National Grid 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.56

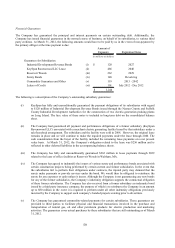

0.28%. The interest rate was 0.20% and 0.26% at March 31, 2012 and March 31, 2011, respectively. Interest expense

related to these notes for each of the years ended March 31, 2012 and March 31, 2011 was approximately $0.1 million.

At March 31, 2012, the Company had outstanding $430 million of the Pollution Control Revenue Bonds in tax exempt

commercial paper mode with maturity dates ranging from October 2015 to October 2022 and variable interest ranging

from 0.25% to 0.93% for the year ended March 31, 2012. In addition, at March 31, 2012, the Company had $53 million

of tax exempt Electric Revenue Bonds in commercial paper mode with varying maturity dates from 2016 through 2042

and variable interest rates ranging from 0.35% to 0.90% during the year ended March 31, 2012. The bonds were issued

by the Massachusetts Development Finance Agency in connection with the Company’ s financing of its first and second

underground and submarine cable projects. Sinking fund payments of $250 thousand were made during the year ended

March 31, 2012.

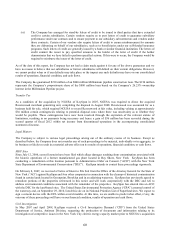

At March 31, 2011, three of the Company’ s subsidiaries had a Standby Bond Purchase Agreement ("SBPA") of $455

million, which was due to expire in November 2011. On November 22, 2011, the Company amended the SBPA to have

a limit of $500 million and expiring on November 20, 2012. This agreement was available to provide liquidity support

for $483 million of the Company’ s long-term bonds in tax-exempt commercial paper mode. The Company has classified

this debt as long-term due to its intent and ability to refinance the debt on a long-term basis in the event of a failure to

remarket the bonds. NGUSA, together with other affiliates of National Grid Plc., has rights to issue debt under a $850

million syndicated revolving credit facility which can be drawn upon at any time until its maturity in November 2015

and may be used, if needed, to refinance the tax-exempt commercial paper on a long-term basis. This facility has a

number of financial and non-financial covenants which the Company is obliged to meet. At March 31, 2012 and March

31, 2011, the Company was in compliance with all covenants.

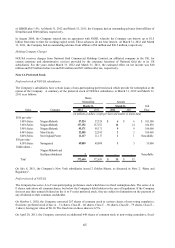

Industrial Development Revenue Bonds

At March 31, 2012 and March 31, 2011, KeySpan had outstanding $128 million of tax-exempt bonds with a 5.25%

coupon maturing in June 2027, $53 million of these Industrial Development Revenue Bonds were issued on its behalf

through the Nassau County Industrial Development Authority for the construction of the Glenwood Energy Center, an

electric-generation peaking plant, and the balance of $75 million was issued on its behalf by the Suffolk County

Industrial Development Authority for the Port Jefferson Energy Center an electric-generation peaking plant. KeySpan

has guaranteed all payment obligations of these subsidiaries with regard to these bonds.

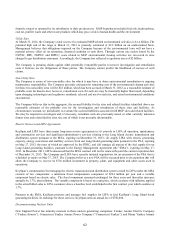

Committed Facility Agreements

At March 31, 2011, NGUSA had three committed bank loans outstanding totaling $500 million which mature in 2014.

These loans are used to provide funds for working capital needs. The interest rates on these bank loans were reset

periodically and are set at 0.90% over the London Interbank Offered Rate (“LIBOR”). These bank loans have since been

repaid in full and were no longer outstanding as of March 31, 2012.

At March 31, 2012, NGUSA and certain of its affiliated companies have a committed revolving credit facility of $850

million which matures in November 2015. This facility, bearing interest at LIBOR plus 0.6%, has not been drawn

against and therefore there is no balance outstanding. NGUSA and its affiliated companies which are signatories to this

arrangement can all draw on this facility in a variety of currencies as needed, but the aggregate borrowings across the

group cannot exceed the $850 million limit. The terms of the facility restrict the borrowing of all US registered

subsidiaries of the Company to $18 billion excluding intercompany indebtedness. Additionally, this facility has a

number of non-financial covenants which the Company is obliged to meet. At March 31, 2012 and March 31, 2011, the

Company was in compliance with all covenants.

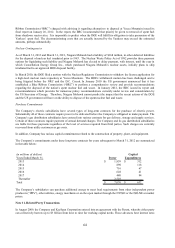

Intercompany Notes Payable

At March 31, 2012, the Company had intercompany notes due to Parent of $500 million at an interest rate ranging from

0.7% to 0.9% over LIBOR, due November 2012 through November 2015. At March 31, 2011, the Company had

intercompany notes due to Parent of $550 million at an interest rate ranging from 0.6% to 0.9% over LIBOR, due

February 2011 through November 2015.