National Grid 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

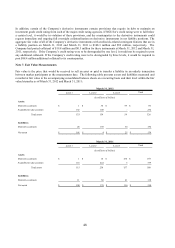

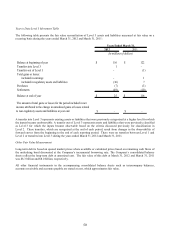

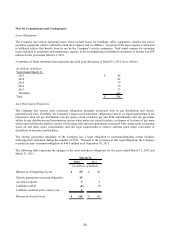

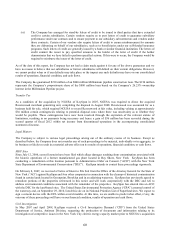

The following table reconciles the changes to the Company’ s unrecognized tax benefits for the years ended March 31,

2012 and March 31, 2011:

2012 2011

Balance at the beginning of the year 798$ 845$

Additions based on tax positions related to the prior years (94) (3)

Additions based on tax positions related to the current year 388

Settlements with tax authorities -(122)

Reductions due to lapse of statute of limitations -(10)

Balance at the end of the year 707$ 798$

Years Ended March 31,

(in thousands of dollars)

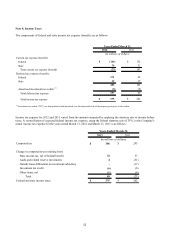

As of March 31, 2012 and March 31, 2011, the Company has accrued for interest related to unrecognized tax benefits of

$75 million and $62 million, respectively. During the years ended March 31, 2012 and March 31, 2011, the Company

recorded interest expense of $10 million and interest income of $33 million, respectively. The Company recognizes

accrued interest related to unrecognized tax benefits in other interest expense and related penalties, if applicable, in other

deductions in the accompanying consolidated statements of income. No penalties were recognized during the years

ended March 31, 2012 and March 31, 2011.

It is reasonably possible that other events will occur during the next 12 months that would cause the total amount of

unrecognized tax benefits to increase or decrease. However, the Company does not believe any such increases or

decreases would be material to its results of operations, financial position, or liquidity.

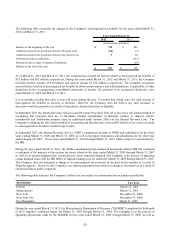

In September 2011 the Internal Revenue Service issued Revenue Procedure 2011-43 to provide a safe harbor method of

accounting that taxpayers may use to determine whether expenditures to maintain, replace, or improve electric

transmission and distribution property must be capitalized under Section 263(a) of the Internal Revenue Code. The

Company is adopting the safe harbor method of accounting and therefore has reversed $92 million of tax reserves related

to unrecognized tax benefits recorded in prior years.

In September 2011, the Internal Revenue Service (“IRS”) commenced an audit of NGHI and subsidiaries for the fiscal

years ending March 31, 2008 and March 31, 2009, as well as KeySpan Corporation and subsidiaries for the short year

ended August 24, 2007. Fiscal years ended March 31, 2010 through March 31, 2012 remain subject to examination by

the IRS.

During the year ended March 31, 2011, the NGHI consolidated group reached an agreement with the IRS that contained

a settlement of the majority of the income tax issues related to the years ended March 31, 2005 through March 31, 2007

as well as an acknowledgment that certain discrete items remained disputed. The Company is the process of appealing

certain disputed issues with the IRS Office of Appeals relating to its tax returns for March 31, 2005 through March 31, 2007.

The Company does not anticipate a change in its unrecognized tax positions in the next twelve months as a result of

filing the appeals. However, the Company’ s tax sharing agreement may result in a change to allocated tax as a result of

current and future audits or appeals.

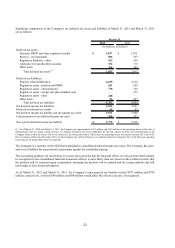

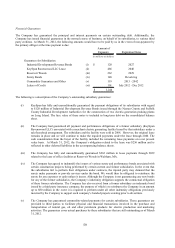

The following table indicates the Company’ s earliest tax year subject to examination for each major jurisdiction:

Jurisdiction Tax Year

Federal

March 31, 2005

Massachusetts

March 31, 2001

New York

December 31, 2000

New York City

December 31, 2000

New Hampshire March 31, 2009

During the year ended March 31, 2011, the Massachusetts Department of Revenue ("MADOR") completed its field audit

of the Company's combined returns for March 31, 2003 through March 31, 2005. The Company is in the process of

appealing adjustments made by the MADOR for the years ended March 31, 2003 through March 31, 2005, as well as