National Grid 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

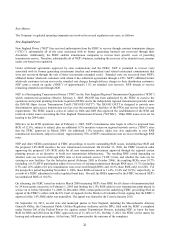

In September 2008, NEP, Narragansett, and Northeast Utilities jointly filed an application with the FERC to recover

financial incentives for the New England East-West Solution (“NEEWS”), pursuant to the FERC’ s Transmission Pricing

Policy Order, Order No. 679. NEEWS consists of a series of inter-related transmission upgrades identified in the New

England Regional System Plan and is being undertaken to address a number of reliability problems in the tri-state area of

Connecticut, Massachusetts, and Rhode Island. NEP’ s share is estimated to be approximately $200 million. Effective

November 2008, the FERC granted (1) an incentive ROE of 12.89% (125 basis points above the approved base ROE of

11.64%), (2) 100% construction work in progress in rate base and (3) recovery of plant abandoned for reasons beyond

the companies’ control. Parties opposing the NEEWS incentives sought rehearing of the FERC order. On June 28, 2011,

the FERC denied all requests for rehearing.

Under the terms of its FERC Electric Tariff No. 1, NEP operates its transmission facilities and those of its New England

affiliates as a single integrated system and reimburses its affiliates for the cost of those facilities, including a return.

NEP’ s costs under Tariff No. 1 are then allocated among transmission customers in New England in accordance with the

terms of the ISO-NE OATT. On December 30, 2009, NEP filed with the FERC a proposed amendment to Tariff No.1 to

(1) adjust depreciation rates and PBOPs according to recent depreciation and actuarial studies updating such costs, and

(2) update rate formulas applicable to Massachusetts Electric Company. The result of the proposed rate change would be

an overall rate decrease of $1.6 million. In March 2010, the FERC issued an order establishing hearing and settlement

procedures for this filing and made the new rates effective January 1, 2010, subject to refund, pending the outcome of the

proceeding. In March 2011, NEP filed an uncontested settlement agreement with the FERC resolving all issues raised by

the Massachusetts Attorney General in this proceeding. On July 8, 2011, the FERC accepted the settlement without

modification.

Niagara Mohawk

Electric Rate Case Filing

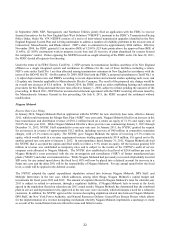

In January 2010, Niagara Mohawk filed an application with the NYPSC for new electricity base rates, effective January

2011, which would terminate the Merger Rate Plan (“MRP”) one year early. Niagara Mohawk filed for an increase in the

base transmission and distribution revenue of $361.2 million based on a return on equity of 11.1% and equity ratio of

50.01% for rate year 2011. While Niagara Mohawk filed for a three-year rate case commencing January 1, 2011 through

December 31, 2013, NYPSC Staff responded to a one-year rate case. In January 2011, the NYPSC granted the request

for an increase in revenue of approximately $112 million, including recovery of $40 million in competitive transition

charges, with a 9.1% return on equity. The NYPSC gave Niagara Mohawk the option of receiving a 9.3% return on

equity, which would result in a revenue requirement increase totaling approximately $119 million, if it agreed not to file

another general rate case prior to January 1, 2012. In correspondence dated January 31, 2011, Niagara Mohawk advised

the NYPSC that it accepted the option and filed tariffs to reflect a 9.3% return on equity. Of the increase granted, $50

million in revenue was established as temporary rates and is subject to the results of the NYPSC’ s audit of service

company costs allocated to Niagara Mohawk. The NYPSC also established a fixed level of $29.8 million per year for

Niagara Mohawk’ s costs associated with the site investigation and remediation (“SIR”) of former manufactured gas

plants (“MGPs”) and other environmental sites. While Niagara Mohawk had previously recovered all prudently incurred

SIR costs, for any annual spend above the fixed level, 80% will now be placed into a deferral account for recovery in a

future rate case and the other 20% will be the responsibility of Niagara Mohawk. For any annual spend below the fixed

level, a credit will be applied to the deferral account.

The NYPSC adopted the capital expenditures stipulation entered into between Niagara Mohawk, DPS Staff, and

Multiple Intervenors in the rate case, which addresses, among other things, Niagara Mohawk’ s capital budget and

investments for fiscal years 2011 and 2012. The amount of capital reflected in Niagara Mohawk’ s rates for calendar year

2011 is subject to refund to customers, through a regulatory liability, if Niagara Mohawk fails to invest at the levels

agreed in the stipulation. Based on calendar year 2011 actual results, Niagara Mohawk has determined that the combined

plant in service and depreciation levels, approved in the rate case, were exceeded, which eliminates a need for a refund to

customers. In addition, the NYPSC approved the revenue decoupling stipulation entered into between Niagara Mohawk,

DPS Staff, the New York Power Authority, and Natural Resources Defense Council/Pace Energy Project which allows

for the implementation of a revenue decoupling mechanism whereby Niagara Mohawk implements a surcharge or credit

as a result of the reconciliation between allowed revenue and billed revenue.