National Grid 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

Ribbon Commission (“BRC”) charged with advising it regarding alternatives to disposal at Yucca Mountain issued its

final report on January 26, 2012. In the report, the BRC recommended that priority be given to removal of spent fuel

from shutdown reactor sites. It is impossible to predict when the DOE will fulfill its obligation to take possession of the

Yankees’ spent fuel. The decommissioning costs that are actually incurred by the Yankees may exceed the estimated

amounts, perhaps substantially.

Nuclear Contingencies

As of March 31, 2012 and March 31, 2011, Niagara Mohawk had a liability of $168 million, in other deferred liabilities

for the disposal of nuclear fuel irradiated prior to 1983. The Nuclear Waste Policy Act of 1982 provides three payment

options for liquidating such liability and Niagara Mohawk has elected to delay payment, with interest, until the year in

which Constellation Energy Group Inc., which purchased Niagara Mohawk’ s nuclear assets, initially plans to ship

irradiated fuel to an approved DOE disposal facility.

In March 2010, the DOE filed a motion with the Nuclear Regulatory Commission to withdraw the license application for

a high-level nuclear waste repository at Yucca Mountain. The DOE's withdrawal motion has been challenged and is

being litigated before the NRC and the D.C. Circuit. In January 2010 the US government announced that it has

established a Blue Ribbon Commission (“BRC”) to perform a comprehensive review and provide recommendations

regarding the disposal of the nation’ s spent nuclear fuel and waste. In January 2012, the BRC issued its report and

recommendations which provides for numerous policy recommendations currently under review and consideration by

the US Secretary of Energy. Therefore, Niagara Mohawk cannot predict the impact that the recent actions of the DOE

and the US government will have on the ability to dispose of the spent nuclear fuel and waste.

Purchase Commitments

The Company’ s electric subsidiaries have several types of long-term contracts for the purchase of electric power.

Substantially all of these contracts require power to be delivered before the Company is obligated to make payment. The

Company’ s gas distribution subsidiaries have entered into various contracts for gas delivery, storage and supply services.

Certain of these contracts require payment of annual demand charges. The Company and its gas distribution subsidiaries

are liable for these payments regardless of the level of services required from third parties. Such charges are currently

recovered from utility customers as gas costs.

In addition, Company has various capital commitments related to the construction of property, plant, and equipment.

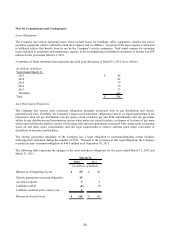

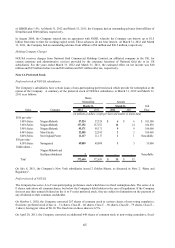

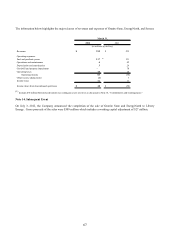

The Company’ s commitments under these long-term contracts for years subsequent to March 31, 2012 are summarized

in the table below:

(in millions of dollars)

Capital

Years Ended March 31,

Power

Expenditures

2013 1,859$ 312$

2014 890 118

2015 716 67

2016 628 41

2017 480 94

Thereafter 2,503 -

Total 7,076$ 632$

The Company’ s subsidiaries can purchase additional energy to meet load requirements from other independent power

producers (“IPPs”), other utilities, energy merchants or on the open market through the NYISO or the ISO-NE at market

prices.

Note 11. Related Party Transactions

In August 2009, the Company and KeySpan Corporation entered into an agreement with the Parent, whereby either party

can collectively borrow up to $3 billion from time to time for working capital needs. These advances bear interest rates