Navy Federal Credit Union 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

4

N F C U

C S C R U E

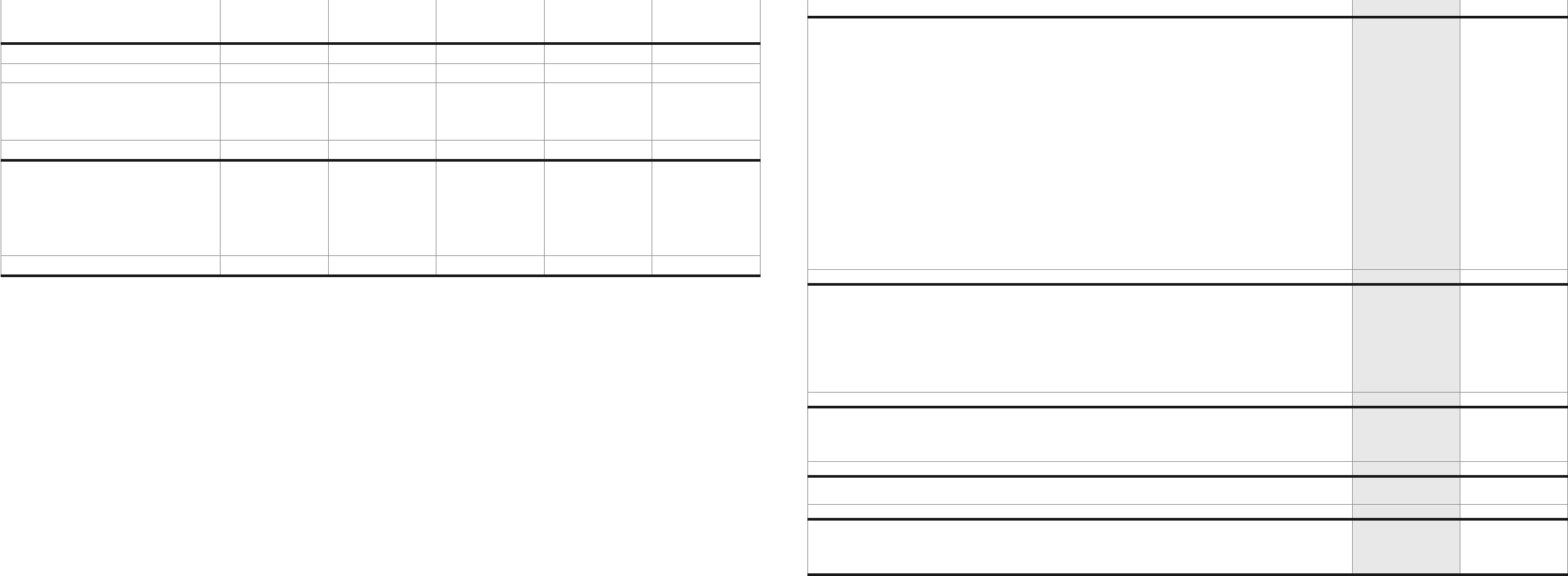

(dollars in thousands)

(1) See Note 5 for details.

(2) See Note 14 for details.

e accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

N F C U

C S C F

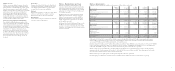

(dollars in thousands)

e accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

Years Ended December 31 2006 2005

Cash flows from operating activities

Net income $ 401,588 $ 266,337

Adjustments to reconcile net income to net cash provided by operating activities:

Provision for loan losses 120,567 244,369

Depreciation of fixed assets 49,518 42,395

Amortization of mortgage servicing rights –20,672

Loss/(gain) on disposal of fixed assets (85) 353

Mortgage loans originated for sale (3,189,856) (4,363,626)

Mortgage loan sales proceeds 3,341,361 4,442,771

(Increase) in mortgage servicing assets (27,372) (49,954)

(Increase) in accrued interest receivable (11,342) (8,207)

(Increase) in prepaid expenses (45,499) (19,201)

(Increase) in accounts receivable (11,241) (50,099)

(Increase)/decrease in other assets (6,368) 2,270

Increase in dividends payable (106) (674)

Increase in drafts payable 1,356 29,442

Increase in accrued expenses and accounts payable 26,347 14,724

Increase in accrued interest payable 6,178 2,347

Increase/(decrease) in other liabilities (1,409) 1,573

Net cash provided by operating activities 653,637 575,492

Cash flows from investing activities

Net decrease in Federal funds and other short-term investments 575,339 856,164

Purchase of HTM investment securities (327,623) (1,388,549)

Proceeds from maturity of HTM investment securities 1,259,376 1,137,280

Net increase in loans to members (4,017,899) (2,444,345)

Purchase of fixed assets (172,935) (95,045)

Sale of fixed assets 42,213 32,136

Increase in deposit to NCUSIF (8,573) (13,504)

Net cash used in investing activities (2,650,102) (1,915,863)

Cash flows from financing activities

Net increase in members’ accounts 1,765,814 1,321,506

Increase in equity from merger with Gulfport CBC Credit Union 1,519 –

Net increase in securities sold under repurchase agreements 236,573 112,199

Net cash provided by financing activities 2,003,906 1,433,705

Net increase in cash 7,441 93,334

Cash at beginning of year 349,216 255,882

Cash at end of year $ 356,657 $ 349,216

Additional cash flow information:

Interest paid $ 683,323 $ 505,040

Transfers from loans to other real estate 10,610 2,977

Impact of adoption of SFAS No. 156 39,669 –

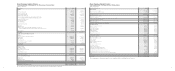

Regular

Reserve Capital

Reserve Undivided

Earnings

Accumulated

Other Comprehensive

Income Total Reserves and

Undivided Earnings

Balance at December 31, 2004 $ 349,406 $ 2,056,796 $ 20,000 $ (85) $ 2,426,117

Net income – – 266,337 – 266,337

Net unrealized loss on available-for-sale securities – – – (24) (24)

Discretionary – 266,337 (266,337) – –

Balance at December 31, 2005 $ 349,406 $ 2,323,133 $ 20,000 $ (109) $ 2,692,430

Net income – – 401,588 – 401,588

Cumulative-effect adjustment⁽¹⁾ – – 39,669 – 39,669

Net unrealized loss on available-for-sale securities – – – 66

Merger⁽²⁾ 402 1,117 – – 1,519

Discretionary – 411,257 (411,257) – –

Balance at December 31, 2006 $ 349,808 $ 2,735,507 $ 50,000 $ (103) $ 3,135,212