National Grid 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

In September 2010, Colonial Gas filed a request with the DPU for recovery of $0.7 million in exogenous costs associated

with the lost base revenue (“LBR”) covering the period May 1, 2009 through April 30, 2010. This exogenous cost is

associated with the LBR resulting from the implementation of Colonial Gas sponsored demand side management

programs prior to 2000. This request was approved by the DPU on August 11, 2011.

Other Regulatory Matters

In November 2008, the Gas Companies filed a combined request for approval of a three year gas portfolio optimization

agreement with ConocoPhillips, which was approved in April 2009 but limited the term to a one year period. This

agreement was extended for one additional year upon the approval of the DPU in April 2010. Since the former

ConocoPhillips agreement terminated as of March 31, 2011, and the Gas Companies’ request for a subsequent co-

management agreement with BG Energy Merchants, LLC (which was intended to commence April 2011), was rejected

by the DPU in May 2011, the Gas Companies have been managing and optimizing their assets on their own. In August

2011, the Gas Companies sought approval for six natural gas asset management services agreements between the Gas

Companies and one of five counterparties. On October 17, 2011, the DPU approved the agreements which commenced

on November 1, 2011 and expired on March 31, 2012. Under these agreements, the Gas Companies will be eligible to

share in 25% of only the portions of the asset management fees that are clearly attributable to capacity release activities

above the prior year’ s margin threshold as directed in the DPU’ s Order, and pursuant to the incentive sharing mechanism

set forth in D.P.U. 93-141-A. These potential earnings will not be determined until the end of the peak season. One

hundred percent of the commodity-related fees will be returned to firm sales customers.

On June 1, 2011, in conjunction with the DPU’ s annual investigation of Boston Gas’ s calendar year 2009 pension and

PBOP rate reconciliation mechanism, the Massachusetts Attorney General argued that Boston Gas be obligated to

provide carrying charges to the benefit of customers on its PBOP liability balances related to its 2003 to 2006 rate

reconciliation filings. In August 2010, the DPU ordered Boston Gas to provide carrying charges on its PBOP liability

balances on its 2007 and 2008 rate reconciliation filings, but the order was silent about providing carrying charges prior

to those years. The matter is pending before the DPU.

On August 26, 2011, Boston Gas Company and Colonial Gas filed for authorization, which was received in December

2011, to issue new long-term debt securities in an aggregate principal amount not to exceed $500 million and $50

million, respectively. The proceeds will be used for debt restructuring and general corporate purposes. On February 17,

2012, Boston Gas issued $500 million of senior unsecured debt.

Energy Efficiency

The Gas Companies’ EE plan is run as a single combined plan. For the calendar years 2010 through 2012, the plan

significantly expands EE programs for customers with a concomitant increase in spending. The DPU approved budget

for the gas companies in Massachusetts, exclusive of LBR (revenues reduced as a result of installed EE measures), for

the calendar years 2010 through 2012 is $203.4 million. In addition to cost recovery, the Company has the opportunity to

earn a performance incentive. A review of the Gas Companies’ 2010 EE Annual Report is ongoing and includes a

proposed pre-tax performance incentive of approximately $2.3 million (after tax $1.4 million). On August 16, 2011, the

Gas Companies filed for recovery of its 2010 LBR and associated carrying costs of $2.9 million. In October 2010 and

2011, the Gas Companies filed requests for approval of Mid-Term Modifications to specific gas EE programs for

calendar years 2011 and 2012 which would result in a lower budget of $186.7 million for the calendar years 2010

through 2012. These matters are pending before the DPU.

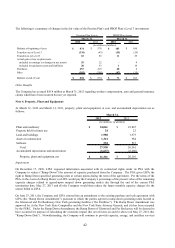

National Grid Generation

In January 2009, our indirectly-owned subsidiary, National Grid Generation filed an application with the FERC for a rate

increase of $92 million for the final five year rate term of the fifteen year contract under the power supply agreement. In

December 2009, the FERC approved the proposed tariff rates, effective from February 1, 2009 subject to refund and the

outcome of any proceedings instituted by the FERC. In October 2009, LIPA and National Grid Generation filed a

settlement with the FERC for a revenue requirement of $436 million, an annual increase of approximately $66 million,

an ROE of 10.75% and a capital structure of 50% debt and 50% equity, which was approved by the FERC in January

2010. All outstanding balances associated with the revenue increases were settled in March 2010.