National Grid 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

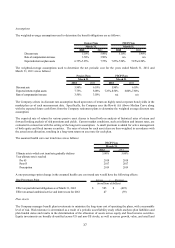

revenue per customer to target revenue per customer for the affected customer classes on an annual basis. The RDM is

designed to eliminate the disincentive for the Companies to implement energy efficiency programs by breaking the link

between sales and revenues. The Companies had combined deferred payable balances related to the RDM in the amount

of $5.0 million and $12.8 million at March 31, 2012 and March 31, 2011, respectively. These payable balances are fully

refundable to the affected customer class.

Boston Gas and Colonial Gas (the “Gas Companies”)

In April 2010, the Gas Companies filed an initial request with the DPU for a combined rate increase of $106 million,

which was revised to $104.1 million in September 2010. In November 2010, the DPU issued an order approving a

combined revenue increase of $58 million based upon a 9.75% rate of return on equity and a 50% equity ratio. In May

2011, the Gas Companies made their first filing with the DPU for recovery of capital costs related to infrastructure

replacement. The requested combined revenue requirement associated with these capital costs is approximately $10.4

million. Since this amount is below the ordered cap of 1% of the Gas Companies’ prior year total revenues, the entire

amount is eligible for recovery. In May 2012, the Company made its annual filing with the DPU for recovery of capital

costs related to infrastructure replacement. The requested revenue requirement associated with these capital costs is

$24.3 million. This request is pending before the DPU.

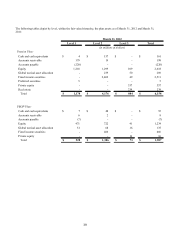

The DPU order also provided for a RDM to take effect as of November 1, 2010. The RDM applies to the Gas

Companies’ firm rate classes, excluding gas lamps and negotiated contracts and permits the Gas Companies to reconcile

actual revenue per customer to target revenue per customer for the affected customer classes on a seasonal basis. The

RDM is designed to eliminate the disincentive for the Gas Companies to continue to aggressively implement energy

efficiency programs. The Gas Companies had deferred receivable balances related to the RDM in the amount of $31.2

million at March 31, 2012 and deferred payable balances of $20.8 million at March 31, 2011. On August 1, 2011, the

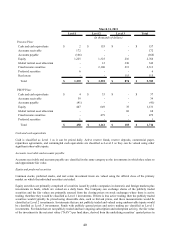

Gas Companies submitted their first RDM filing with the DPU proposing to refund a combined $17.1 million to its

customers. On October 21, 2011, the DPU approved the Gas Companies’ revenue decoupling adjustment factor effective

November 1, 2011 subject to further investigation. On February 1, 2012, the Gas Companies submitted their 2011 Off

Peak RDM filing with the DPU proposing to recover $1.55 million from its customers. On April 23, 2012, the DPU

approved the Gas Companies’ revenue decoupling adjustment factor effective May 1, 2012 subject to further

investigation.

In November 2010, the Gas Companies’ filed two motions in response to the DPU November 2010 rate case order (1) in

their motion for recalculation, the Gas Companies have requested that the DPU recalculate certain adjustments that they

made in determining the $58 million increases approved in its order, which would result in an additional $10.4 million to

a total of approximately $68.4 million (2) in their motion for reconsideration and clarification, the Gas Companies are

seeking reconsideration of the DPU’ s disposition of four issues they believe were based on legal error or lack of

substantial evidence, and clarification on three non-financial matters. The most significant of the four items for

reconsideration involves the DPU’ s disallowance of $11.3 million from Boston Gas rate base related to certain fixed

asset additions from calendar years 1996 to 1998 as well as disallowance of depreciation expenses of approximately $0.8

million per year associated with those assets. On October 26, 2011, the DPU ruled on the Motion for Recalculation

awarding the Gas Companies an increase of $2.8 million effective November 1, 2011 down from the $10.4 million

requested. The DPU indicated it would address Colonial Gas’ $4.5 million adjustment for the Colonial Gas merger

related costs in Colonial Gas’ s Motion for Reconsideration. The Motion for Reconsideration remains pending at the

DPU.

Associated with its general rate case, the DPU opened an investigation to address the allocation and assignment of costs

to the Gas Companies by the National Grid service companies. In June 2011, the Attorney General’ s Office requested

that the DPU expand the scope of the audit to address the allocation and assignment of costs to the Gas Companies’

electric distribution affiliates by the National Grid service companies and to review National Grid’ s cost allocation

practices. The Gas Companies have agreed to expand the scope of the audit to its Massachusetts electric distribution

affiliates. In March 2012, the DPU issued an order confirming that the scope of the audit would include the

Massachusetts electric distribution companies and directing the Company to revise its draft RFP consistent with the

DPU’ s order and refile it within seven days. The Company cannot currently predict the outcome of this proceeding.