National Grid 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Intangible Assets

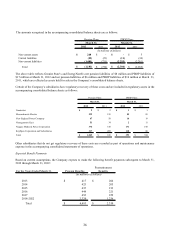

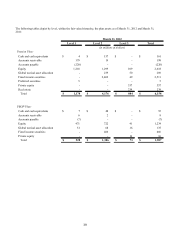

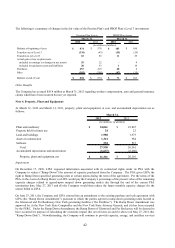

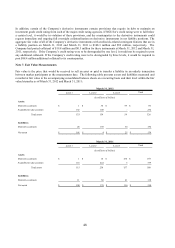

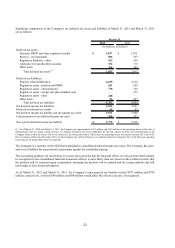

The following table summarizes the Company’ s finite-lived net intangible assets included in the accompanying

consolidated balance sheets at March 31, 2012 and March 31, 2011:

2012 2011

LIPA Contracts 4$ 114$

Licensing and other -4

Total 4$ 118$

March 31,

(in millions of dollars)

For the years ending March 31, 2012 and March 31, 2011, the Company recorded amortization expense on the intangible

assets of $8 million and $21 million, respectively. The remaining intangible asset balance will be amortized by 2013.

Impairment

During the year ended March 31, 2012, the Company recorded a non-cash impairment charge of $102 million to reduce

the net carrying value of its MSA LIPA contract to a fair value of zero, which was determined using an income-based

approach. The impairment was triggered by LIPA announcing on December 15, 2011 that it will not renew the service

agreement contract with the Company beyond its current term expiring in 2013. As the original valuation of the asset

assumed renewal of the MSA contract beyond its current term, based on historical experience with LIPA, the recent

decision by LIPA resulted in an impairment of that value.

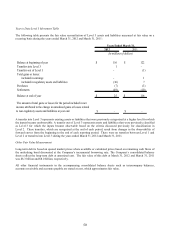

Note 6. Derivative Contracts

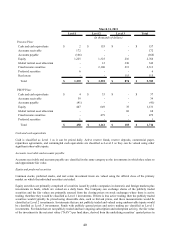

In the normal course of business, the Company’ s subsidiaries are party to derivative instruments, such as futures,

options, swaps, and physical forwards that are principally used to manage commodity prices associated with its natural

gas distribution operations. These financial exposures are monitored and managed as an integral part of the Company’ s

overall financial risk management policy. The Company generally engages in activities at risk only to the extent that

those activities fall within commodities and financial markets to which it has a physical market exposure in terms and

volumes consistent with its core business.

The majority of the derivative instruments utilized by the Company are subject to the current accounting guidance for

rate-regulated enterprises since various rate agreements associated with its gas distribution subsidiaries allow for the

pass-through of the commodity cost of natural gas and the costs related to hedging activities.

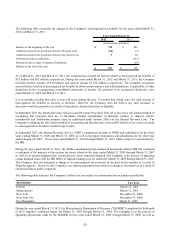

Commodity Derivative Instruments - Regulated Accounting

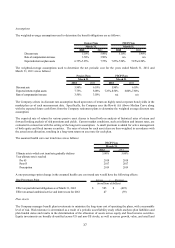

We use derivative financial instruments to reduce the cash flow variability associated with the purchase price for a

portion of future natural gas purchases associated with our New York, Long Island and New England gas service

territories. Our strategy is to minimize fluctuations in gas sales prices to our regulated customers. The accounting for

these derivative instruments is subject to current guidance for rate-regulated enterprises. Therefore, the fair value of

these derivatives is recorded as current or deferred assets and liabilities, with offsetting positions recorded as regulatory

assets and regulatory liabilities in the accompanying consolidated balance sheets. Gains or losses on the settlement of

these contracts are initially deferred and then refunded to or collected from customers consistent with regulatory

requirements.

Commodity Derivative Instruments – Mark-to-Market Accounting

The Company employs a small number of derivative instruments related to storage optimization and a limited number of

natural gas swaps to hedge the risk associated with fixed price natural gas sales contracts for certain large gas sales

customers. As these instruments do not qualify for or were not designated as cash-flow hedges, they are accounted for in

the accompanying consolidated balance sheets at fair value with all changes in fair value reported in earnings.