidated Statements of Changes in Reserves and

Undivided Earnings.

e changes in MSRs during 2006 and 2005 were as

follows (dollars in thousands):

(1) As of December 31, 2005, the carrying value of MSRs under SFAS No. 140

was $39.7 million less than the fair value. Effective January 1, 2006, with adoption

of SFAS No. 156, Navy Federal increased the carrying value of MSRs by $39.7

million to record its MSRs at the fair value.

(2) Upon adoption of SFAS No. 156, Navy Federal discontinued amortizing

MSRs over the period of estimated net serving income and also ended measuring

impairment to account for MSRs at the lower-of-cost-or-market value.

Navy Federal obtains the fair value of its MSRs from a

third-party service organization. e service organization

determines the fair value by discounting projected net serv-

icing cash flows of the remaining servicing portfolio. e

valuation model used by the service organization considers

market loan prepayment predictions and other economic

factors. e fair value of MSRs is mostly affected by changes

in mortgage interest rates since rate changes cause the loan

prepayment acceleration factors to increase or decrease.

Navy Federal received mortgage loan servicing fees of $50.3

million and $43.1 million in 2006 and 2005, respectively.

Related late charges and miscellaneous fees totaled $6.78

million and $5.49 million in 2006 and 2005, respectively.

e key economic assumptions used in determining the

fair value of MSRs at December 31, 2006 and 2005 were

as follows:

(1) Prepayment speed is the constant prepayment rate that results in the weighted

average life.

2006 2005

Balance, beginning of period $ 131,667 $ 102,384

Fair falue adjustment⁽¹⁾ 39,668 –

Originations 48,519 54,928

Gain (loss) on charges in

value of MSRs (21,147) –

Amortization⁽²⁾ –(20,672)

Allowance for impairment⁽²⁾ –(4,973)

Balance, end of period $ 198,707 $ 131,667

December 31 2006 2005

Weighted average life (years) 5.85 6.02

Prepayment speed⁽¹⁾ 13.91% 12.82%

Yield to maturity discount rate 9.45% 9.48%

December 31, 2004 $ 15,693

Reduction in goodwill related to decreased num-

ber of new accounts opened (254)

December 31, 2005 $ 15,439

Reduction in goodwill related to decreased num-

ber of new accounts opened (225)

December 31, 2006 $ 15,214