National Grid 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

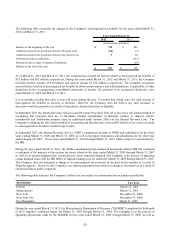

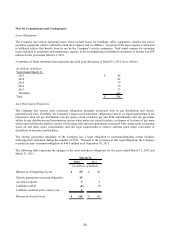

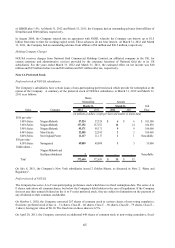

Financial Guarantees

The Company has guaranteed the principal and interest payments on certain outstanding debt. Additionally, the

Company has issued financial guarantees in the normal course of business, on behalf of its subsidiaries, to various third

party creditors. At March 31, 2012, the following amounts would have to be paid by us in the event of non-payment by

the primary obligor at the time payment is due:

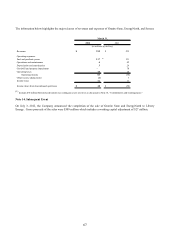

Amount of

Exposure Expiration Dates

(in millions of dollars)

Guarantees for Subsidiaries:

Industrial Development Revenue Bonds (i) 128$ 2027

KeySpan Ravenswood LLC Lease (ii) 486 2040

Reservoir Woods (iii) 262 2029

Surety Bonds (iv) 148 Revolving

Commodity Guarantees and Other (v) 119 2013 - 2042

Letters of Credit (vi) 101 July 2012 - Dec 2012

1,244$

The following is a description of the Company’ s outstanding subsidiary guarantees:

(i) KeySpan has fully and unconditionally guaranteed the payment obligations of its subsidiaries with regard

to $128 million of Industrial Development Revenue Bonds issued through the Nassau County and Suffolk

County Industrial Development Authorities for the construction of two electric-generation peaking plants

on Long Island. The face value of these notes is included in long-term debt on the consolidated balance

sheet.

(ii) The Company had guaranteed all payment and performance obligations of a former subsidiary (KeySpan

Ravenswood LLC) associated with a merchant electric generating facility leased by that subsidiary under a

sale/leaseback arrangement. The subsidiary and the facility were sold in 2008. However, the original lease

remains in place and we will continue to make the required payments under the lease through 2040. The

cash consideration from the buyer of the facility included the remaining lease payments on a net present

value basis. At March 31, 2012, the Company’ s obligation related to the lease was $256 million and is

reflected in other deferred liabilities in the accompanying balance sheets.

(iii) The Company has fully and unconditionally guaranteed $262 million in lease payments through 2029

related to the lease of office facilities at Reservoir Woods in Waltham, MA.

(iv) The Company has agreed to indemnify the issuers of various surety and performance bonds associated with

certain construction projects being performed by certain current and former subsidiaries. In the event that

the subsidiaries fail to perform their obligations under contracts, the injured party may demand that the

surety make payments or provide services under the bond. We would then be obligated to reimburse the

surety for any expenses or cash outlays it incurs. Although the Company is not guaranteeing any new bonds

for any of the former subsidiaries, the Company’ s indemnity obligation supports the contractual obligation

of these former subsidiaries. The Company has also received from a former subsidiary an indemnity bond

issued by a third party insurance company, the purpose of which is to reimburse the Company in an amount

up to $80 million in the event it is required to perform under all other indemnity obligations previously

incurred by the Company to support such company’ s bonded projects existing prior to divestiture.

(v) The Company has guaranteed commodity-related payments for certain subsidiaries. These guarantees are

provided to third parties to facilitate physical and financial transactions involved in the purchase and

transportation of natural gas, oil and other petroleum products for electric production and marketing

activities. The guarantees cover actual purchases by these subsidiaries that are still outstanding as of March

31, 2012.