National Grid 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

from Glenwood and Far Rockaway to LIPA until such time as the units become eligible for retirement, pending

completion of certain transmission projects in the area currently served by these facilities. These Facilities became

eligible for retirement in June 2012.

The Company will be responsible for the costs to remediate/demolish the Glenwood and Far Rockaway units following

retirement. In anticipation of the Ramp Down of Glenwood and Far Rockaway, as of March 31, 2011, the Company

recorded estimated charges for impairment to long-lived assets of $31 million. The recorded impairment charges have

reduced the carrying value of the power generating units located in Glenwood and Far Rockaway to their net recoverable

value as determined by use of discounted cash flows and estimated salvage value. The electric generation subsidiary of

the Company has a legal obligation to remediate/demolish certain facilities following their retirement during the summer

of 2012. Pursuant to the existence of this legal obligation, the Company recorded an asset retirement obligation of $44.6

million as of September 30, 2011.

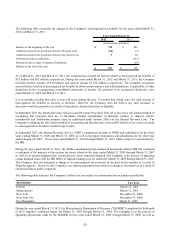

In January 2010, NGUSA initiated an implementation program of SAP AG’ s enterprise resource planning (“ERP”)

program for NGUSA and its wholly-owned subsidiaries. This implementation program included a planning phase and

implementation phase. After progressing through the planning phase and into a portion of the implementation phase, the

Company identified various program costs and estimated what percentages of those costs were due to transition issues,

re-working due to new specifications and other costs that should not be capitalized as a part of the program. In addition, the

Company’ s timeline and date of completion has been significantly delayed. The Company’ s consideration of these and other

factors caused it to reserve approximately $30 million of capitalized software development costs for the year ended March 31,

2011.

KeySpan applies the full cost method of accounting for its oil and gas production activities. In applying the full cost method,

the Company performs an impairment test (“ceiling test”) at each reporting date. At March 31, 2011, the Company recorded

ceiling test impairment charge of $9 million, related to the carrying values and its properties.

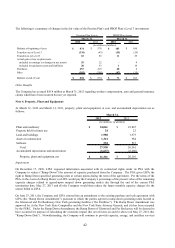

Note 5. Goodwill and Other Intangible Assets

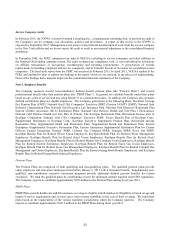

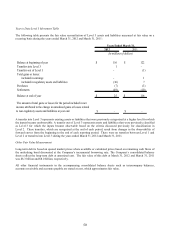

At March 31, 2012 and March 31, 2011, the carrying amount of the goodwill, net of accumulated impairment losses is as

follows:

2012

2011

Goodwill, beginning of year

7,133

$

7,275

$

Regulatory recovery

-

(142)

Goodwill, end of year

7,133

$

7,133

$

March 31,

(in millions of dollars)

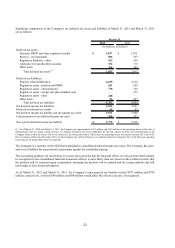

In 1998, Colonial Gas acquired Eastern Enterprises Inc. (“Eastern”) and applied for recovery from the Massachusetts

Department of Telecommunications and Energy of the acquisition premium paid pursuant to the Eastern Merger of $224

million, net of tax. Colonial Gas and Eastern agreed to a ten-year rate freeze as well as a reduction of the price of burner-

tip gas for rate-payers for recovery of certain costs including the recovery of $369 million of acquisition premium, pre-

tax. On November 1, 2010 (“the Effective Date”) the DPU issued DPU 10-55 which authorized recovery of $235 million

of acquisition premium, pre-tax. Colonial Gas recorded a regulatory asset of that amount and recorded corresponding

credits to a deferred tax liability of $93 million and a reclassification of $142 million to reduce goodwill. Colonial Gas

will amortize this amount over 30 years as prescribed by DPU 10-55. Colonial Gas recorded a catch-up adjustment at

March 31, 2011, for $3 million to reflect amortization from the Effective Date through March 31, 2011.